Semiconductor packaging and testing company Amkor Technology (NASDAQ: AMKR) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 3.4% year on year to $1.51 billion. On top of that, next quarter’s revenue guidance ($1.93 billion at the midpoint) was surprisingly good and 9.3% above what analysts were expecting. Its GAAP profit of $0.22 per share was 37.7% above analysts’ consensus estimates.

Is now the time to buy Amkor? Find out by accessing our full research report, it’s free.

Amkor (AMKR) Q2 CY2025 Highlights:

- Revenue: $1.51 billion vs analyst estimates of $1.42 billion (3.4% year-on-year growth, 6.3% beat)

- EPS (GAAP): $0.22 vs analyst estimates of $0.16 (37.7% beat)

- Adjusted EBITDA: $259 million vs analyst estimates of $218.5 million (17.1% margin, 18.5% beat)

- Revenue Guidance for Q3 CY2025 is $1.93 billion at the midpoint, above analyst estimates of $1.76 billion

- EPS (GAAP) guidance for Q3 CY2025 is $0.41 at the midpoint, missing analyst estimates by 7.5%

- Operating Margin: 6.1%, in line with the same quarter last year

- Free Cash Flow Margin: 7.4%, up from 4% in the same quarter last year

- Inventory Days Outstanding: 26, in line with the previous quarter

- Market Capitalization: $5.23 billion

Company Overview

Operating through a largely Asian facility footprint, Amkor Technologies (NASDAQ: AMKR) provides outsourced packaging and testing for semiconductors.

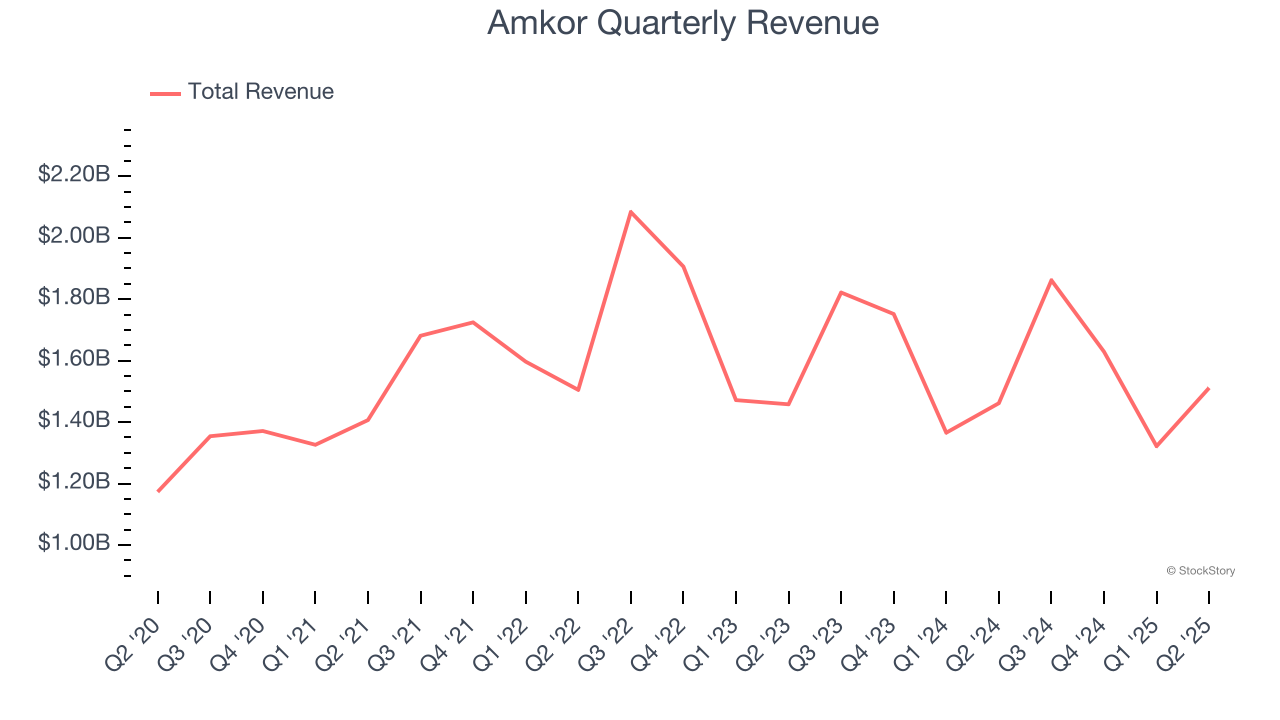

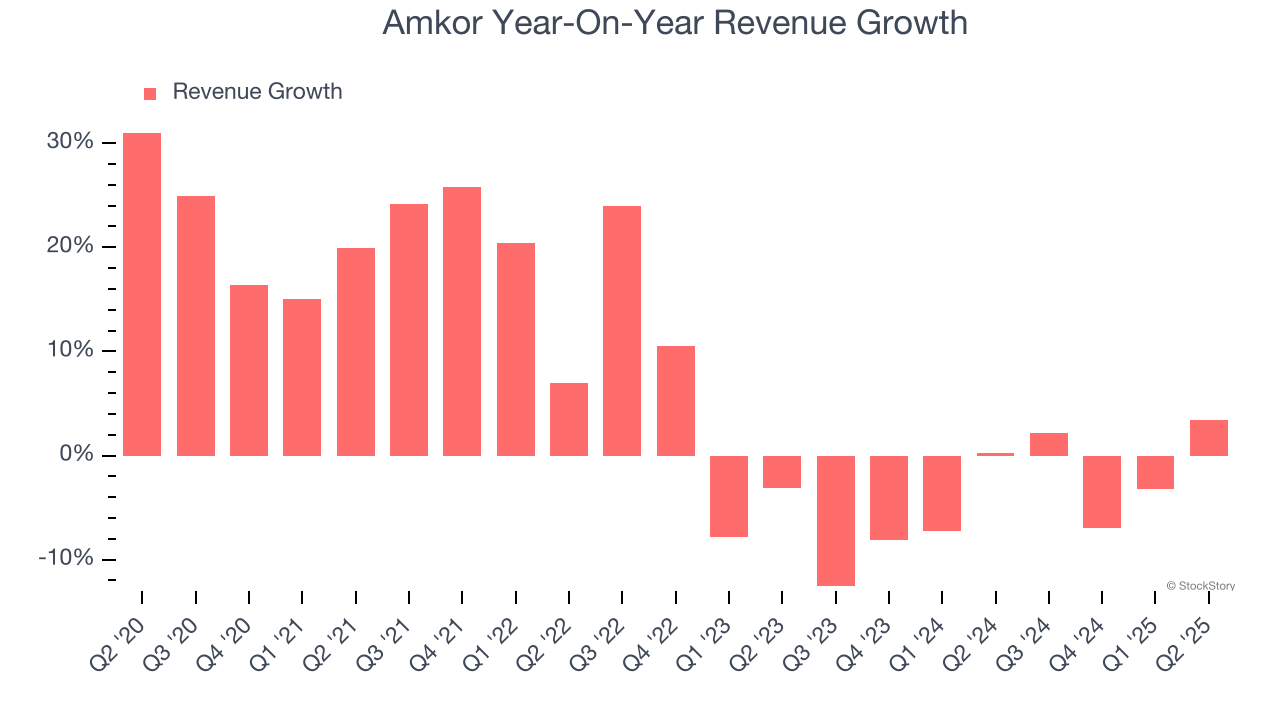

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Amkor grew its sales at a mediocre 6.6% compounded annual growth rate. This fell short of our benchmark for the semiconductor sector and is a poor baseline for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Amkor’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 4.4% annually.

This quarter, Amkor reported modest year-on-year revenue growth of 3.4% but beat Wall Street’s estimates by 6.3%. Adding to the positive news, Amkor’s growth inflected positively this quarter, news that will likely give some shareholders hope. Company management is currently guiding for a 3.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months. While this projection indicates its newer products and services will spur better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

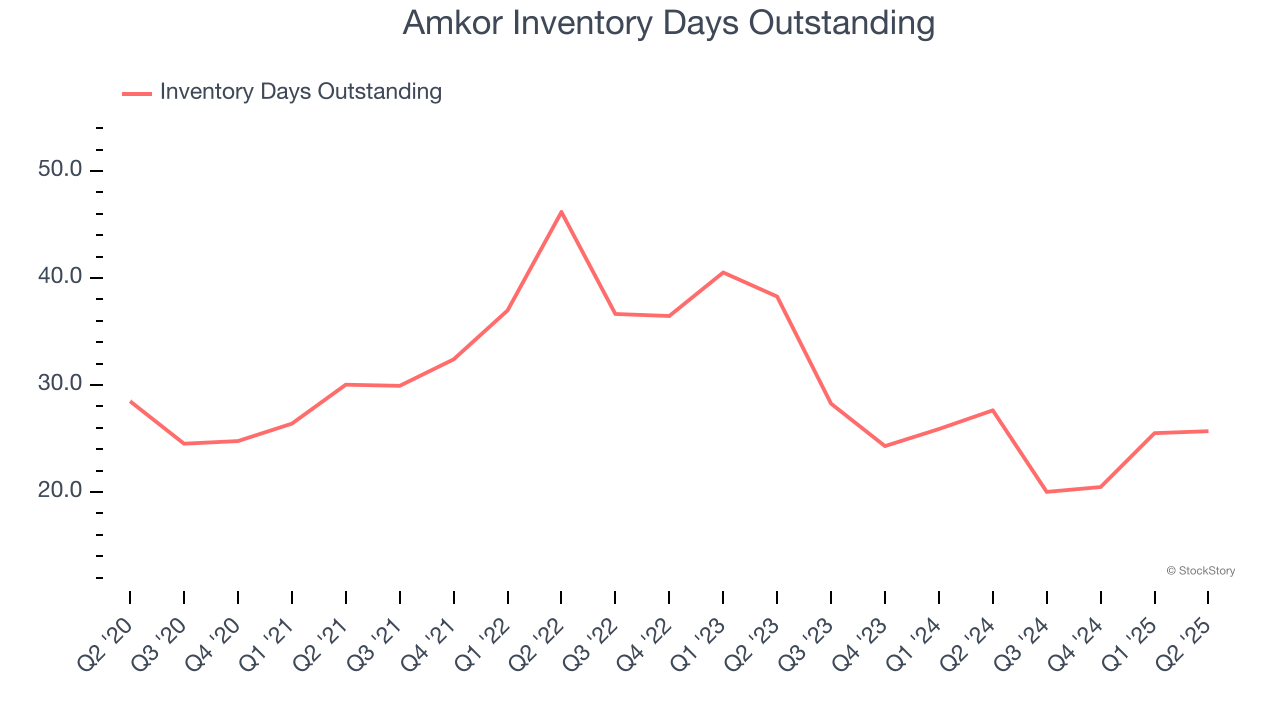

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Amkor’s DIO came in at 26, which is 4 days below its five-year average. Flat versus last quarter, there’s no indication of an excessive inventory buildup.

Key Takeaways from Amkor’s Q2 Results

We were impressed by how significantly Amkor blew past analysts’ EPS expectations this quarter. We were also glad its revenue guidance for next quarter trumped Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 6.3% to $22.57 immediately following the results.

Amkor put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.