Heating and cooling solutions company AAON (NASDAQ: AAON) fell short of the market’s revenue expectations in Q4 CY2024, with sales falling 2.9% year on year to $297.7 million. Its non-GAAP profit of $0.30 per share was 43.7% below analysts’ consensus estimates.

Is now the time to buy AAON? Find out by accessing our full research report, it’s free.

AAON (AAON) Q4 CY2024 Highlights:

- Revenue: $297.7 million vs analyst estimates of $320.5 million (2.9% year-on-year decline, 7.1% miss)

- Adjusted EPS: $0.30 vs analyst expectations of $0.53 (43.7% miss)

- Adjusted EBITDA: $47.02 million vs analyst estimates of $76.76 million (15.8% margin, 38.7% miss)

- Operating Margin: 9.9%, down from 21% in the same quarter last year

- Free Cash Flow was -$95.44 million, down from $30.36 million in the same quarter last year

- Backlog: $867.1 million at quarter end

- Market Capitalization: $8.29 billion

Gary Fields, CEO, stated, "As we anticipated early in the year, 2024 had its share of triumphs and obstacles for AAON. The BASX brand made a significant impact on the data center market with the industry's first large-scale development and sale of a custom-designed liquid cooling solution. Along with strong demand for BASX's air-side data center cooling equipment, this drove the Company's total backlog to finish the year up 70.0% from the end of 2023. To meet a strengthening pipeline of demand beyond the backlog, we also successfully increased production capacity in 2024 with the completion of our 245,000 square foot addition at our Longview, Texas location and the purchase of our new 787,000 square foot building in Memphis, Tennessee. Conversely, the Company's AAON brand faced two major challenges: an industry-regulated refrigerant transition and nonresidential construction activity that weakened throughout the year. Despite the challenges, sales of AAON-branded equipment were down only modestly in 2024. Bookings and year-end backlog of this equipment were up year-over-year in the mid-to-high teens. All in, we deem the year to be a success. "

Company Overview

Backed by two million square feet of lab testing space, AAON (NASDAQ: AAON) makes heating, ventilation, and air conditioning equipment for different types of buildings.

HVAC and Water Systems

Many HVAC and water systems companies sell essential, non-discretionary infrastructure for buildings. Since the useful lives of these water heaters and vents are fairly standard, these companies have a portion of predictable replacement revenue. In the last decade, trends in energy efficiency and clean water are driving innovation that is leading to incremental demand. On the other hand, new installations for these companies are at the whim of residential and commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

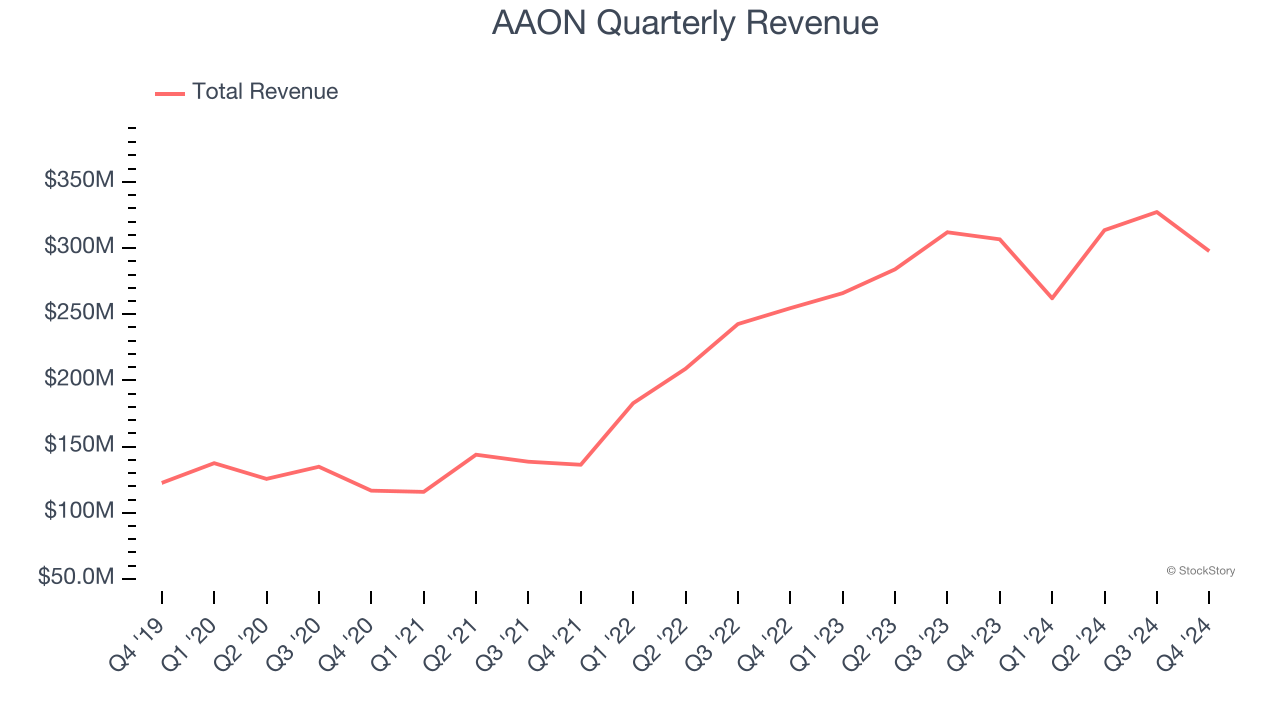

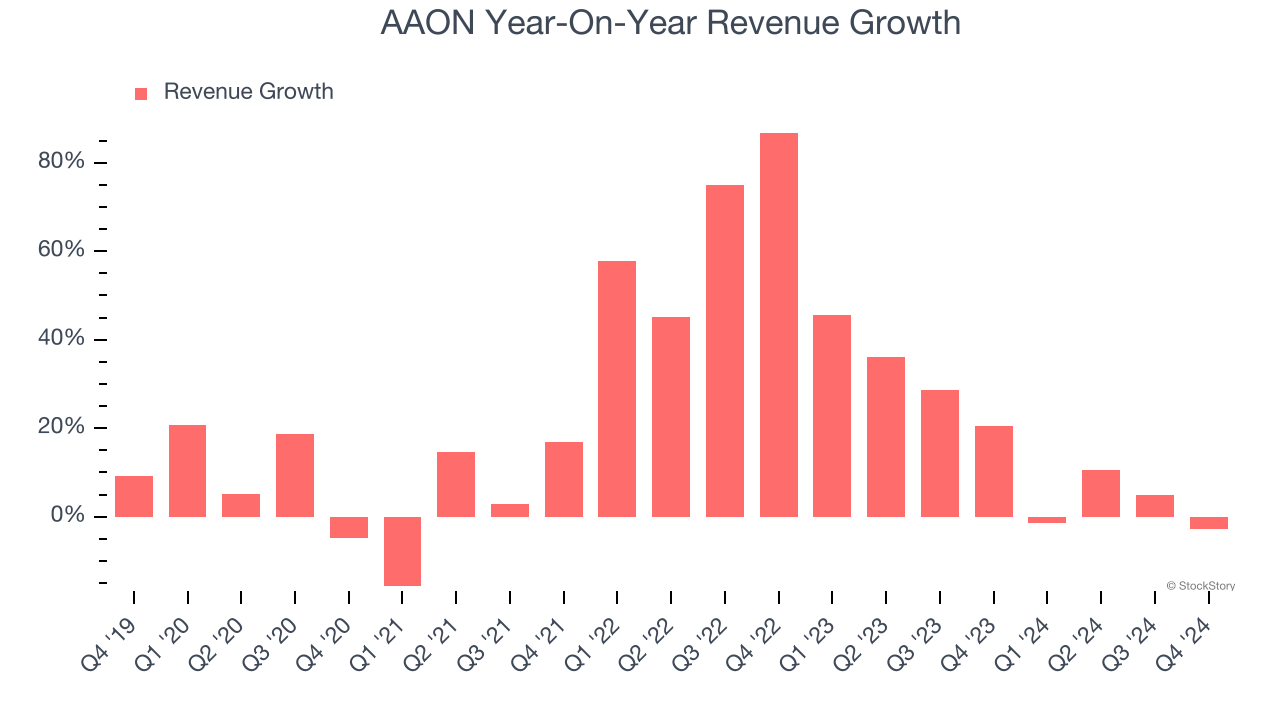

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, AAON’s 20.7% annualized revenue growth over the last five years was incredible. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. AAON’s annualized revenue growth of 16.2% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

This quarter, AAON missed Wall Street’s estimates and reported a rather uninspiring 2.9% year-on-year revenue decline, generating $297.7 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 26.5% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will spur better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

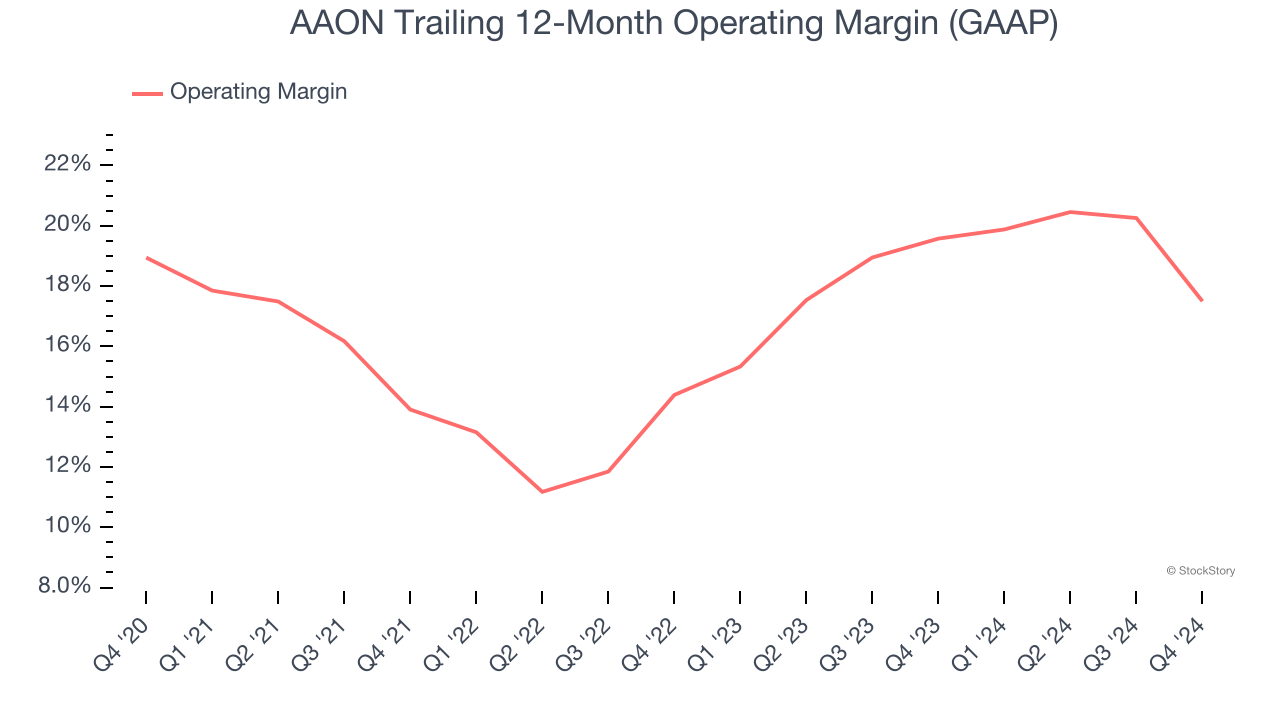

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

AAON has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17.1%.

Analyzing the trend in its profitability, AAON’s operating margin decreased by 1.4 percentage points over the last five years. This raises an eyebrow about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, AAON generated an operating profit margin of 9.9%, down 11.1 percentage points year on year. Since AAON’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

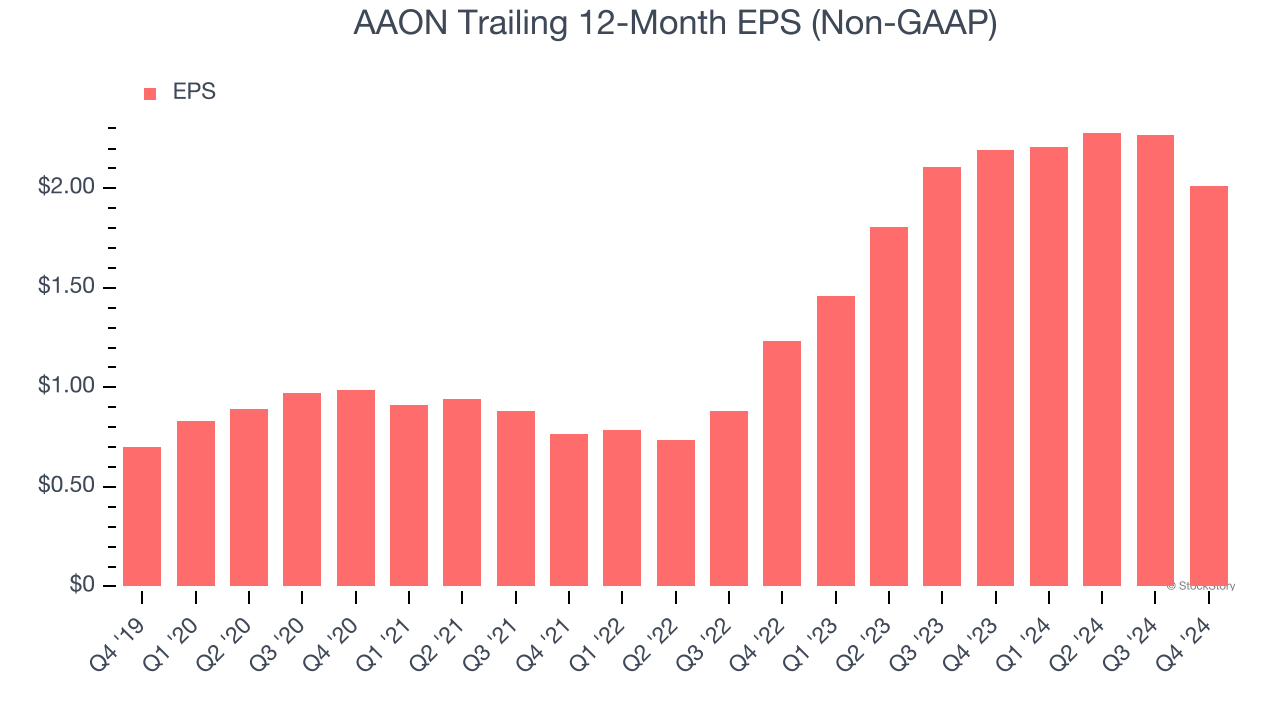

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

AAON’s EPS grew at an astounding 23.5% compounded annual growth rate over the last five years, higher than its 20.7% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t expand and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For AAON, its two-year annual EPS growth of 27.7% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, AAON reported EPS at $0.30, down from $0.56 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects AAON’s full-year EPS of $2.01 to grow 46%.

Key Takeaways from AAON’s Q4 Results

We struggled to find many positives in these results. Its revenue missed significantly and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 10.2% to $91.60 immediately following the results.

AAON’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.