Global entertainment and media company Warner Bros. Discovery (NASDAQ: WBD) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 9.8% year on year to $8.98 billion. Its GAAP loss of $0.18 per share was 39% below analysts’ consensus estimates.

Is now the time to buy Warner Bros. Discovery? Find out by accessing our full research report, it’s free.

Warner Bros. Discovery (WBD) Q1 CY2025 Highlights:

- Revenue: $8.98 billion vs analyst estimates of $9.56 billion (9.8% year-on-year decline, 6% miss)

- EPS (GAAP): -$0.18 vs analyst expectations of -$0.13 (39% miss)

- Adjusted EBITDA: $2.11 billion vs analyst estimates of $2.08 billion (23.4% margin, 1.1% beat)

- Operating Margin: -0.4%, up from -2.7% in the same quarter last year

- Free Cash Flow Margin: 3.4%, similar to the same quarter last year

- Market Capitalization: $21.18 billion

Company Overview

Formed from the merger of WarnerMedia and Discovery, Warner Bros. Discovery (NASDAQ: WBD) is a multinational media and entertainment company, offering television networks, streaming services, and film and television production.

Sales Growth

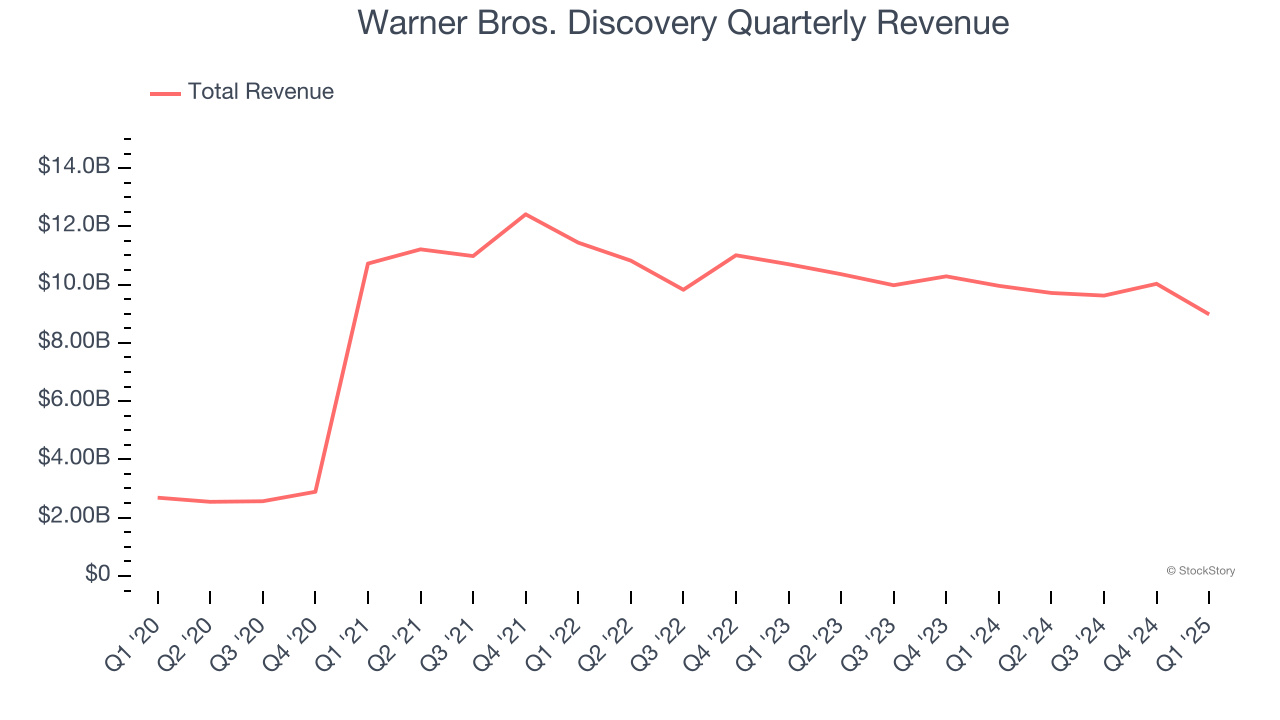

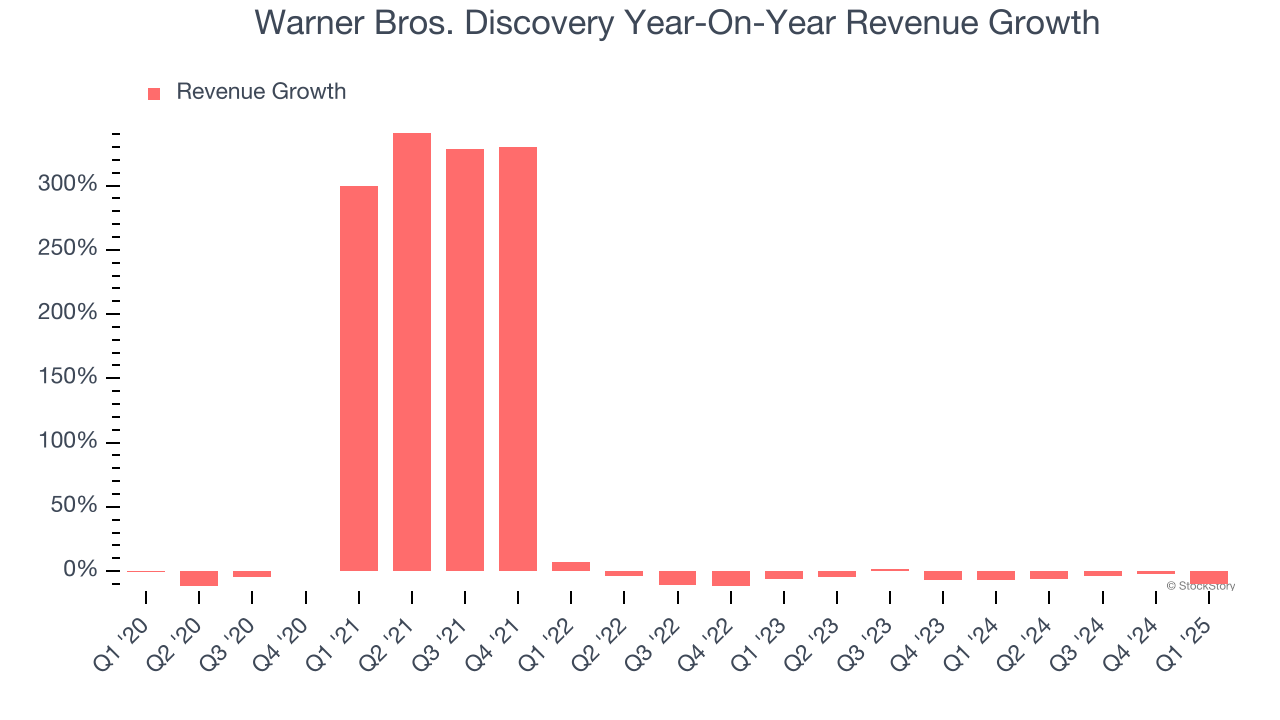

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Warner Bros. Discovery’s 28.1% annualized revenue growth over the last five years was exceptional. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Warner Bros. Discovery’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 4.9% over the last two years.

We can better understand the company’s revenue dynamics by analyzing its three most important segments: Distribution, Advertising, and Content, which are 54.4%, 22.1%, and 20.8% of revenue. Over the last two years, Warner Bros. Discovery’s revenues in all three segments declined. Its Distribution revenue (licensing fees) averaged year-on-year decreases of 1.7% while its Advertising (marketing services) and Content (films, streaming, games) revenues averaged drops of 8.8% and 8.1%.

This quarter, Warner Bros. Discovery missed Wall Street’s estimates and reported a rather uninspiring 9.8% year-on-year revenue decline, generating $8.98 billion of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

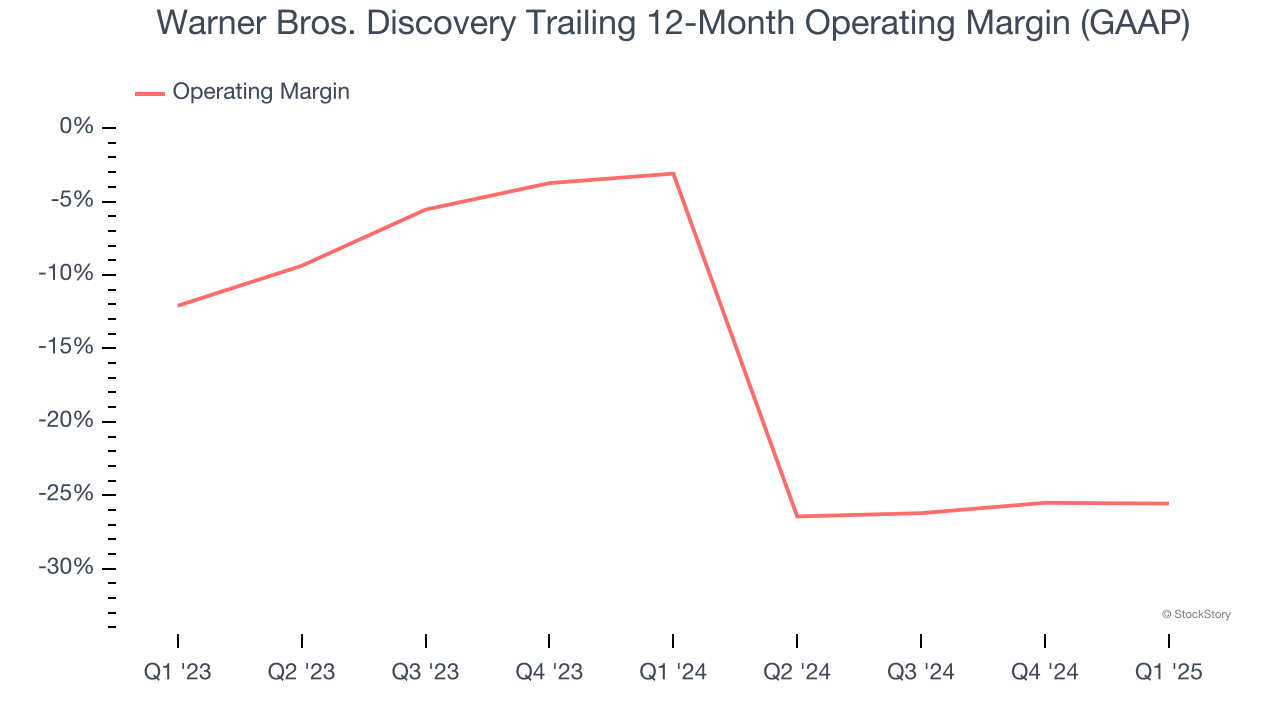

Warner Bros. Discovery’s operating margin has been trending down over the last 12 months and averaged negative 14% over the last two years. Unprofitable, high-growth companies warrant extra scrutiny, especially if their margins fall because they’re spending loads of money to stay relevant, an unsustainable practice.

This quarter, Warner Bros. Discovery generated a negative 0.4% operating margin. The company's consistent lack of profits raise a flag.

Earnings Per Share

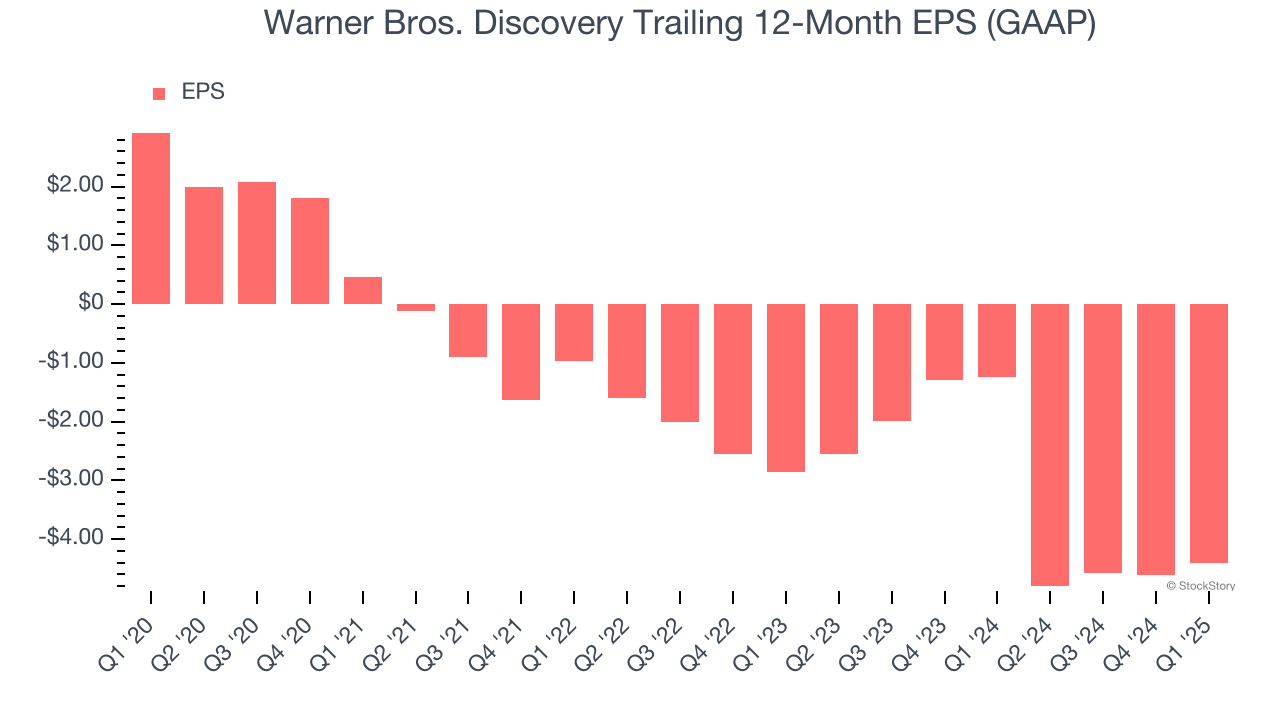

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Warner Bros. Discovery, its EPS declined by 28.5% annually over the last five years while its revenue grew by 28.1%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q1, Warner Bros. Discovery reported EPS at negative $0.18, up from negative $0.40 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Warner Bros. Discovery’s full-year EPS of negative $4.40 will reach break even.

Key Takeaways from Warner Bros. Discovery’s Q1 Results

We struggled to find many positives in these results. Its revenue missed significantly and its EPS fell short of Wall Street’s estimates. A bright spot was its EBITDA outperformance, but overall, this was a softer quarter. The stock surprisingly traded up 4.2% to $8.95 immediately after reporting.

Is Warner Bros. Discovery an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.