Procter & Gamble has been treading water for the past six months, holding steady at $167.30. The stock also fell short of the S&P 500’s 13.1% gain during that period.

Given the weaker price action, is now a good time to buy PG? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free.

Why Does PG Stock Spark Debate?

Founded by candle maker William Procter and soap maker James Gamble, Proctor & Gamble (NYSE: PG) is a consumer products behemoth whose product portfolio spans everything from facial tissues to laundry detergent to feminine care to men’s grooming.

Two Things to Like:

1. Economies of Scale Give It Negotiating Leverage with Suppliers

With $84.35 billion in revenue over the past 12 months, Procter & Gamble is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have). However, its scale is a double-edged sword because there are only so many big store chains to sell into, making it harder to find incremental growth. To accelerate sales, Procter & Gamble must lean into newer products.

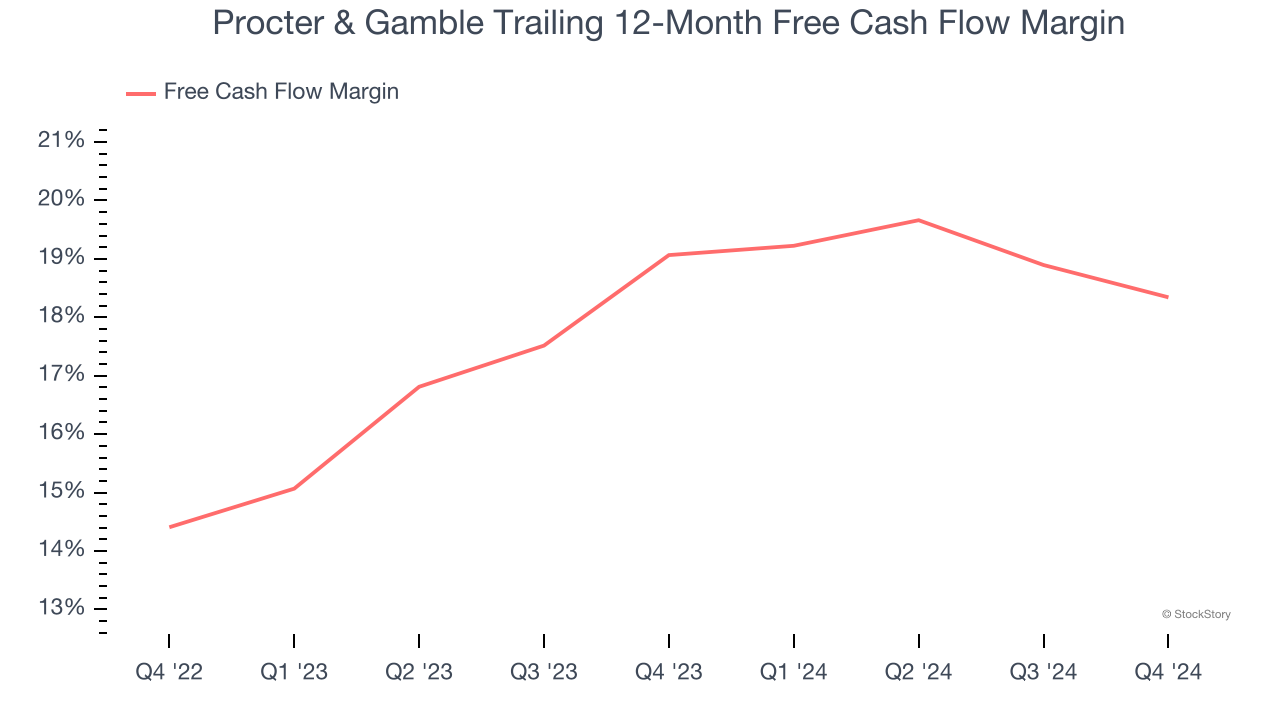

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Procter & Gamble has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 18.7% over the last two years.

One Reason to be Careful:

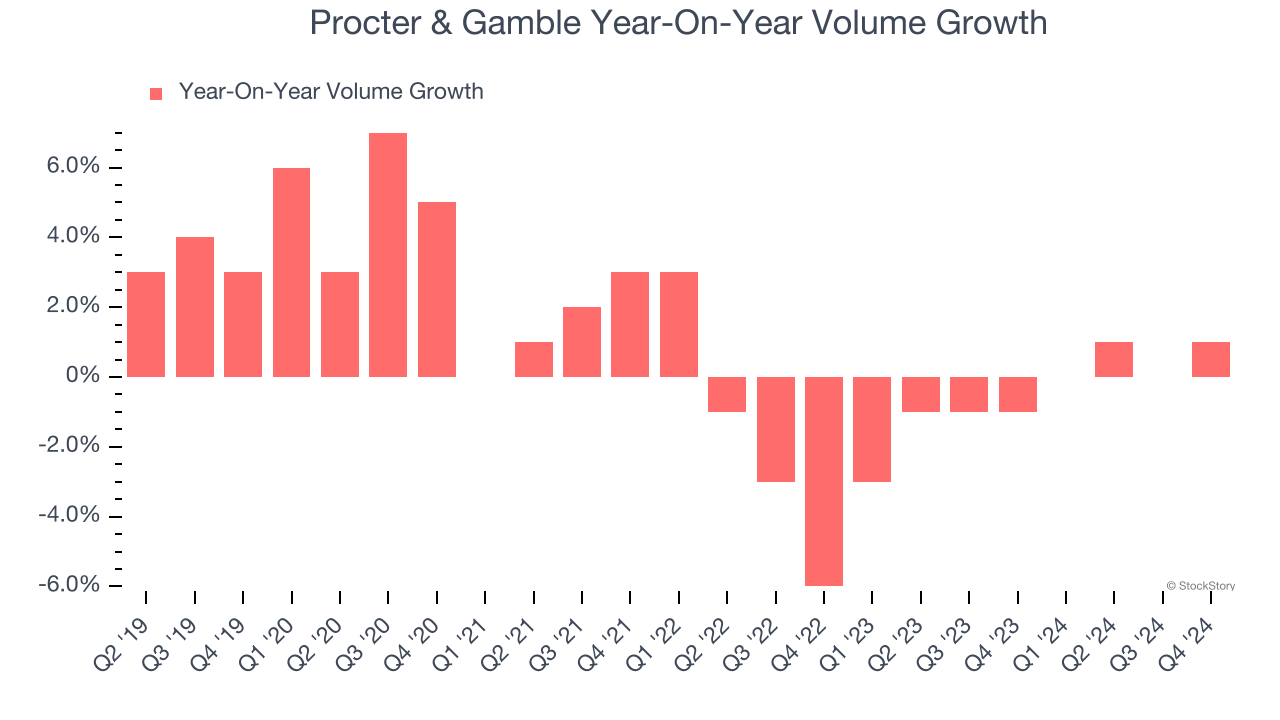

Sales Volumes Stall, Demand Waning

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Procter & Gamble’s quarterly sales volumes have, on average, stayed about the same over the last two years. This stability is normal because the quantity demanded for consumer staples products typically doesn’t see much volatility.

Final Judgment

Procter & Gamble’s merits more than compensate for its flaws. With its shares trailing the market in recent months, the stock trades at 23.5× forward price-to-earnings (or $167.30 per share). Is now a good time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Procter & Gamble

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.