Lucky Strike Entertainment’s stock price has taken a beating over the past six months, shedding 20.6% of its value and falling to $9.25 per share. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Lucky Strike Entertainment, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why LUCK doesn't excite us and a stock we'd rather own.

Why Do We Think Lucky Strike Entertainment Will Underperform?

Born from the transformation of traditional bowling alleys into modern entertainment destinations, Lucky Strike Entertainment (NYSE: LUCK) operates bowling alleys and other entertainment venues with upscale amenities, arcade games, and food and beverage services across North America.

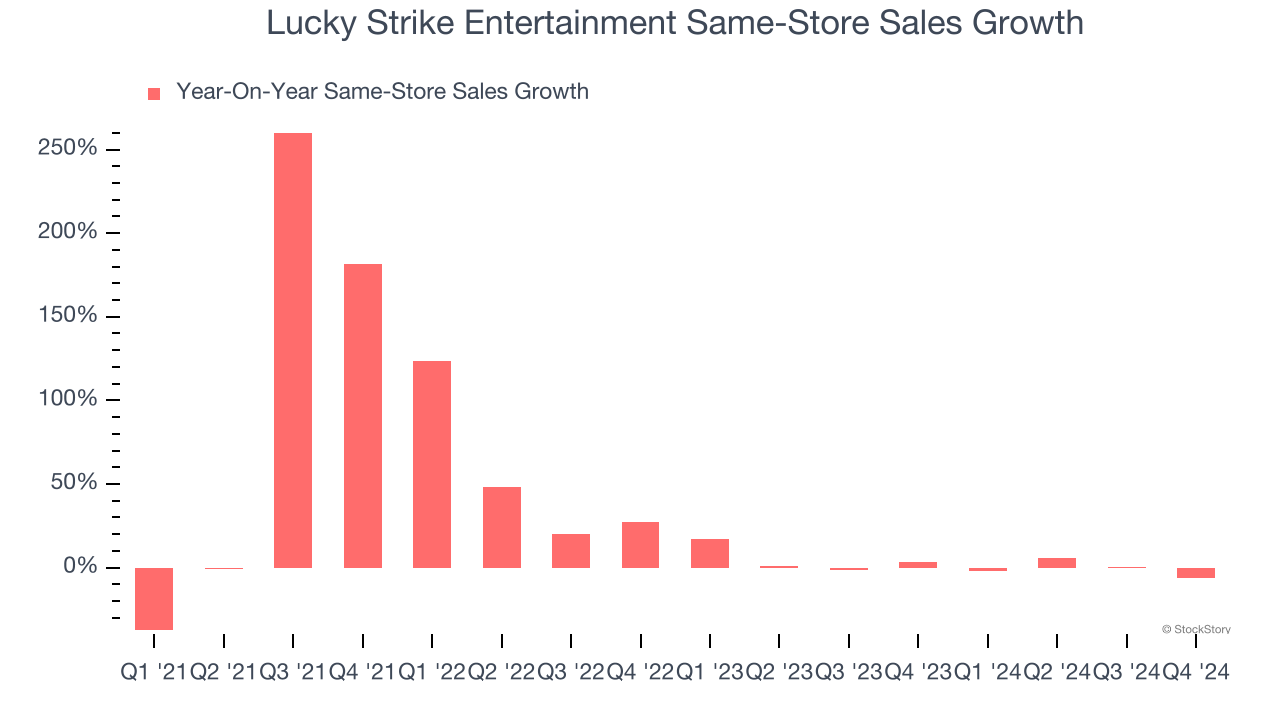

1. Same-Store Sales Falling Behind Peers

Investors interested in Leisure Facilities companies should track same-store sales in addition to reported revenue. This metric measures the change in sales at brick-and-mortar locations that have existed for at least a year, giving visibility into Lucky Strike Entertainment’s underlying demand characteristics.

Over the last two years, Lucky Strike Entertainment’s same-store sales averaged 2.2% year-on-year growth. This performance was underwhelming and suggests it might have to change its strategy or pricing, which can disrupt operations.

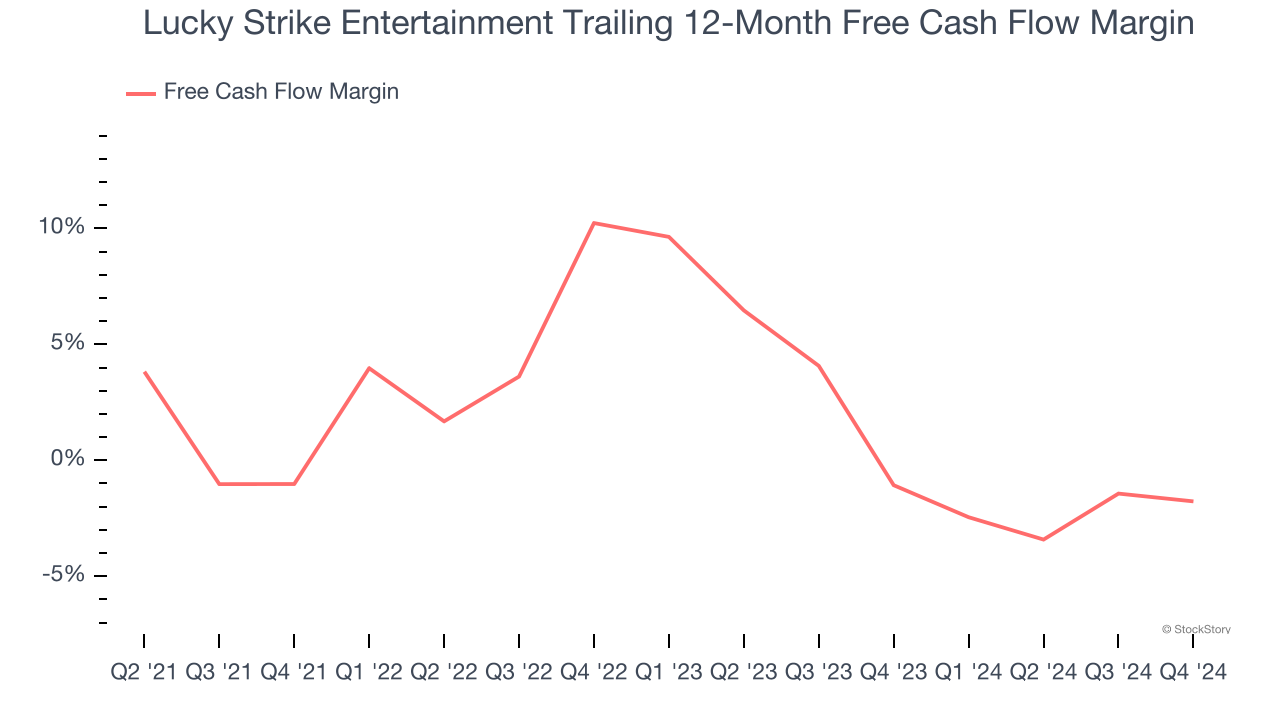

2. Cash Burn Ignites Concerns

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Over the last two years, Lucky Strike Entertainment’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1.4%, meaning it lit $1.44 of cash on fire for every $100 in revenue.

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Lucky Strike Entertainment burned through $20.96 million of cash over the last year, and its $2.57 billion of debt exceeds the $80.76 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Lucky Strike Entertainment’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Lucky Strike Entertainment until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

Lucky Strike Entertainment doesn’t pass our quality test. After the recent drawdown, the stock trades at 29.3× forward price-to-earnings (or $9.25 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better stocks to buy right now. We’d suggest looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of Lucky Strike Entertainment

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.