Gaming metaverse operator Roblox (NYSE: RBLX) reported Q4 CY2024 results exceeding the market’s revenue expectations, with sales up 31.8% year on year to $988.2 million. The company expects next quarter’s revenue to be around $1.00 billion, coming in 2.5% above analysts’ estimates. Its GAAP loss of $0.33 per share was 26.2% above analysts’ consensus estimates.

Is now the time to buy Roblox? Find out by accessing our full research report, it’s free.

Roblox (RBLX) Q4 CY2024 Highlights:

- Revenue: $988.2 million vs analyst estimates of $970 million (31.8% year-on-year growth, 1.9% beat)

- EPS (GAAP): -$0.33 vs analyst estimates of -$0.45 (26.2% beat)

- Adjusted EBITDA: $65.61 million vs analyst estimates of $351.4 million (6.6% margin, 81.3% miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $4.30 billion at the midpoint, missing analyst estimates by 17.9% and implying 19.2% growth (vs 28.5% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $227.5 million at the midpoint, below analyst estimates of $1.03 billion

- Operating Margin: -24.7%, up from -47.4% in the same quarter last year

- Free Cash Flow Margin: 12.2%, down from 23.7% in the previous quarter

- Daily Active Users: 85.3 million, up 13.8 million year on year

- Market Capitalization: $49.53 billion

“Roblox had a strong 2024, driven by our commitment to innovation and community. We’re building a platform that goes beyond technology—it’s about fostering genuine connections. As we aim to support 10% of the global gaming content market, we’ll continue investing in our virtual economy, app performance, and AI-powered discovery and safety, empowering creators and enhancing the user experience,” said David Baszucki, founder and CEO of Roblox.

Company Overview

Best known for its wide assortment of user-generated content, Roblox (NYSE: RBLX) is an online gaming platform and game creation system.

Video Gaming

Since videogames were invented in the 1970s, they have gradually taken more share of entertainment time. Ubiquitous mobile devices have powered a surge in “snackable” games that can be played on the go. Over time, games have developed more social engagement features where friends can play games together over the internet. The business models of games publishers have become less volatile due to digitization of distribution, in game monetization, and like Hollywood, an increasing dependence on surefire hit franchises. Covid driven lockdowns accelerated adoption and usage of videogames – a trend that has not slowed.

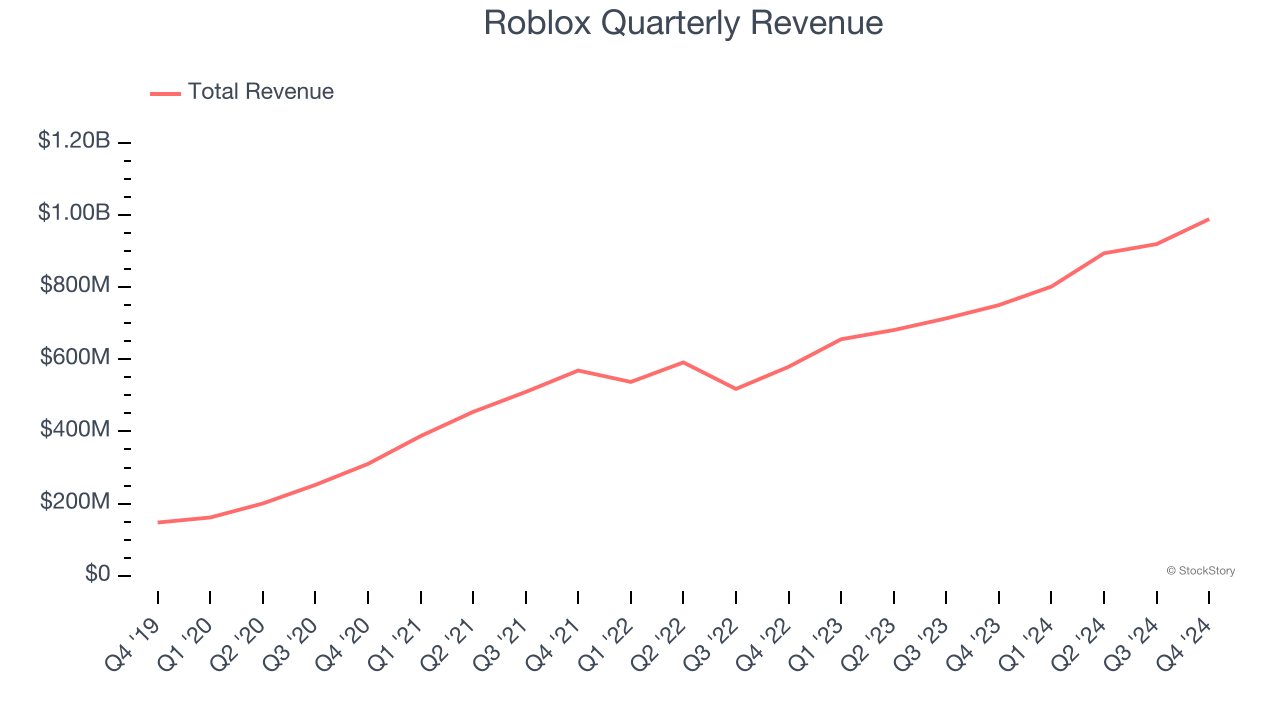

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Roblox grew its sales at an excellent 23.4% compounded annual growth rate. Its growth beat the average consumer internet company and shows its offerings resonate with customers, a helpful starting point for our analysis.

This quarter, Roblox reported wonderful year-on-year revenue growth of 31.8%, and its $988.2 million of revenue exceeded Wall Street’s estimates by 1.9%. Company management is currently guiding for a 25.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 21.3% over the next 12 months, a slight deceleration versus the last three years. Still, this projection is admirable and suggests the market is factoring in success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

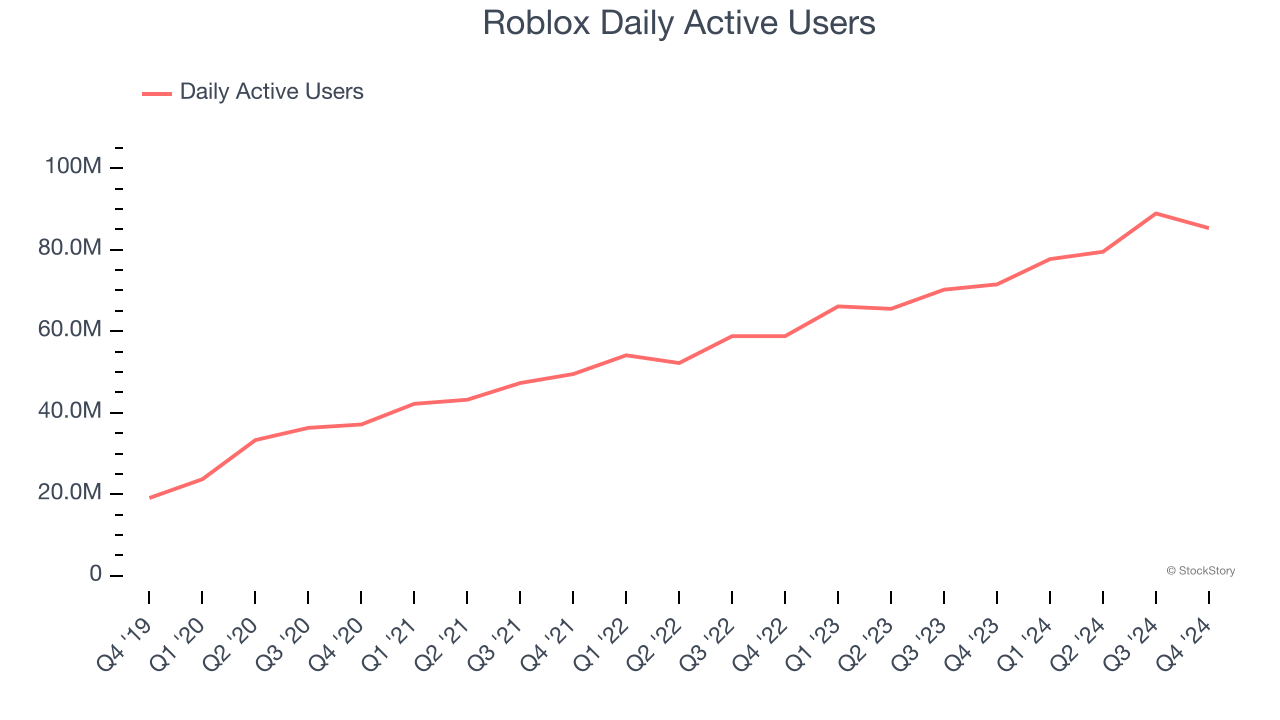

Daily Active Users

User Growth

As a video gaming company, Roblox generates revenue growth by expanding both the number of people playing its games as well as how much each of those players spends on (or in) their games.

Over the last two years, Roblox’s daily active users, a key performance metric for the company, increased by 21.7% annually to 85.3 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

In Q4, Roblox added 13.8 million daily active users, leading to 19.3% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating user growth just yet.

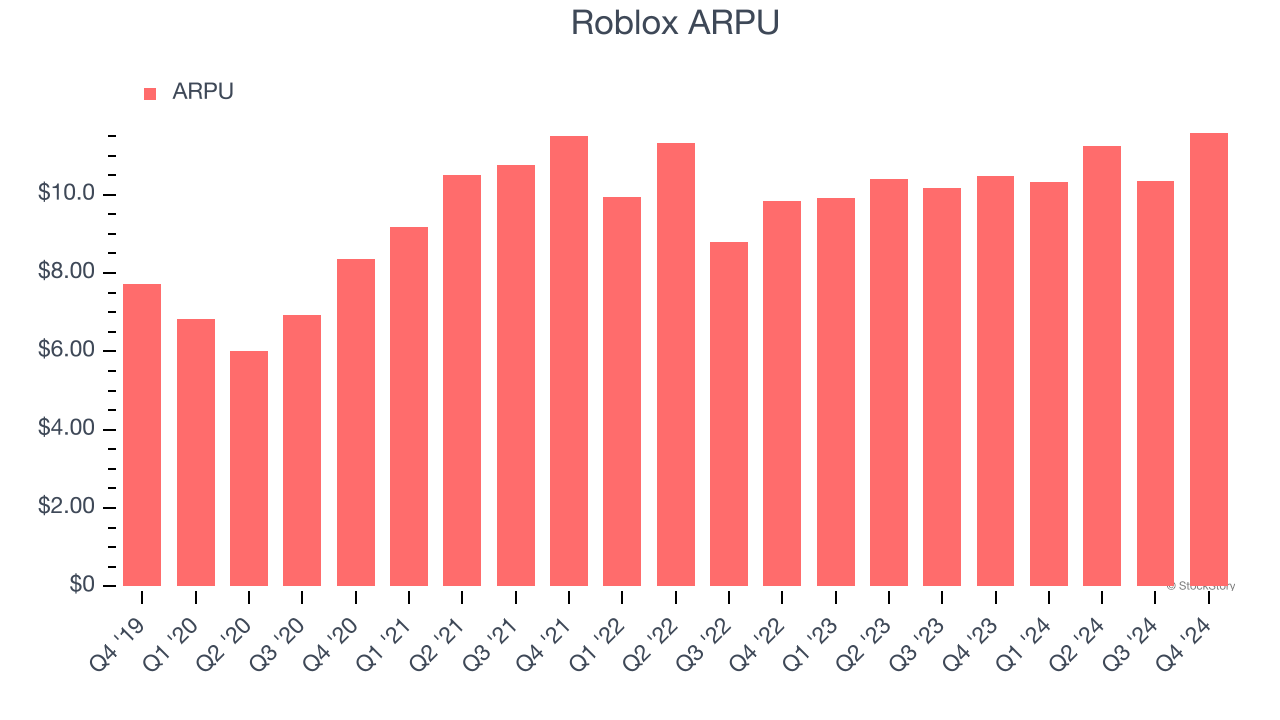

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for video gaming businesses like Roblox because it measures how much revenue each user generates, which is a function of how much paying users spend on its games.

Roblox’s ARPU growth has been mediocre over the last two years, averaging 4.7%. This isn’t great, but the increase in daily active users is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Roblox tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

This quarter, Roblox’s ARPU clocked in at $11.58. It grew by 10.5% year on year, slower than its user growth.

Key Takeaways from Roblox’s Q4 Results

We were glad Roblox expanded its number of users and beat analysts' revenue expectations this quarter. On the other hand, its full-year revenue and EBITDA guidance missed significantly - the company's anticipated bookings growth of 20% for 2025 met the growth targets shared in its November 2023 Investor Day but Wall Street was hoping for better. Overall, this was a softer quarter. The stock traded down 21.5% to $59.30 immediately after reporting.

Roblox underperformed this quarter, but does that create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.