Fast-food pizza chain Papa John’s (NASDAQ: PZZA) announced better-than-expected revenue in Q4 CY2024, but sales fell by 7.1% year on year to $530.8 million. Its non-GAAP profit of $0.63 per share was 27.1% above analysts’ consensus estimates.

Is now the time to buy Papa John's? Find out by accessing our full research report, it’s free.

Papa John's (PZZA) Q4 CY2024 Highlights:

- Revenue: $530.8 million vs analyst estimates of $516.6 million (7.1% year-on-year decline, 2.7% beat)

- Adjusted EPS: $0.63 vs analyst estimates of $0.50 (27.1% beat)

- Adjusted EBITDA: $46.41 million vs analyst estimates of $49.87 million (8.7% margin, 6.9% miss)

- EBITDA guidance for the upcoming financial year 2025 is $210 million at the midpoint, below analyst estimates of $218.8 million

- Operating Margin: 5.6%, down from 7.5% in the same quarter last year

- Locations: 6,030 at quarter end, up from 5,906 in the same quarter last year

- Same-Store Sales fell 2.8% year on year (0.3% in the same quarter last year)

- Market Capitalization: $1.51 billion

“I am pleased with the early progress we are seeing in our transformation as we work to improve our value perception, simplify our operations, and enhance our digital and loyalty experiences. These efforts helped to deliver results consistent with our fourth quarter expectations,” said Todd Penegor, president and CEO.

Company Overview

Founded by the eclectic John “Papa John” Schnatter, Papa John’s (NASDAQ: PZZA) is a globally recognized pizza delivery and carryout chain known for “better ingredients” and “better pizza”.

Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $2.06 billion in revenue over the past 12 months, Papa John's is a mid-sized restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

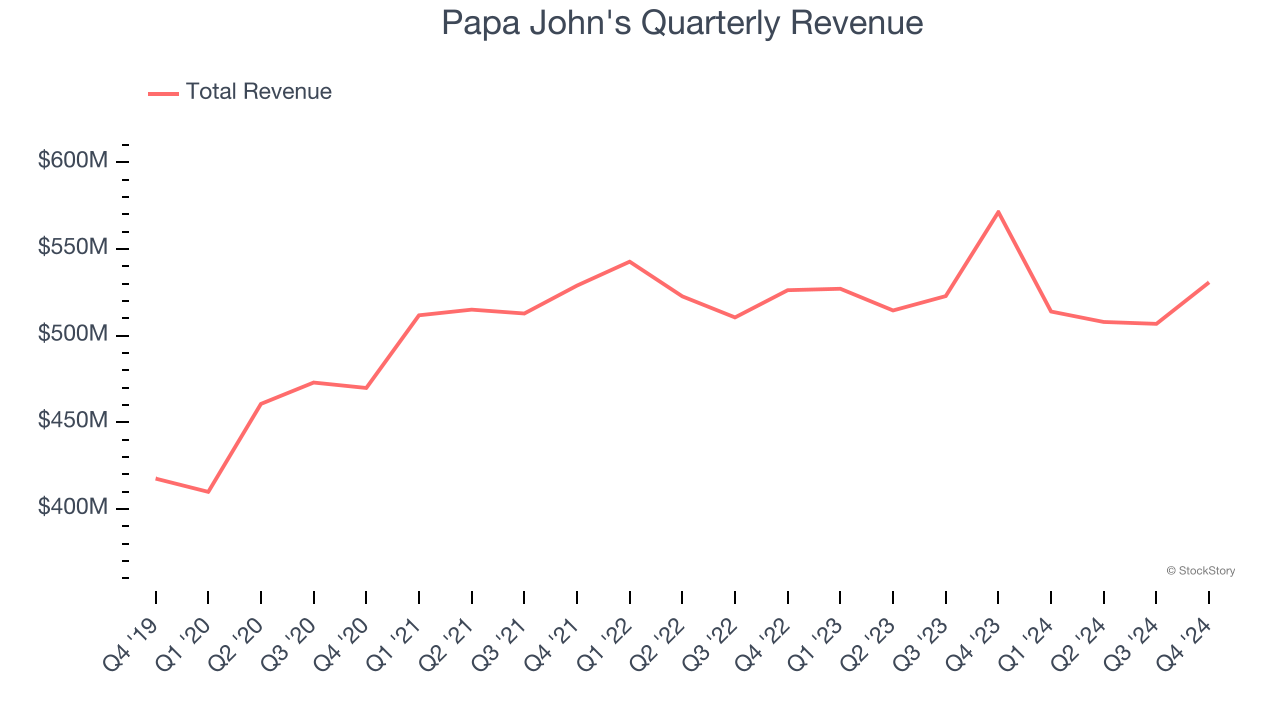

As you can see below, Papa John’s 4.9% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was sluggish.

This quarter, Papa John’s revenue fell by 7.1% year on year to $530.8 million but beat Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to grow 1.2% over the next 12 months, a deceleration versus the last five years. This projection is underwhelming and implies its menu offerings will face some demand challenges.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Restaurant Performance

Number of Restaurants

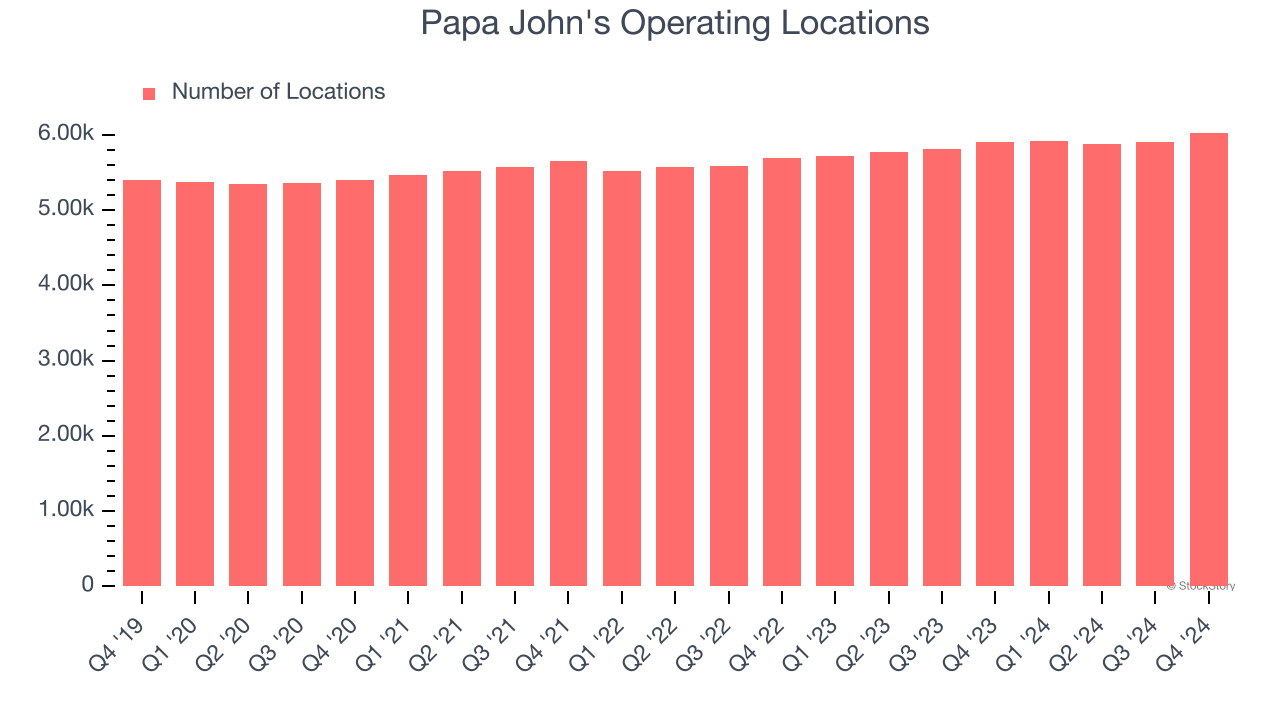

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Papa John's operated 6,030 locations in the latest quarter. It has opened new restaurants quickly over the last two years, averaging 3% annual growth, faster than the broader restaurant sector. Furthermore, one dynamic making expansion more seamless is the company’s franchise model, where franchisees are primarily responsible for opening new restaurants while Papa John's provides support.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

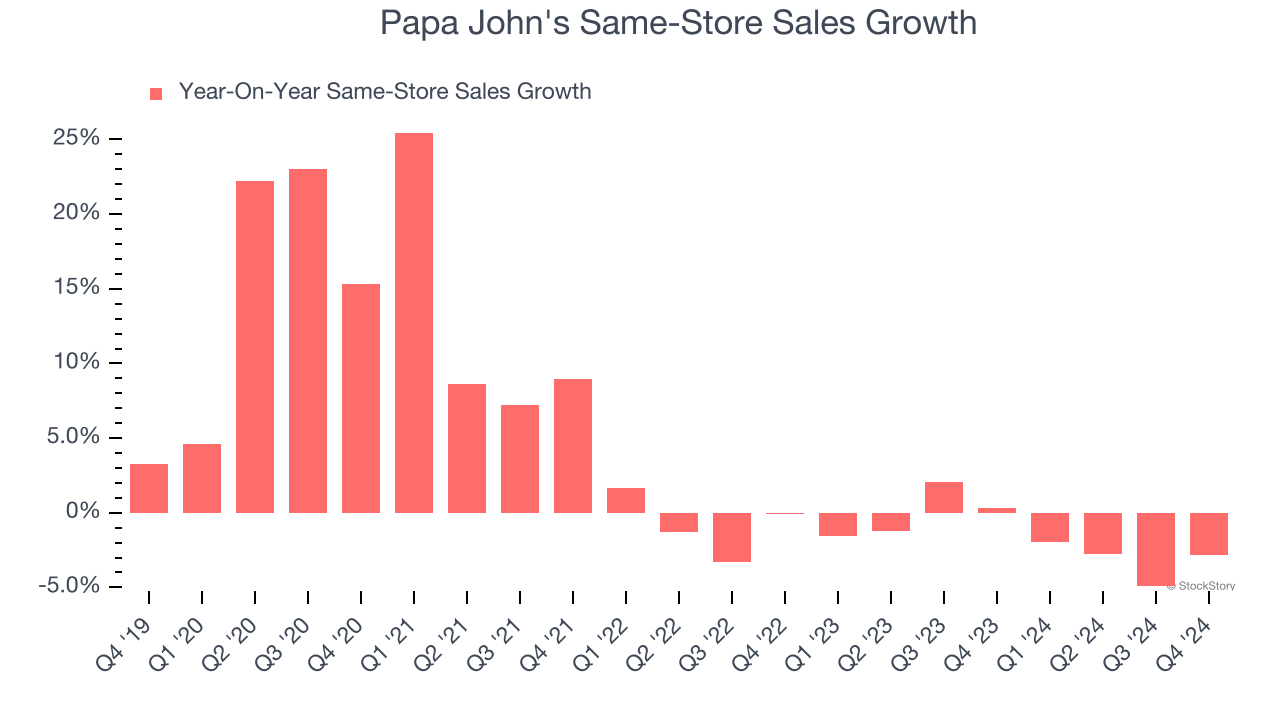

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

Papa John’s demand has been shrinking over the last two years as its same-store sales have averaged 1.6% annual declines. This performance is concerning - it shows Papa John's artificially boosts its revenue by building new restaurants. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its restaurant base.

In the latest quarter, Papa John’s same-store sales fell by 2.8% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Papa John’s Q4 Results

We enjoyed seeing Papa John's beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this was a mixed quarter. Still, the stock traded up 7% to $49.49 immediately following the results.

Is Papa John's an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.