Medication company Viatris (NASDAQ: VTRS) fell short of the market’s revenue expectations in Q4 CY2024, with sales falling 8.1% year on year to $3.53 billion. The company’s full-year revenue guidance of $13.75 billion at the midpoint came in 3.3% below analysts’ estimates. Its non-GAAP profit of $0.54 per share was 5.6% below analysts’ consensus estimates.

Is now the time to buy Viatris? Find out by accessing our full research report, it’s free.

Viatris (VTRS) Q4 CY2024 Highlights:

- Revenue: $3.53 billion vs analyst estimates of $3.59 billion (8.1% year-on-year decline, 1.8% miss)

- Adjusted EPS: $0.54 vs analyst expectations of $0.57 (5.6% miss)

- Adjusted EBITDA: $983.5 million vs analyst estimates of $1.02 billion (27.9% margin, 3.6% miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $13.75 billion at the midpoint, missing analyst estimates by 3.3% and implying -6.7% growth (vs -4.4% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $2.19 at the midpoint, missing analyst estimates by 15.4%

- EBITDA guidance for the upcoming financial year 2025 is $4.05 billion at the midpoint, below analyst estimates of $4.43 billion

- Operating Margin: -5.1%, up from -11.8% in the same quarter last year

- Market Capitalization: $13.42 billion

Company Overview

Formed in 2020 through the merger of Mylan and Upjohn, Viatris (NASDAQ: VTRS) provides a portfolio of branded, generic, and over-the-counter medications as well as biosimilars aimed at addressing a wide range of therapeutic areas.

Generic Pharmaceuticals

The generic pharmaceutical industry operates on a volume-driven, low-cost business model, producing bioequivalent versions of branded drugs once their patents expire. These companies benefit from consistent demand for affordable medications, as they are critical to reducing healthcare costs. Generics typically face lower R&D expenses and shorter regulatory approval timelines compared to branded drug makers, enabling cost efficiencies. However, the industry is highly competitive, with intense pricing pressures, thin margins, and frequent legal challenges from branded pharmaceutical companies over patent disputes. Looking ahead, the industry is supported by tailwinds such as the role of AI in streamlining drug development (reverse engineering complex formulations) and manufacturing efficiency (optimize processes and remove inefficiencies). Governments and insurers' focus on reducing drug costs can also boost generics' adoption. However, headwinds include escalating pricing pressure from large buyers like pharmacy chains and healthcare distributors as well as evolving regulatory hurdles.

Sales Growth

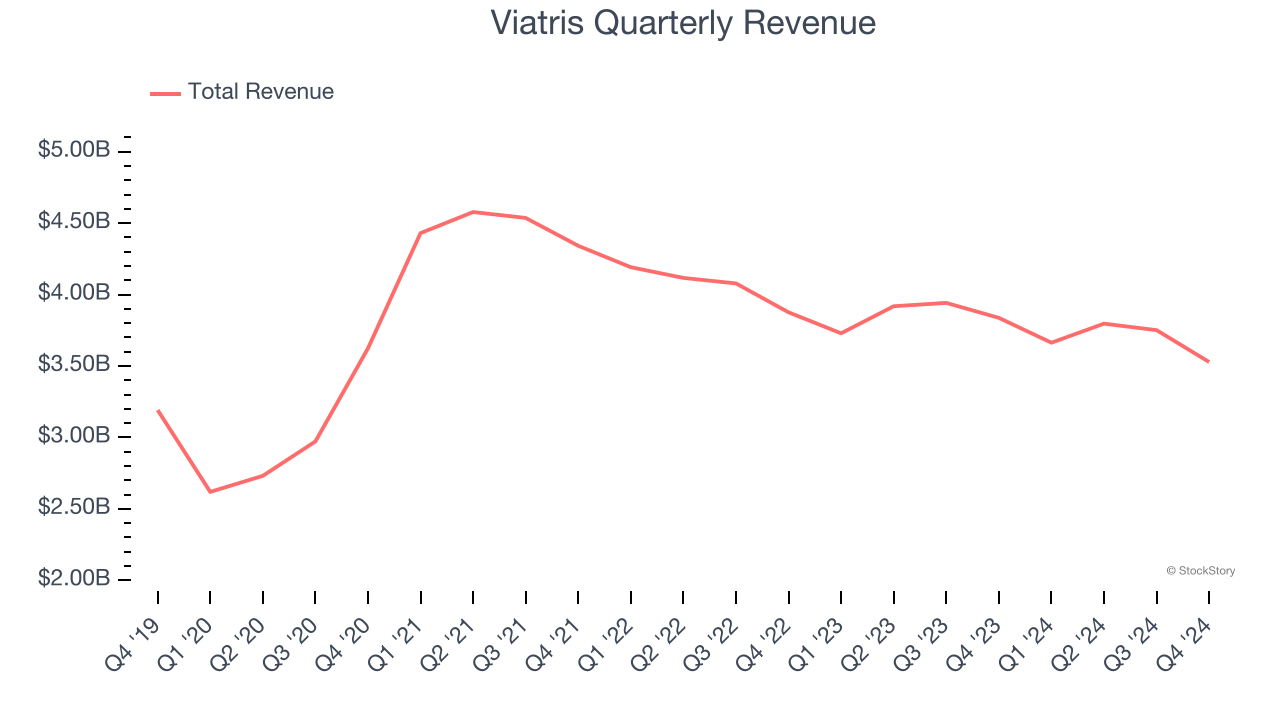

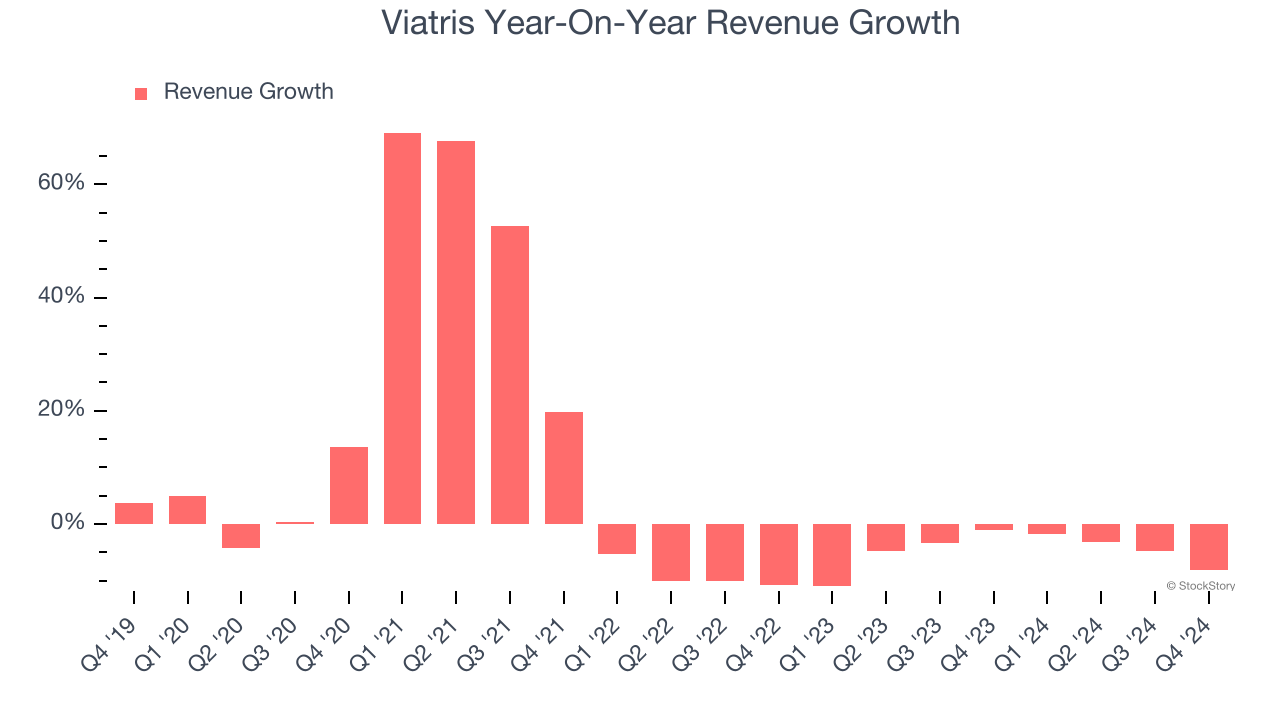

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Viatris’s sales grew at a mediocre 5.1% compounded annual growth rate over the last five years. This fell short of our benchmark for the healthcare sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Viatris’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 4.8% annually.

This quarter, Viatris missed Wall Street’s estimates and reported a rather uninspiring 8.1% year-on-year revenue decline, generating $3.53 billion of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 4.4% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its newer products and services will not lead to better top-line performance yet.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

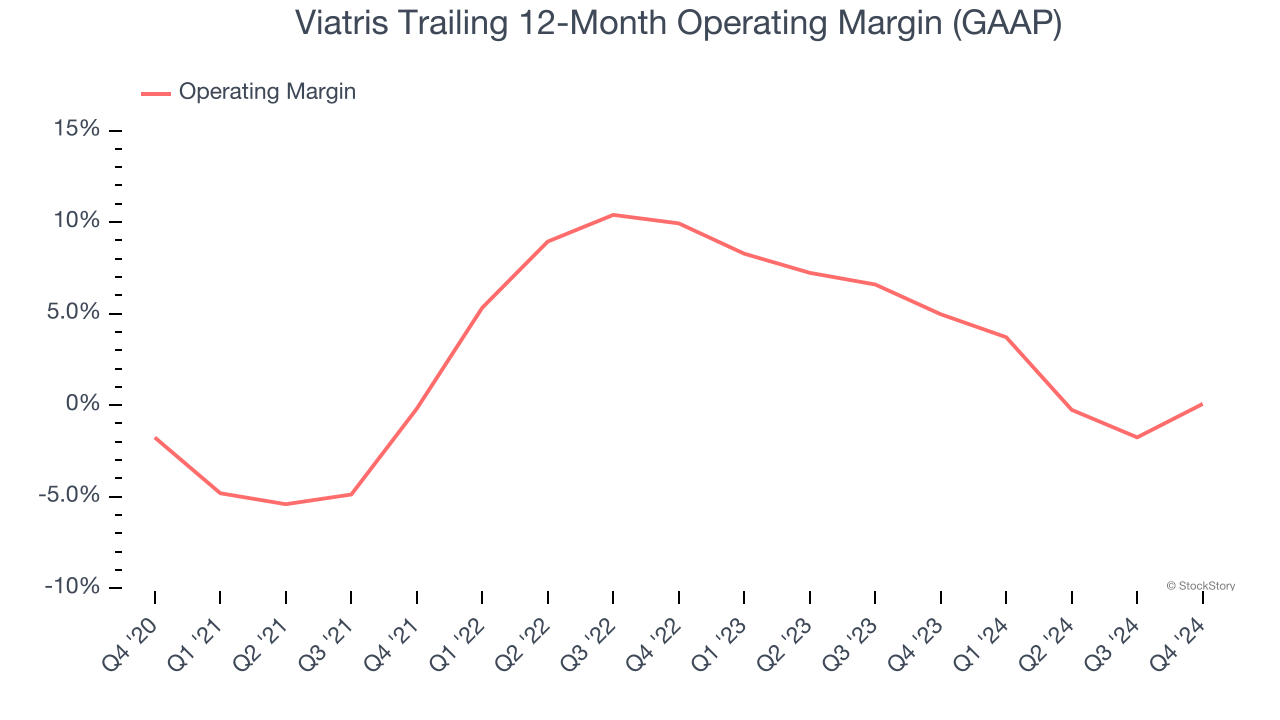

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Viatris was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.8% was weak for a healthcare business.

On the plus side, Viatris’s operating margin rose by 1.8 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming into its more recent performance, however, we can see the company’s margin has decreased by 9.9 percentage points on a two-year basis. If Viatris wants to pass our bar, it must prove it can expand its profitability consistently.

This quarter, Viatris generated an operating profit margin of negative 5.1%, up 6.7 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was recently more efficient because it scaled down its expenses.

Earnings Per Share

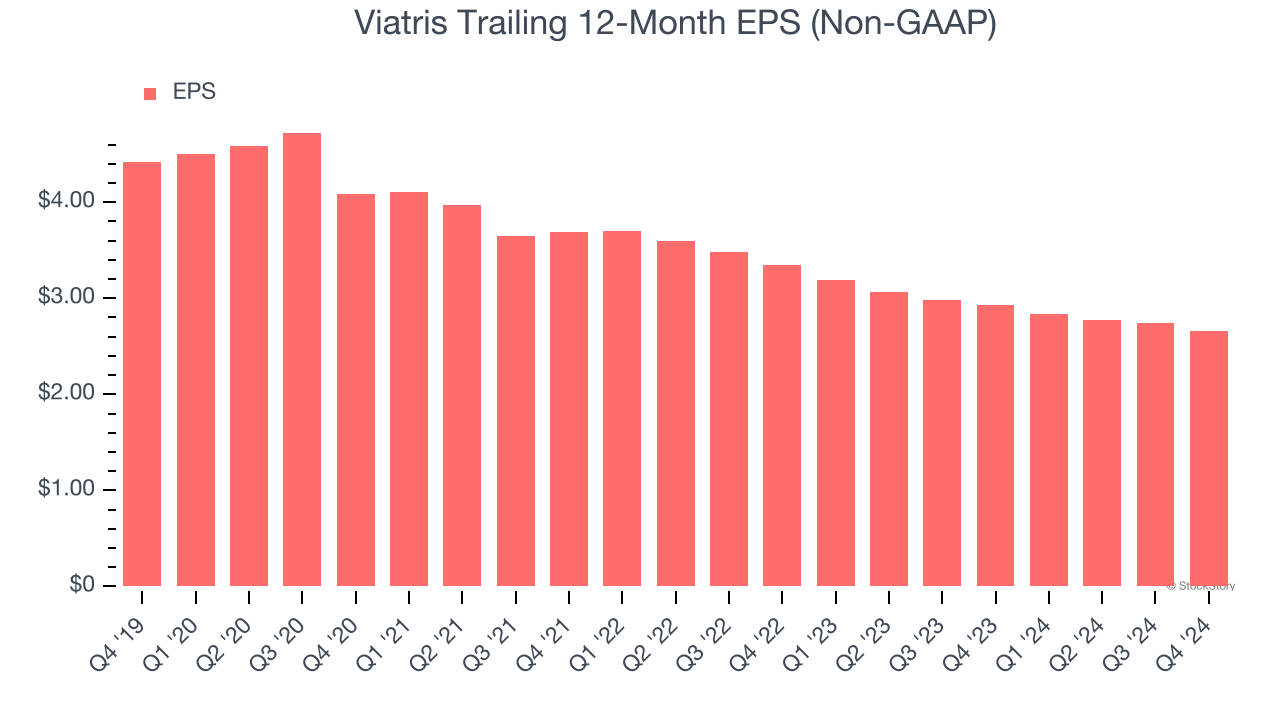

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Viatris, its EPS declined by 9.7% annually over the last five years while its revenue grew by 5.1%. However, its operating margin actually expanded during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

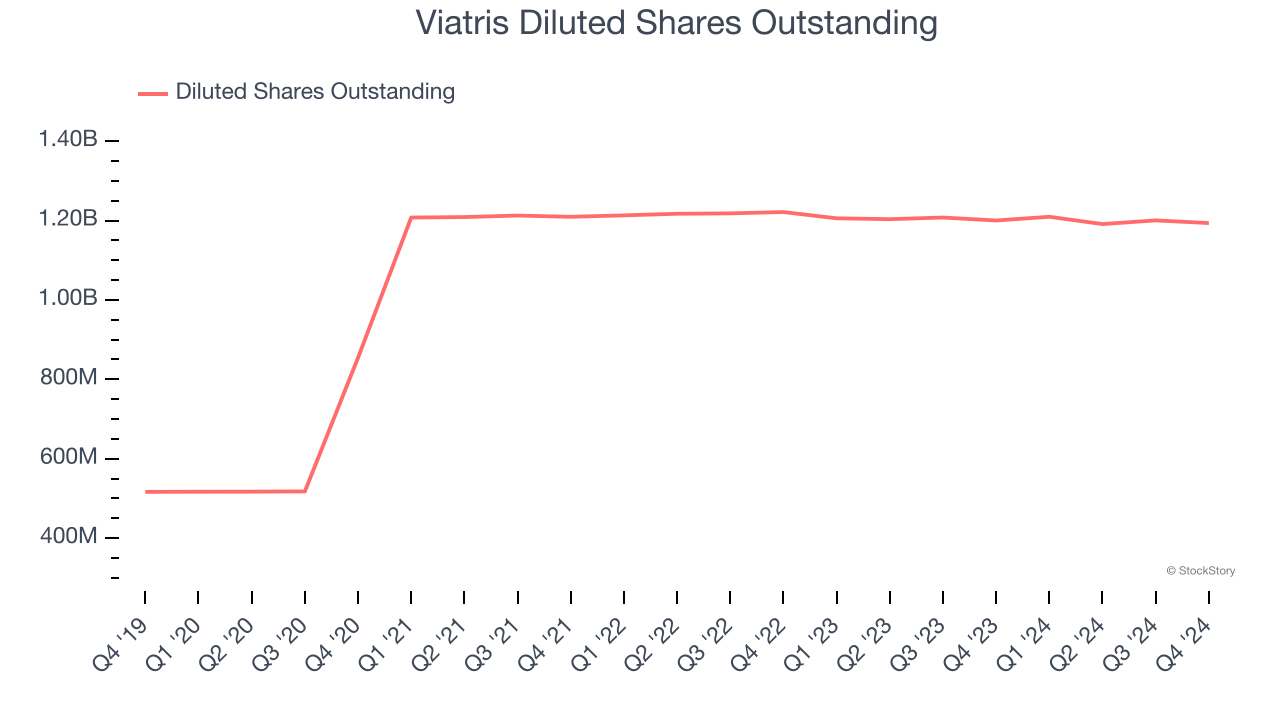

We can take a deeper look into Viatris’s earnings to better understand the drivers of its performance. A five-year view shows Viatris has diluted its shareholders, growing its share count by 131%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Viatris reported EPS at $0.54, down from $0.62 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Viatris’s full-year EPS of $2.66 to shrink by 3.8%.

Key Takeaways from Viatris’s Q4 Results

We struggled to find many positives in these results. Its full-year revenue guidance missed significantly and its full-year EPS guidance fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 7.8% to $10.35 immediately following the results.

Viatris may have had a tough quarter, but does that actually create an opportunity to invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.