Over the past six months, Humana’s shares (currently trading at $268.69) have posted a disappointing 15.2% loss while the S&P 500 was down 1.4%. This might have investors contemplating their next move.

Following the pullback, is now an opportune time to buy HUM? Find out in our full research report, it’s free.

Why Are We Positive On HUM?

With over 80% of its revenue derived from federal government contracts, Humana (NYSE: HUM) provides health insurance plans and healthcare services to approximately 17 million members, with a strong focus on Medicare Advantage plans for seniors.

1. Long-Term Revenue Growth Shows Strong Momentum

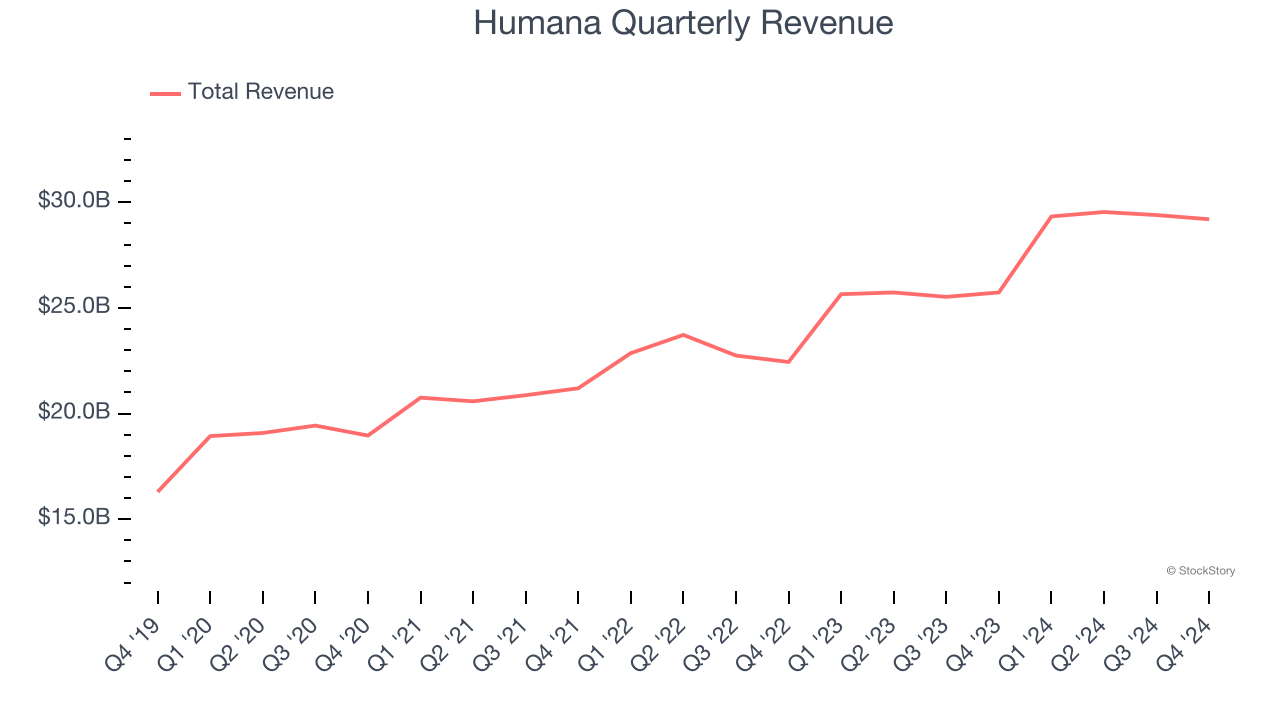

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Humana grew its sales at a solid 12.6% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

2. Economies of Scale Give It Negotiating Leverage with Suppliers

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $117.5 billion in revenue over the past 12 months, Humana is one of the most scaled enterprises in healthcare. This is particularly important because health insurance providers companies are volume-driven businesses due to their low margins.

3. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Humana’s five-year average ROIC was 37.1%, placing it among the best healthcare companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

Final Judgment

These are just a few reasons why we're bullish on Humana. After the recent drawdown, the stock trades at 16× forward price-to-earnings (or $268.69 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Humana

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.