Combining multiple stock option strategies can be a prudent way to generate income as long as you are familiar with each one. Once you are comfortable with the strategies, the next step is to link them together. In this article, we'll review a strategy called the wheel that can be used year-round to generate income and stock appreciation.

Combining multiple stock option strategies can be a prudent way to generate income as long as you are familiar with each one. Once you are comfortable with the strategies, the next step is to link them together. In this article, we'll review a strategy called the wheel that can be used year-round to generate income and stock appreciation.

What Is The Wheel Strategy?

The wheel is a popular options trading approach that aims to generate income and potentially acquire stocks at a discount. It consists of two options strategies: a cash-secured put and a covered call. The wheel lets you collect premiums on both parts of the strategy, with a payoff at the end if your stock gets called out.

The strategy is called "the wheel" because it can be repeated in a cyclical manner: selling puts to acquire stock and then selling calls to generate additional income, continuously rolling through these steps.

How to Execute the Wheel Strategy

The wheel strategy involves two main steps: selling cash-secured puts and then selling covered calls if the stock is assigned (meaning they are sold at the strike price and you are back to flat).

Selling Cash-Secured Puts:

- You sell put options on a stock you are willing to own.

- You collect a premium from the sale of these options.

- If the stock price remains above the strike price at expiration, the put options expire worthless, and you keep the premium.

- If the stock price falls below the strike price, you are obligated to buy the stock at the strike price, effectively acquiring the stock at a discount (considering the premium received).

Selling Covered Calls:

- Once you own the stock (either through assignment from the put options or from previous holdings), you sell call options on the stock.

- You collect a premium from the sale of these options.

- If the stock price remains below the strike price at expiration, the call options expire worthless, and you keep the premium.

- If the stock price rises above the strike price, you are obligated to sell the stock at the strike price, potentially capping your profit but you're still benefiting from the premium received.

Example of The Wheel Strategy

Let's go through each part of this process using a very liquid stock in the computer and technology sector, AI chip leader NVIDIA (NASDAQ: NVDA), as an example.

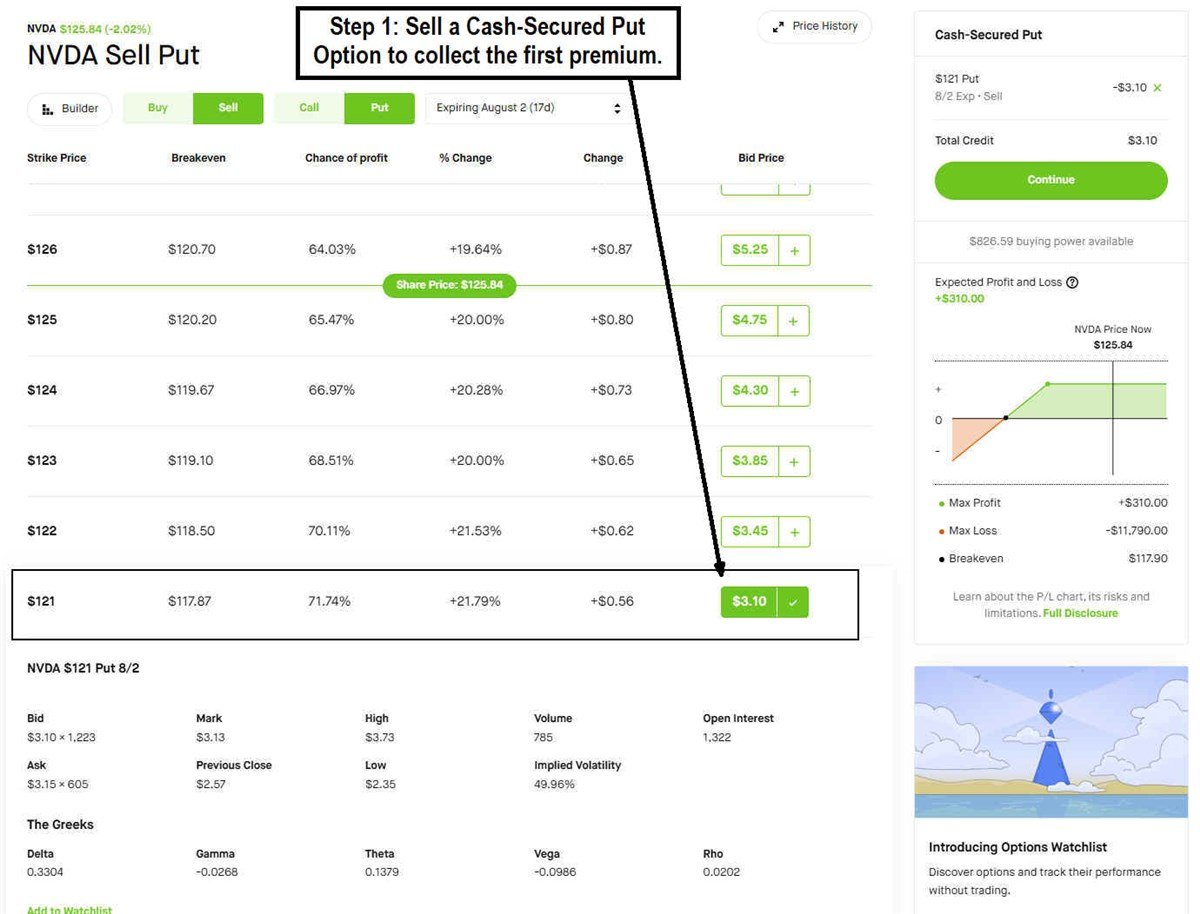

Step 1: Sell an OTM Cash-Secured Put

The first step is to sell an out-of-the money (OTM) cash secured put at a strike price below the current price that you’re comfortable holding the stock if you get assigned. This will provide the first piece of income by collecting a credit. While seasoned traders might use naked put options, most brokers will likely require you to have cash in your account in case you get assigned the stock.

For NVDA, the $120 price level has been a consistent support. You can start the strategy using the $121 put strike price expiring August 2, 2024, which is 17 days away.

The trade would be: Sell 1 NVDA $121 Cash-Secured Put for $3.10

This enables you to collect a $3.10 credit in the account for an income of $310. Keep in mind that you will need to make sure you have $12,100 in your trading account in case you get assigned the stock. On a margin account, you will need at least $6,050, assuming the maintenance margin is 50% for 2:1 overnight leverage. You will also need to confirm you have the options approval level to execute cash-secured puts.

Upon expiration on August 2, 2024, if NVDA stock closes above $121, then you'll keep the full premium, and you can repeat the trade by selling one cash-secured put again to keep racking up premium income. You continue to do this until you actually get assigned the stock.

Let’s assume NVDA closes at $120.50 on expiration. The following Monday, you will have 100 shares of NVDA stock in your account that you paid $121 per share for.

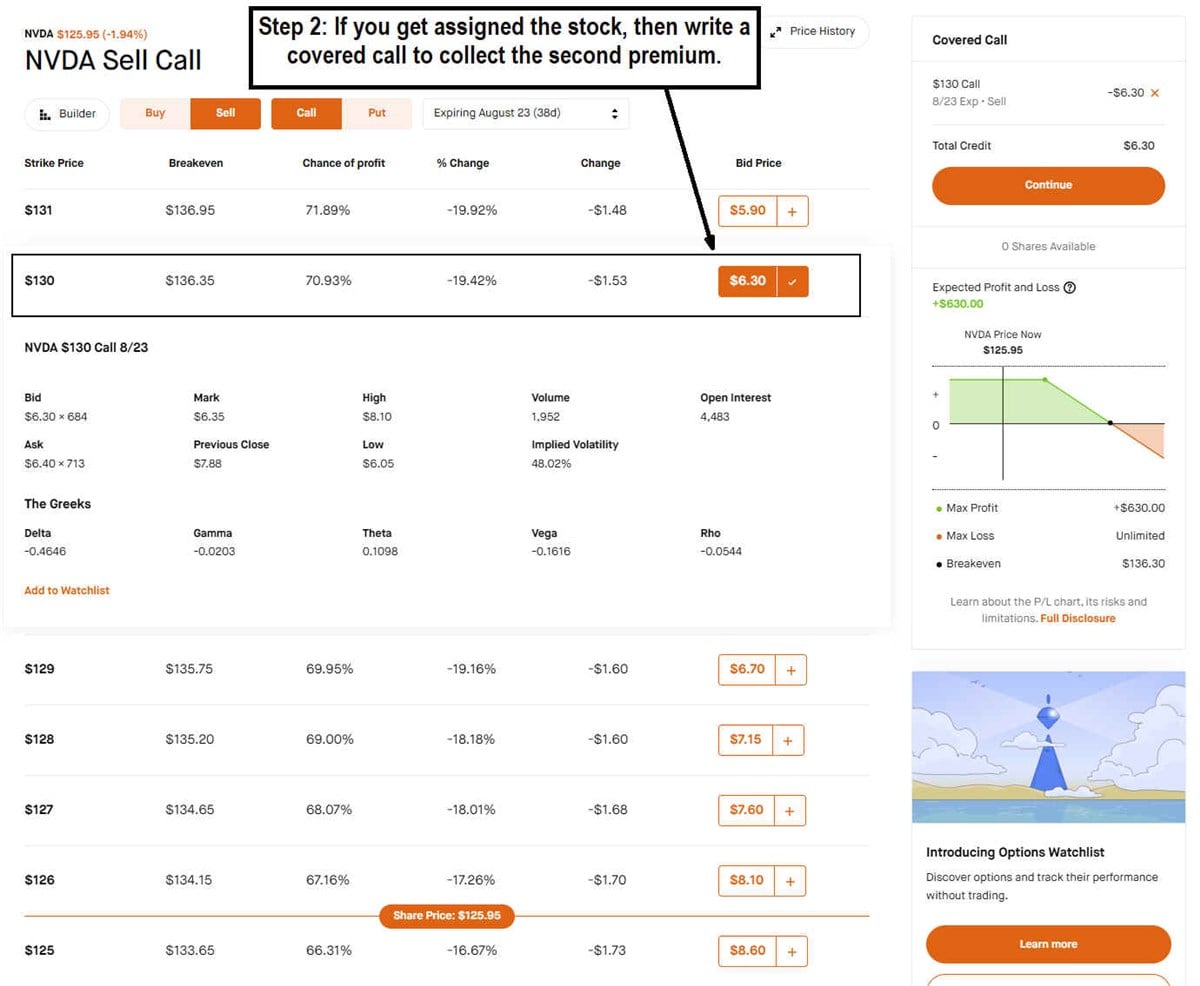

Step 2: Write an OTM Covered Call

NVDA has been holding resistance at $130, so you can opt to write a covered call expiring August 23, 2024, 37 days away.

The trade would be: Sell 1 NVDA $130 Covered Call for $6.45

For the sake of this example, let’s assume you own 100 shares of NVDA from a cash-secured put option that’s already been assigned. This gives you another credit of $6.45 per share or $645. It also gives you the potential for a $4.05 per share gain upside if the stock gets called out.

Upon expiration on August 23, 2024, if NVDA stock closes below $130, then you can repeat the covered call and sell another covered call, rolling the trade forward. However, if NVDA closes above $130, then you keep the additional profit from the gain in the stock, and you have completed a revolution. You can then repeat the cycle, starting with Step 1, by selling another case-secured put to keep the wheel strategy rolling forward.

Can You Lose Money with the Wheel Strategy?

Any investment strategy comes with the risk of financial losses, and the wheel strategy is no exception.

However, the wheel strategy allows you to buffer the initial losses by rolling forward the covered call to continue collecting premium. When you do finally get called out, you can start the process again with Step 1 and keep the wheel moving forward.

In the above NVIDIA example, you'd collect $3.10 from the cash-secured put and then another $6.30 on the covered call premium. That $9.40 of premium is income but also acts as a buffer in case NVIDIA stock collapses. Since your covered call wouldn't be called out, you can then collect more premiums by writing another covered call. This way, you continue to collect premium, which helps you buffer downside moves on the underlying stock.

The wheel strategy works best for stocks with good liquidity that you're comfortable holding longer-term, preferably in a rising market.