Homebuilding company Toll Brothers (NYSE: TOL) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 2.7% year on year to $3.42 billion. Its non-GAAP profit of $4.58 per share was 6.1% below analysts’ consensus estimates.

Is now the time to buy Toll Brothers? Find out by accessing our full research report, it’s free for active Edge members.

Toll Brothers (TOL) Q3 CY2025 Highlights:

- Revenue: $3.42 billion vs analyst estimates of $3.32 billion (2.7% year-on-year growth, 3.2% beat)

- Adjusted EPS: $4.58 vs analyst expectations of $4.88 (6.1% miss)

- Operating Margin: 16.5%, down from 19% in the same quarter last year

- Backlog: $5.5 billion at quarter end, down 15% year on year

- Market Capitalization: $13.39 billion

Douglas C. Yearley, Jr., chairman and chief executive officer, stated: “Fiscal 2025 proved to be another strong year for Toll Brothers, as we executed well in a choppy environment. We delivered 11,292 homes at an average price of $960,000, generating a record $10.8 billion of home sales revenues, and posted an adjusted gross margin of 27.3%, an SG&A margin of 9.5%, and earnings of $13.49 per diluted share. We grew our community count by 9%, continued to produce strong operating cash flows of $1.1 billion, returned approximately $750 million to stockholders through share repurchases and dividends, and generated a return on beginning equity of 17.6%. In our fourth quarter, we met or exceeded guidance across all of our core home building metrics, generating $3.4 billion in home sales revenue with an adjusted gross margin of 27.1% and an SG&A margin of 8.3%. We earned $4.58 per diluted share, which was modestly below guidance due to the delayed closing of the sale of our Apartment Living business that we announced in September.

Company Overview

Started by two brothers who started by building and selling just one home in Pennsylvania, today Toll Brothers (NYSE: TOL) is a luxury homebuilder across the United States.

Revenue Growth

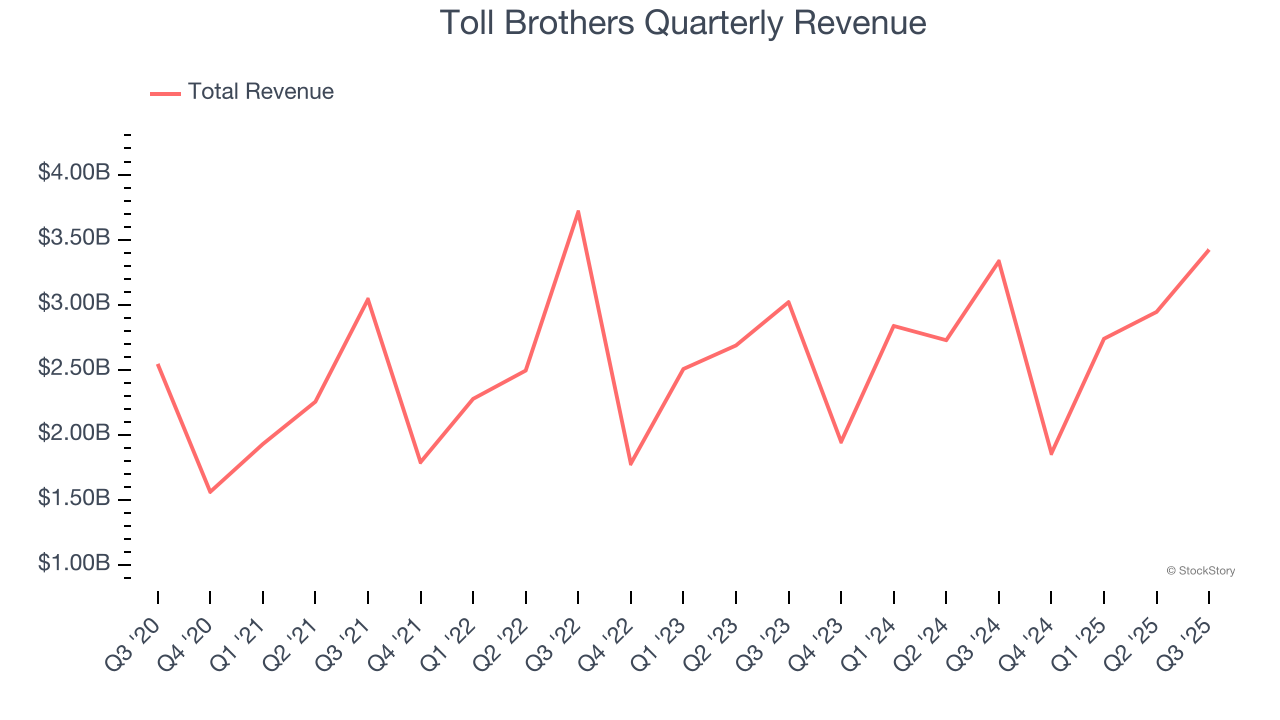

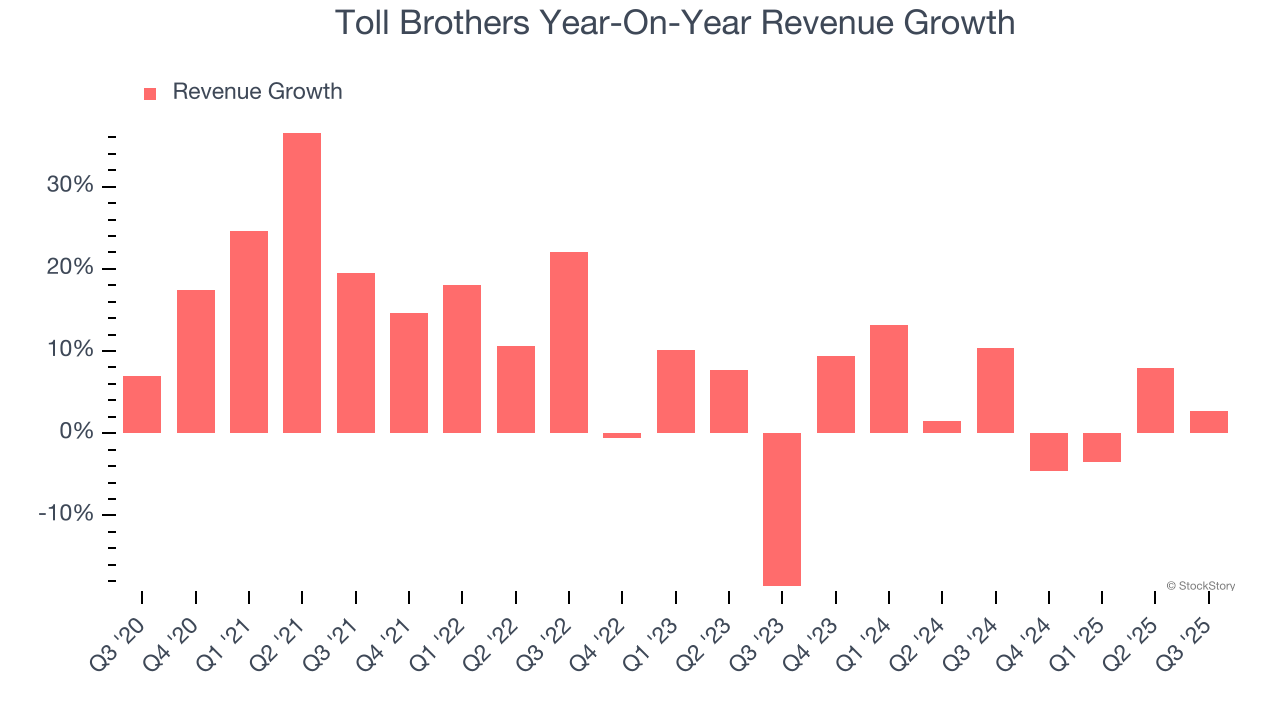

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Toll Brothers’s 9.2% annualized revenue growth over the last five years was solid. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Toll Brothers’s recent performance shows its demand has slowed as its annualized revenue growth of 4.7% over the last two years was below its five-year trend.

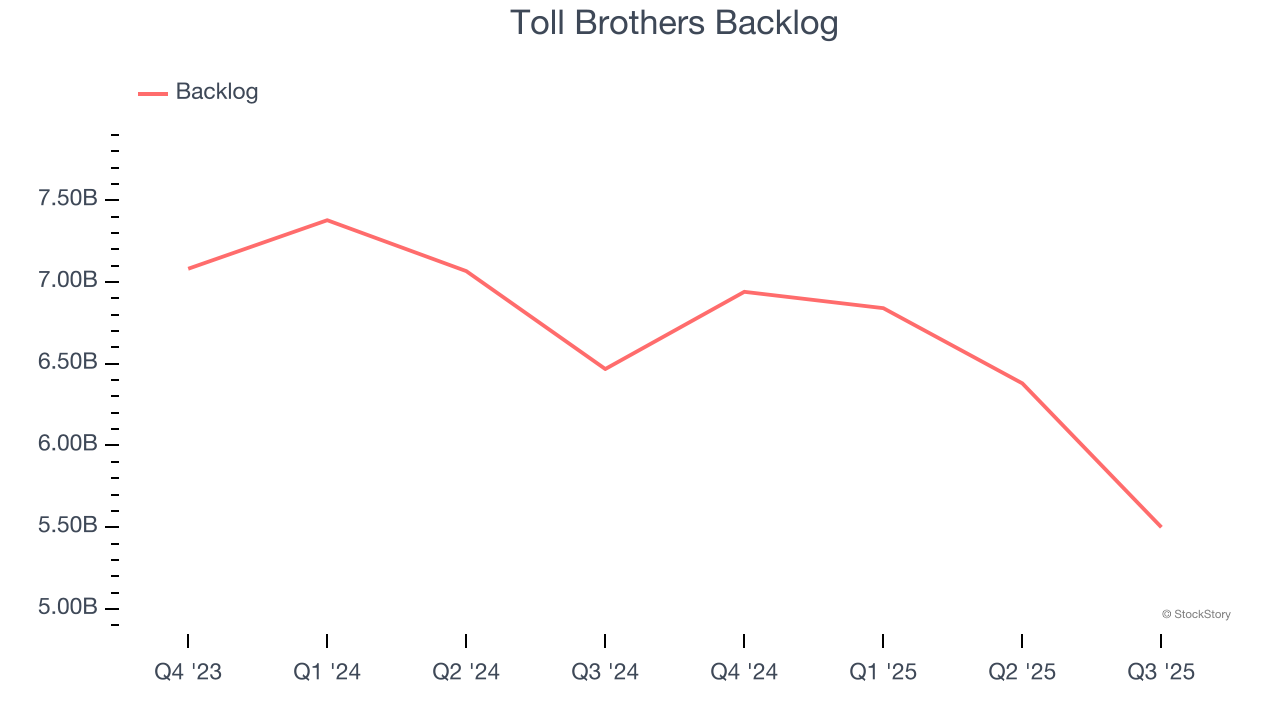

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Toll Brothers’s backlog reached $5.5 billion in the latest quarter and averaged 8.5% year-on-year declines over the last two years. Because this number is lower than its revenue growth, we can see the company hasn’t secured enough new orders to maintain its growth rate in the future.

This quarter, Toll Brothers reported modest year-on-year revenue growth of 2.7% but beat Wall Street’s estimates by 3.2%.

Looking ahead, sell-side analysts expect revenue to decline by 1.9% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

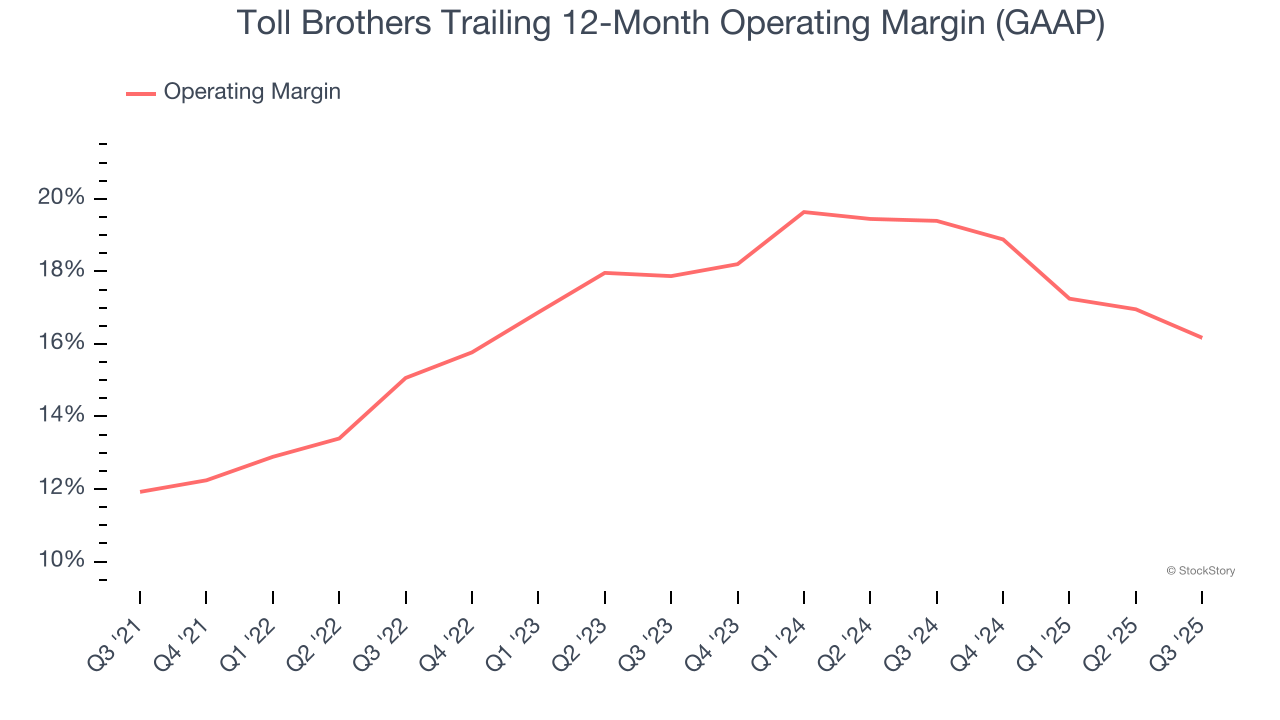

Toll Brothers has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 16.2%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Toll Brothers’s operating margin rose by 4.2 percentage points over the last five years, as its sales growth gave it operating leverage. Its expansion was impressive, especially when considering most Home Builders peers saw their margins plummet.

In Q3, Toll Brothers generated an operating margin profit margin of 16.5%, down 2.6 percentage points year on year. Since Toll Brothers’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

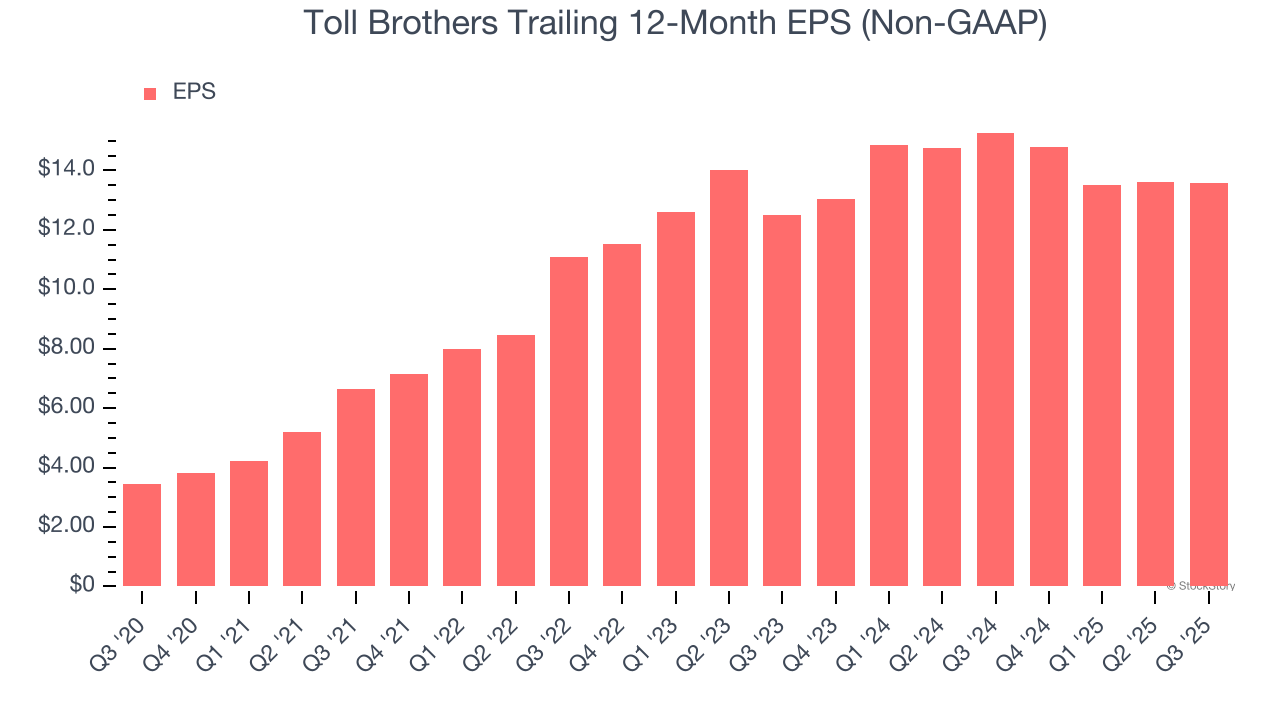

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

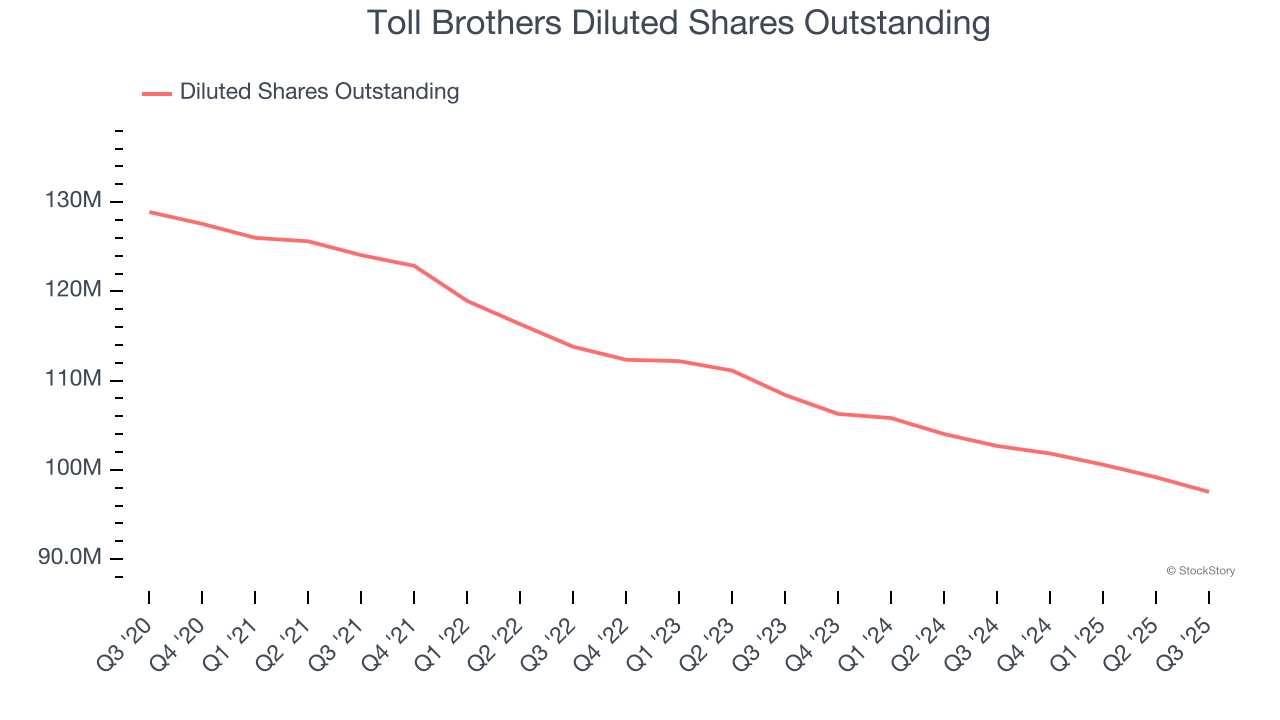

Toll Brothers’s EPS grew at an astounding 31.5% compounded annual growth rate over the last five years, higher than its 9.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Toll Brothers’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Toll Brothers’s operating margin declined this quarter but expanded by 4.2 percentage points over the last five years. Its share count also shrank by 24.3%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Toll Brothers, its two-year annual EPS growth of 4.2% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q3, Toll Brothers reported adjusted EPS of $4.58, down from $4.63 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Toll Brothers’s full-year EPS of $13.56 to stay about the same.

Key Takeaways from Toll Brothers’s Q3 Results

We enjoyed seeing Toll Brothers beat analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Overall, this was a softer quarter. The stock traded down 3% to $132.77 immediately following the results.

Big picture, is Toll Brothers a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.