Chegg’s stock price has taken a beating over the past six months, shedding 27.8% of its value and falling to $1.43 per share. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Chegg, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Even with the cheaper entry price, we're swiping left on Chegg for now. Here are three reasons why you should be careful with CHGG and a stock we'd rather own.

Why Is Chegg Not Exciting?

Started as a physical textbook rental service, Chegg (NYSE: CHGG) is now a digital platform addressing student pain points by providing study and academic assistance.

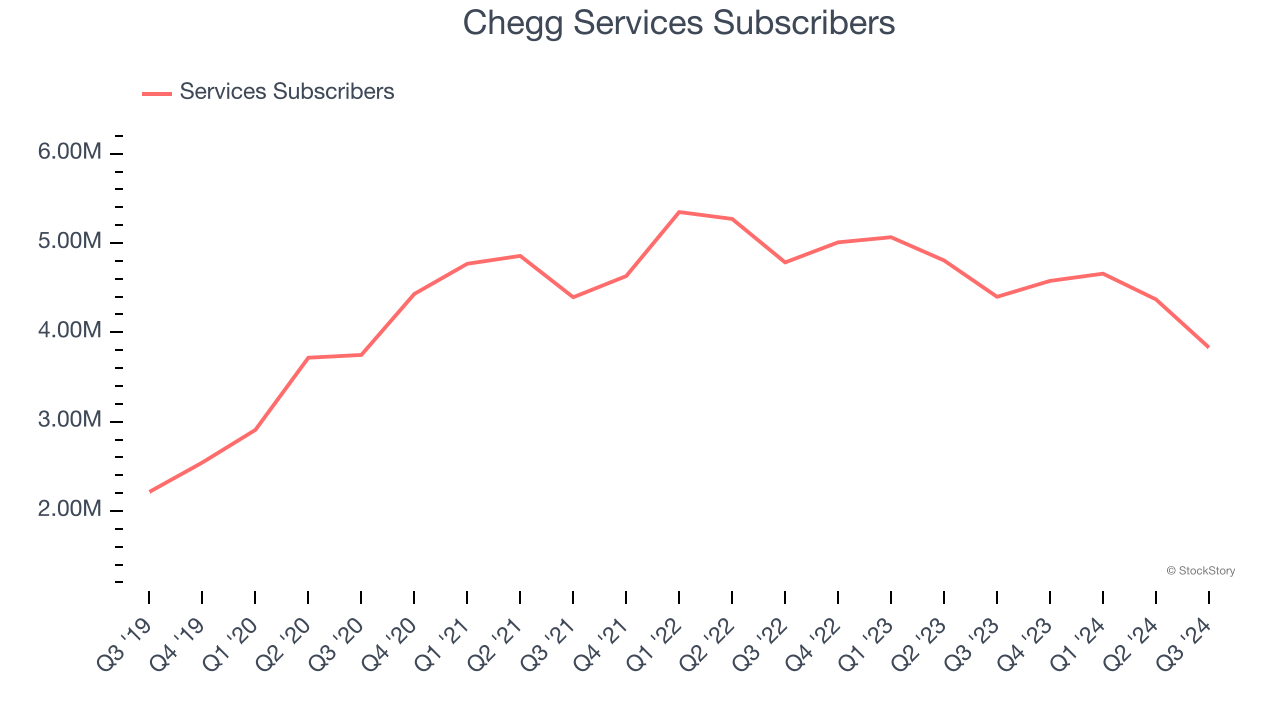

1. Declining Services Subscribers Reflect Product Weakness

As a subscription-based app, Chegg generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

Chegg struggled to engage its audience over the last two years as its services subscribers have declined by 6.6% annually to 3.83 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Chegg wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Chegg’s revenue to drop by 20.1%, a decrease from its 5.1% annualized declines for the past three years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

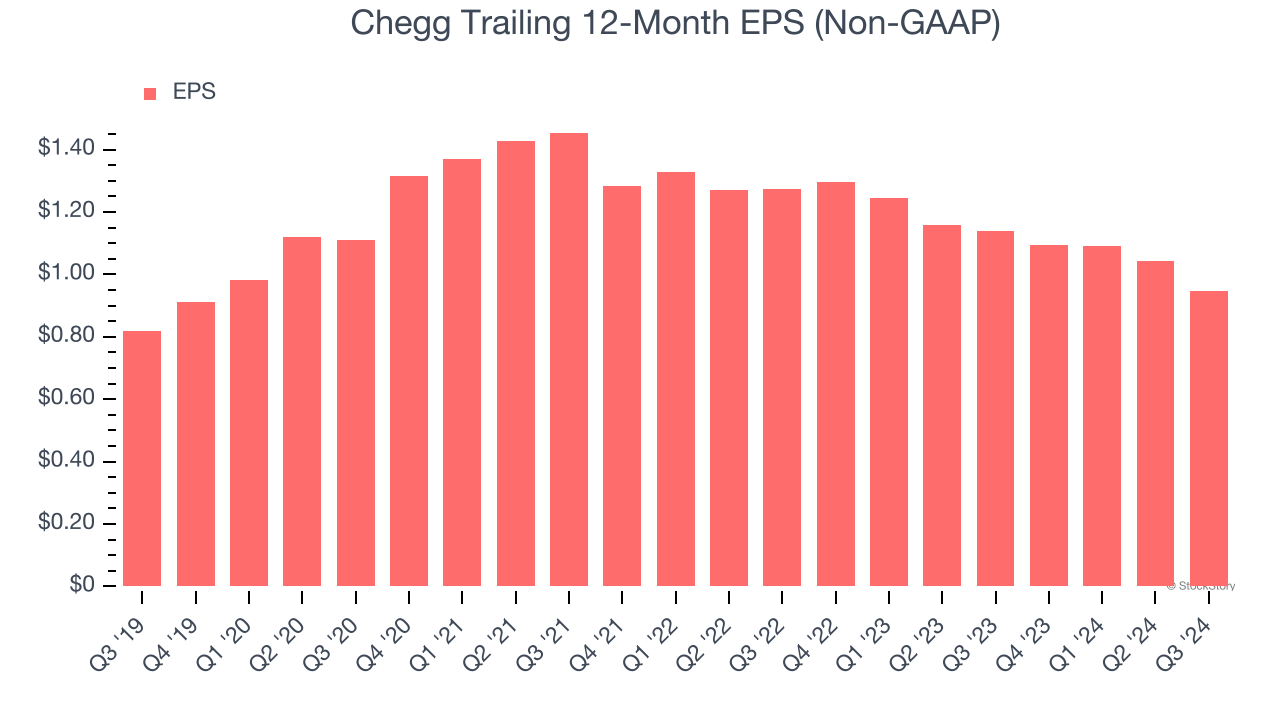

3. EPS Trending Down

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Chegg, its EPS declined by more than its revenue over the last three years, dropping 13.4% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

Chegg isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 0.9× forward EV-to-EBITDA (or $1.43 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better stocks to buy right now. Let us point you toward one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of Chegg

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.