Over the past six months, Plexus’s shares (currently trading at $136.76) have posted a disappointing 11.9% loss, well below the S&P 500’s 5.6% gain. This might have investors contemplating their next move.

Is now the time to buy Plexus, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Plexus Not Exciting?

Despite the more favorable entry price, we don't have much confidence in Plexus. Here are three reasons why you should be careful with PLXS and a stock we'd rather own.

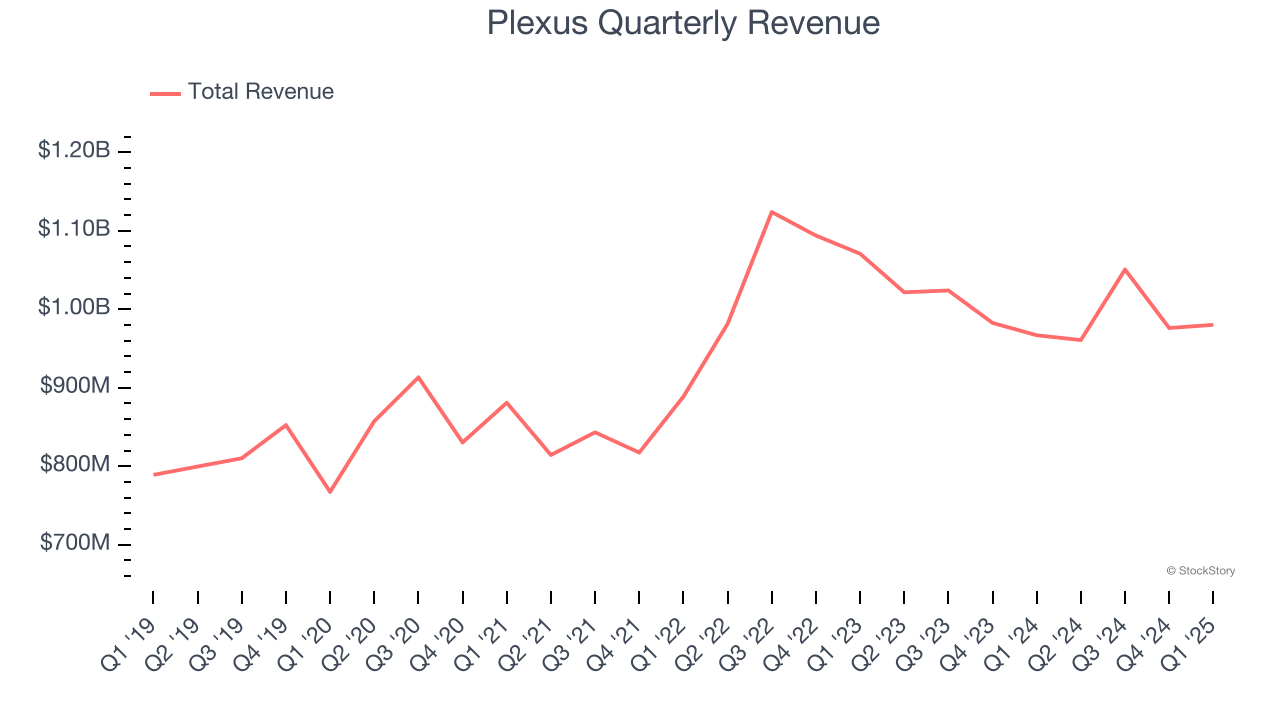

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Plexus’s sales grew at a mediocre 4.2% compounded annual growth rate over the last five years. This fell short of our benchmark for the business services sector.

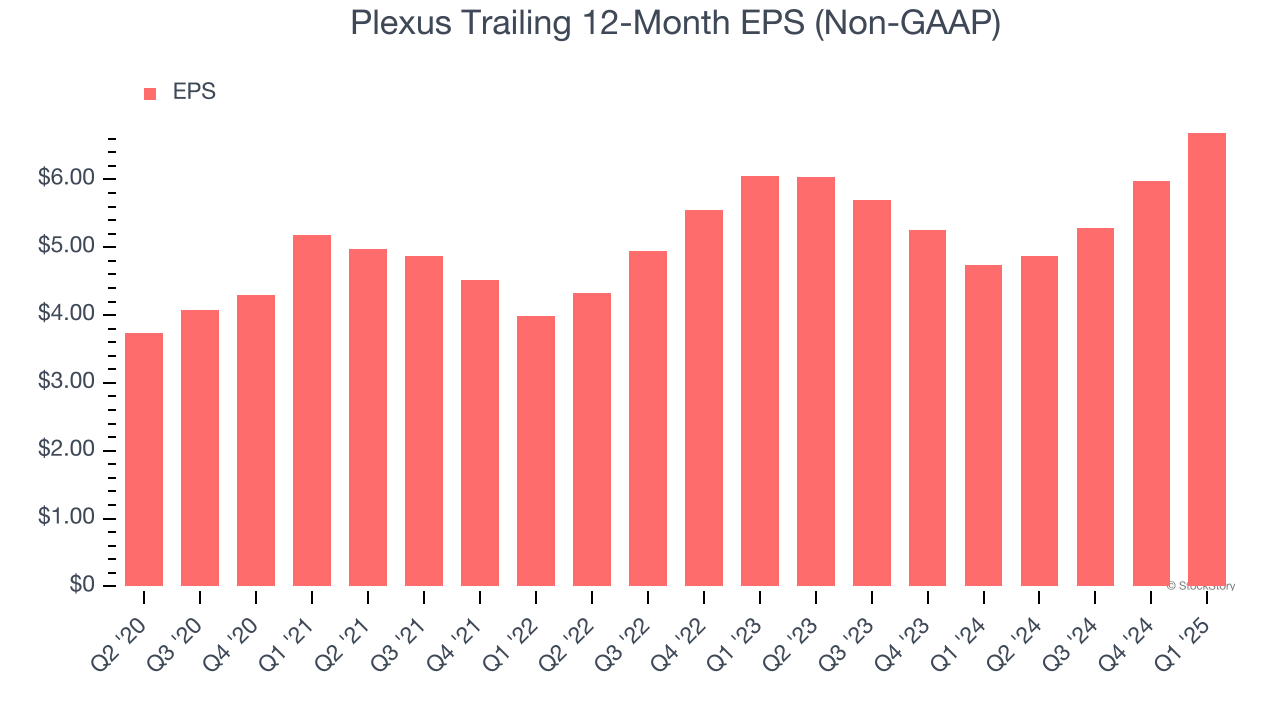

2. Recent EPS Growth Below Our Standards

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Plexus’s EPS grew at an unimpressive 5.2% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its 3.6% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

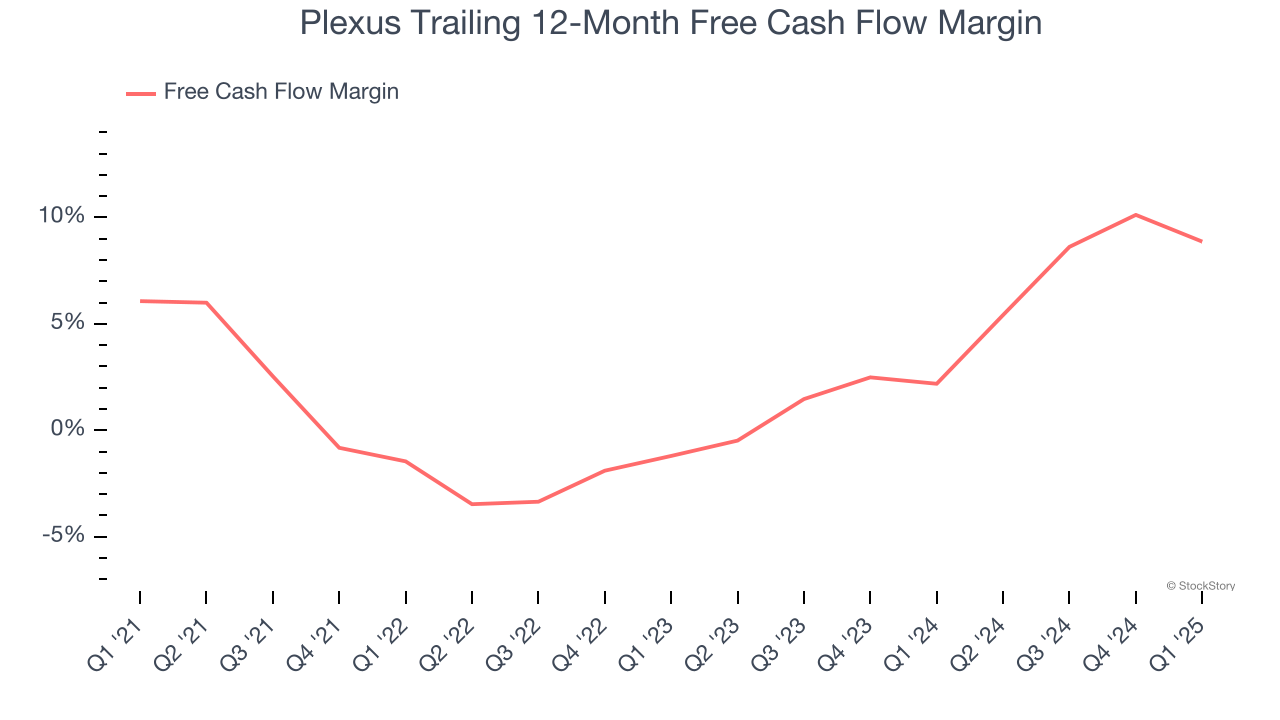

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Plexus has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.9%, subpar for a business services business.

Final Judgment

Plexus isn’t a terrible business, but it isn’t one of our picks. After the recent drawdown, the stock trades at 18.8× forward P/E (or $136.76 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. We’d suggest looking at one of our top software and edge computing picks.

High-Quality Stocks for All Market Conditions

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.