![]()

As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the industrial distributors industry, including Beacon Roofing Supply (NASDAQ: BECN) and its peers.

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Distributors that boast a reliable selection of products–everything from hardhats and fasteners for jet engines to ceiling systems–and quickly deliver goods to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is still a real threat, forcing investment in omnichannel capabilities to better interact with customers. Additionally, distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

The 28 industrial distributors stocks we track reported a mixed Q4. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 18% since the latest earnings results.

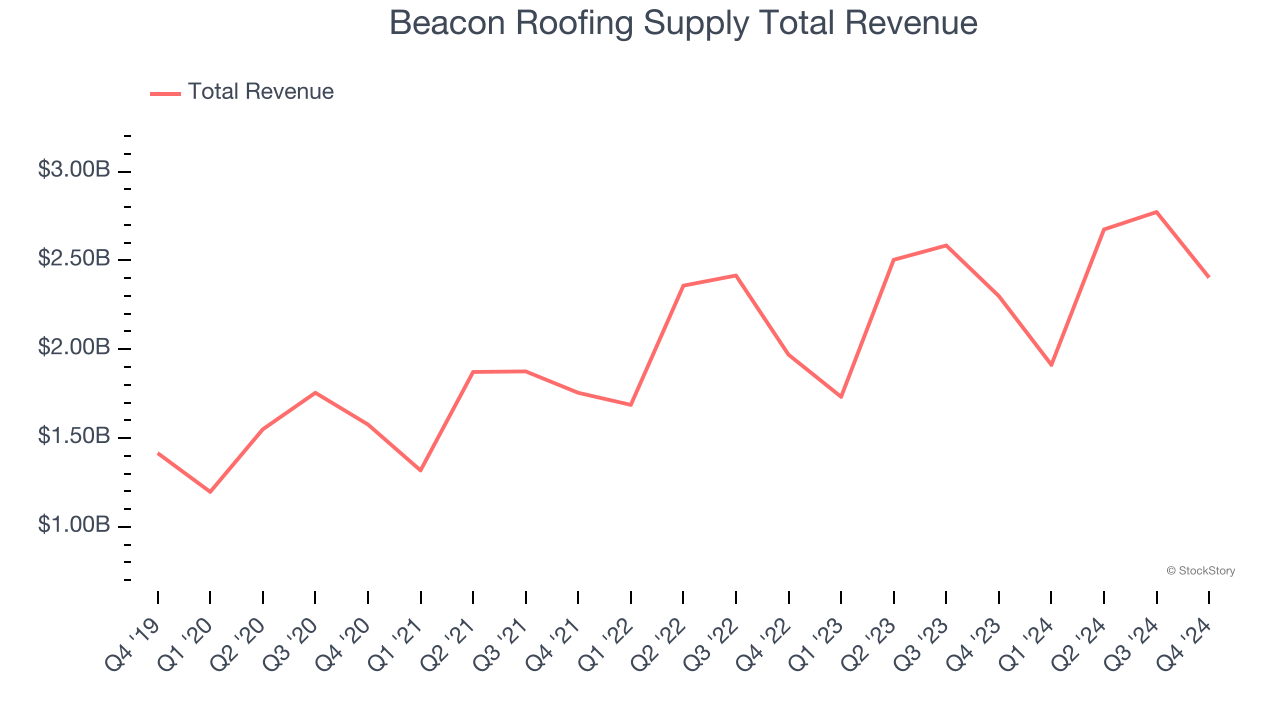

Beacon Roofing Supply (NASDAQ: BECN)

Established in 1928, Beacon Roofing Supply (NASDAQ: BECN) distributes residential and commercial roofing materials and complementary building products.

Beacon Roofing Supply reported revenues of $2.40 billion, up 4.5% year on year. This print fell short of analysts’ expectations by 1.1%. Overall, it was a slower quarter for the company with a significant miss of analysts’ adjusted operating income estimates and a miss of analysts’ EBITDA estimates.

“Despite the challenging economic environment in 2024, we delivered record fourth quarter and full year sales and our highest fourth quarter Adjusted EBITDA in history,” said Julian Francis, Beacon’s President & CEO.

The stock is up 5.6% since reporting and currently trades at $122.54.

Read our full report on Beacon Roofing Supply here, it’s free.

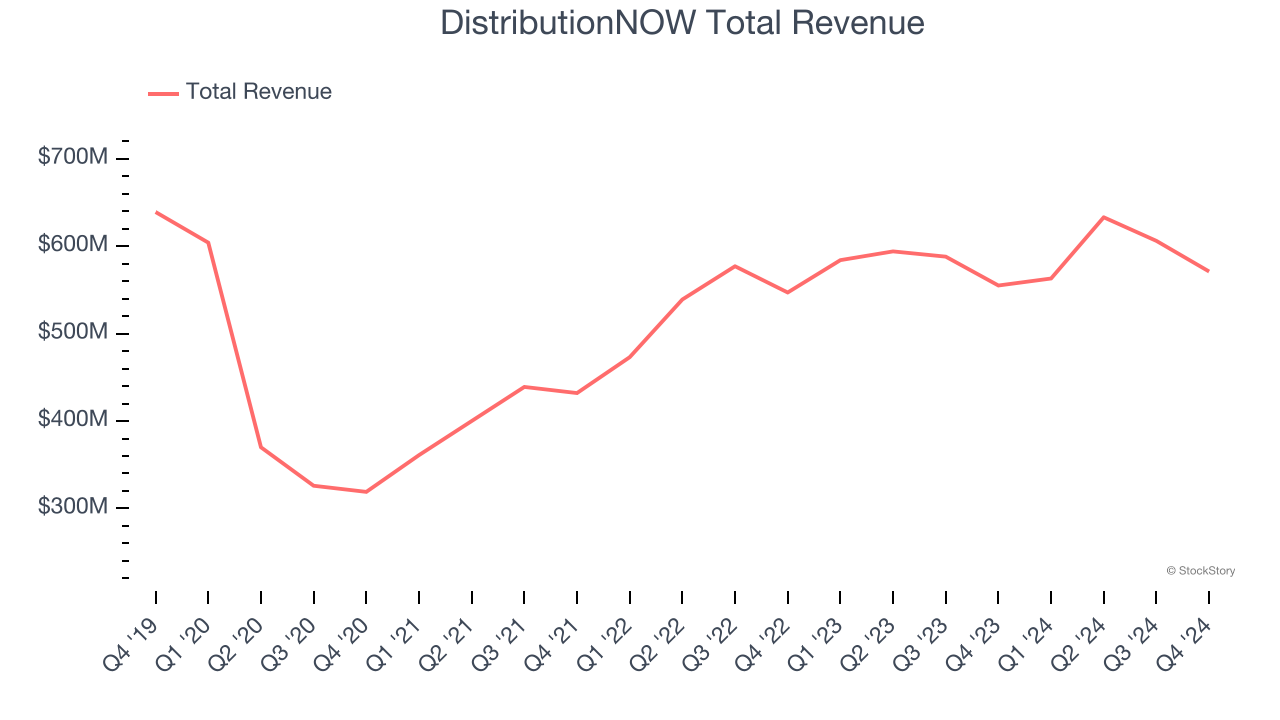

Best Q4: DistributionNOW (NYSE: DNOW)

Spun off from National Oilwell Varco, DistributionNOW (NYSE: DNOW) provides distribution and supply chain solutions for the energy and industrial end markets.

DistributionNOW reported revenues of $571 million, up 2.9% year on year, outperforming analysts’ expectations by 3.4%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is down 2.6% since reporting. It currently trades at $13.77.

Is now the time to buy DistributionNOW? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: MRC Global (NYSE: MRC)

Producing bomb casings and tracks for vehicles during WWII, MRC (NYSE: MRC) offers pipes, valves, and fitting products for various industries.

MRC Global reported revenues of $664 million, down 13.5% year on year, falling short of analysts’ expectations by 8.7%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 14.5% since the results and currently trades at $9.49.

Read our full analysis of MRC Global’s results here.

Richardson Electronics (NASDAQ: RELL)

Founded in 1947, Richardson Electronics (NASDAQ: RELL) is a distributor of power grid and microwave tubes as well as consumables related to those products.

Richardson Electronics reported revenues of $49.49 million, up 12.1% year on year. This number missed analysts’ expectations by 3.5%. Overall, it was a disappointing quarter as it also recorded a significant miss of analysts’ EBITDA and EPS estimates.

The stock is down 39% since reporting and currently trades at $8.97.

Read our full, actionable report on Richardson Electronics here, it’s free.

Global Industrial (NYSE: GIC)

Formerly known as Systemax, Global Industrial (NYSE: GIC) distributes industrial and commercial products to businesses and institutions.

Global Industrial reported revenues of $302.3 million, down 5.6% year on year. This print came in 1.2% below analysts' expectations. It was a slower quarter as it also logged a miss of analysts’ EPS estimates.

The stock is down 12.3% since reporting and currently trades at $21.32.

Read our full, actionable report on Global Industrial here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.