Golden Entertainment has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 13% to $33.01 per share while the index has gained 12.9%.

Is there a buying opportunity in Golden Entertainment, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.We're swiping left on Golden Entertainment for now. Here are three reasons why you should be careful with GDEN and a stock we'd rather own.

Why Is Golden Entertainment Not Exciting?

Founded in 2001, Golden Entertainment (NASDAQ: GDEN) is a gaming company operating casinos, taverns, and distributed gaming platforms.

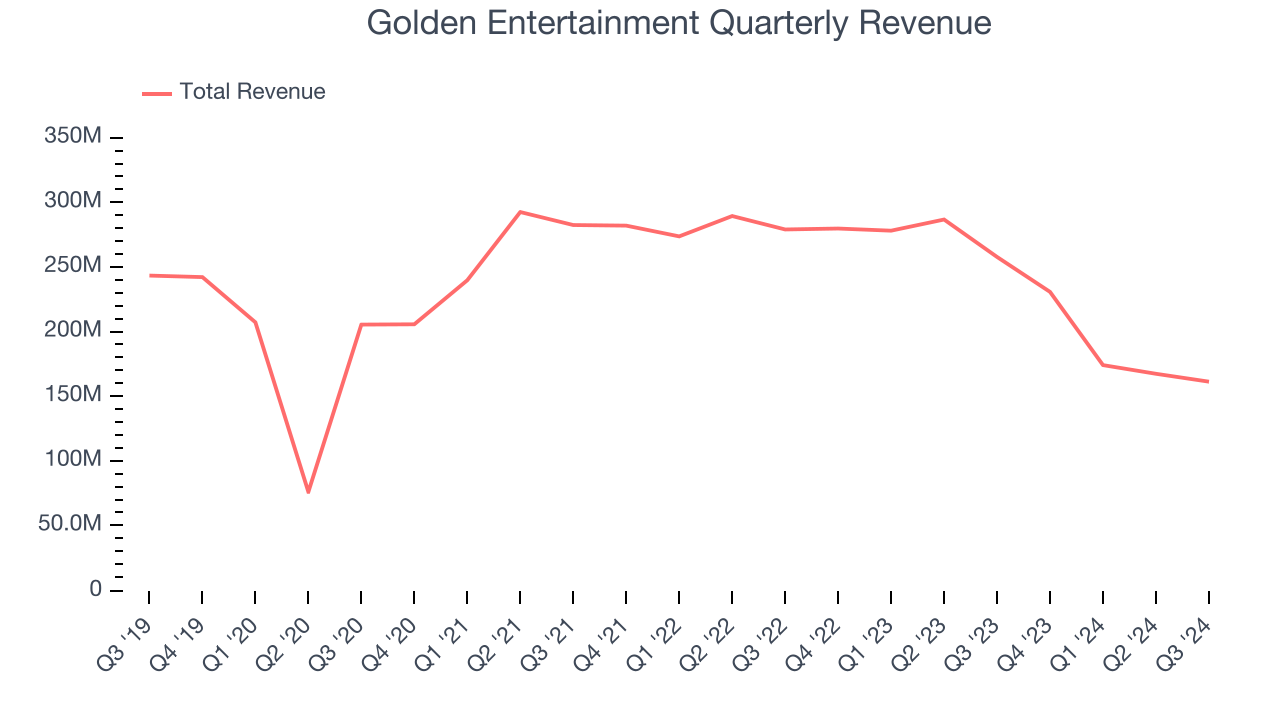

1. Revenue Spiraling Downwards

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Golden Entertainment’s demand was weak over the last five years as its sales fell at a 4.9% annual rate. This fell short of our benchmarks and signals it’s a lower quality business.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Sell-side analysts expect Golden Entertainment’s revenue to decline by 5.9% over the next 12 months. Although this projection is better than its two-year trend, it's hard to get excited about a company that is struggling with demand.

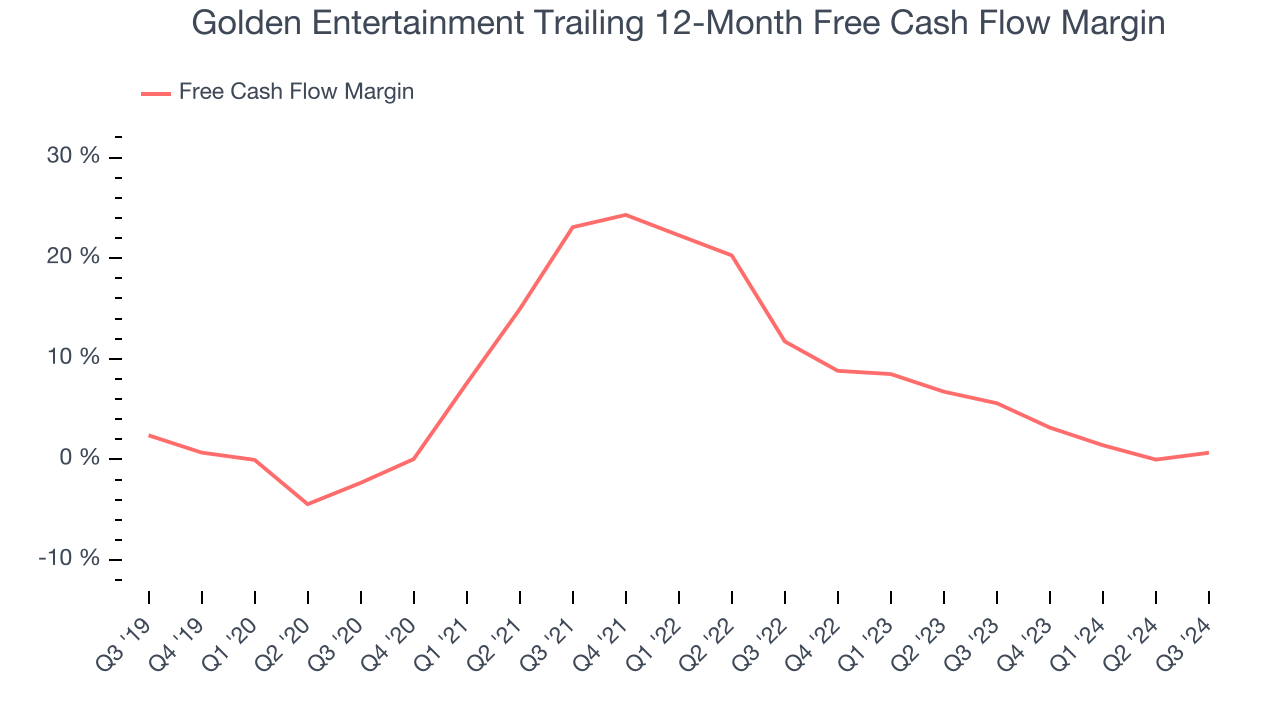

3. Mediocre Free Cash Flow Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Golden Entertainment has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.6%, lousy for a consumer discretionary business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Golden Entertainment to make large cash investments in working capital and capital expenditures.

Final Judgment

Golden Entertainment isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 6.1x forward EV-to-EBITDA (or $33.01 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now. Let us point you toward The Trade Desk, the nucleus of digital advertising.

Stocks We Like More Than Golden Entertainment

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.