Voice AI recognition company SoundHound (NASDAQ: SOUN) missed Wall Street’s revenue expectations in Q1 CY2025, but sales rose 151% year on year to $29.13 million. Its GAAP profit of $0.31 per share was significantly above analysts’ consensus estimates.

Is now the time to buy SoundHound AI? Find out by accessing our full research report, it’s free.

SoundHound AI (SOUN) Q1 CY2025 Highlights:

- Revenue: $29.13 million vs analyst estimates of $30.46 million (151% year-on-year growth, 4.4% miss)

- EPS (GAAP): $0.31 vs analyst estimates of -$0.08 (significant beat)

- Operating Margin: 440%, up from -246% in the same quarter last year

- EPS and operating margin are inflated due to a non-recurring benefit of $176 million (change in fair value of contingent acquisition liabilities)

- Free Cash Flow was -$19.35 million compared to -$33.2 million in the previous quarter

- Market Capitalization: $3.67 billion

Company Overview

Founded in 2005, SoundHound AI (NASDAQ: SOUN) develops independent voice artificial intelligence solutions that enable businesses across various industries to offer customized conversational experiences to consumers.

Sales Growth

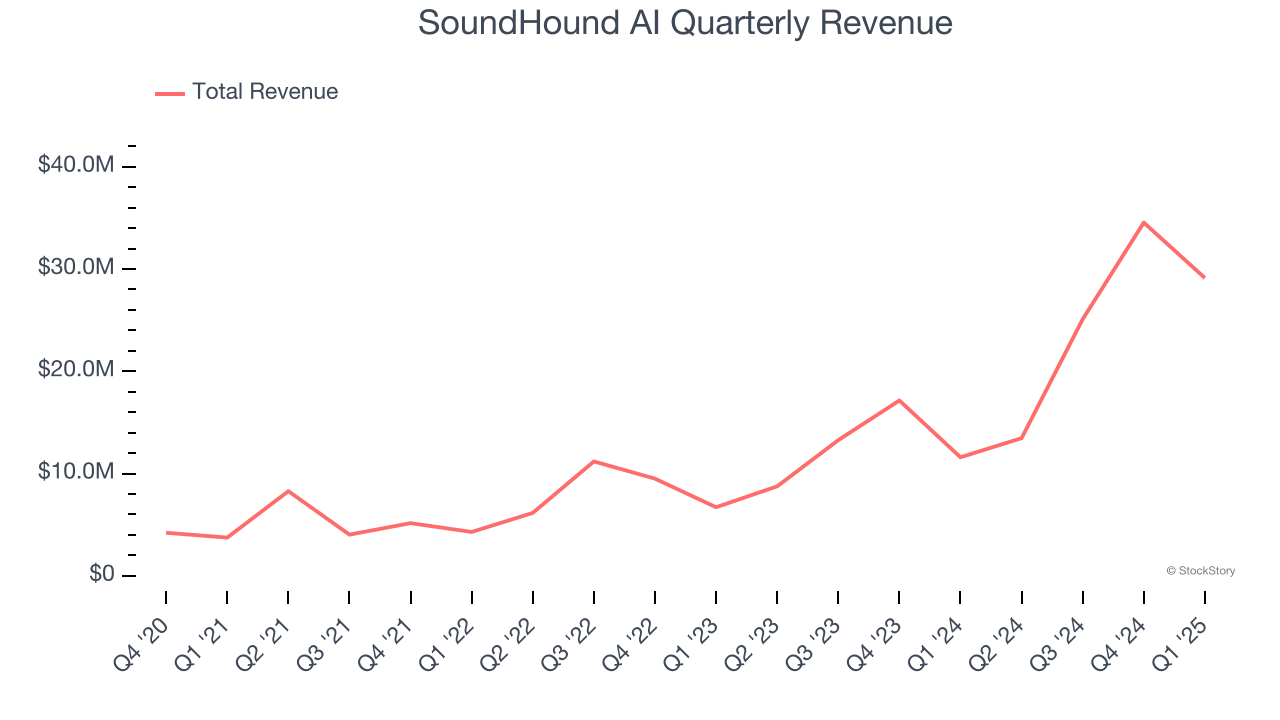

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, SoundHound AI’s 67.5% annualized revenue growth over the last three years was incredible. Its growth beat the average software company and shows its offerings resonate with customers.

This quarter, SoundHound AI achieved a magnificent 151% year-on-year revenue growth rate, but its $29.13 million of revenue fell short of Wall Street’s lofty estimates.

Looking ahead, sell-side analysts expect revenue to grow 59.8% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is commendable and indicates the market is forecasting success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

SoundHound AI is extremely efficient at acquiring new customers, and its CAC payback period checked in at 2.3 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give SoundHound AI more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from SoundHound AI’s Q1 Results

It was tough to see SoundHound AI's revenue significantly miss analysts' expectations. Overall, this was a weaker quarter. The stock traded down 3.8% to $9.36 immediately after reporting.

So do we think SoundHound AI is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.