If you've ever believed that a stock was headed lower but didn't want to take on the risk of short-selling the stock, then you can consider using options strategies instead. We've heard horror stories about short sellers who blew up their trading accounts when caught in a short squeeze. However, option spreads enable you to synthetically short stocks and indexes without the risk of triggering margin calls if the stocks run up against your position.

The two common options strategies are the bear call spread vs the bear put spread. In this article, we will thoroughly review both strategies, the pros and cons and best use cases so that you can add them to your arsenal and use them properly to capitalize when a stock falls in value.

Key Takeaway

Short sellers debate between bear call spreads vs bear put spreads to profit from falling stock prices. We'll outline both strategies and best use cases for each so you are prepared to execute them whenever a bear market situation arises in a stock.

What is a Bear Call Spread vs Bear Put Spread?

First and foremost, let's review what exactly is a bear call spread and bear put spread. Both are options strategies executed when you believe a stock price is headed lower. Rather than risk getting short-squeezed by shorting the stock or paying for an expensive put option, you can use an option spread to define and limit your maximum risk in exchange for capping your maximum gain. Remember that even bear markets have rallies culminating in short squeezes.

Both are considered multi-leg options strategies because they involve 2 options trades, each consisting of 2 options positions per spread. Many brokerage platforms have options spread execution capabilities that will execute multi-leg strategies simultaneously with the click of one button. However, you can also opt to execute these manually as well. Please note that when we refer to selling a call or put option, we're referring to writing or shorting a call or put since you're selling something you don’t own. When you manually sell a call or put on the first leg, you execute a sell-to-open (STO) order.

Bear Call Spread

A bear call spread is executed by selling and buying a call option at a higher strike price with the same expiration date. It is also called a short call spread and a credit call spread.

You receive a credit with the first leg of selling or shorting a call option. You are making a bet that the stock will fall below the strike price by expiration. However, to avoid getting short-squeezed, we also buy a long call option at a higher strike price just in case the stock price rises. Adding the second leg of a long call caps the risk if the stock rises above the long call strike price.

The maximum gain is received up front as a credit. The wider the width between the strikes results in a larger credit. The maximum risk is the width of strike prices minus the credit received.

For example, XYZ is trading at $37, and we believe it will fall in price. We can implement a bear call spread by selling one in-the-money (ITM) $35 call and buying one out-of-the-money (OTM) $40 call. We receive a $300 credit from the short $35 call and spend $100 to buy the $40 call, resulting in a net credit of $200.

The maximum profit is the $200 net credit received on the trade, which occurs if XYZ closes under the $35 short call price. The maximum loss is the difference between the strike prices of $500 minus the $200 credit received, resulting in a $300 maximum loss, which occurs if XYZ closes above the $37 long call. The breakeven price is calculated by taking the short call's strike price, which is $35, and adding the net premium of $2, which is $37.

Bear Put Spread

A bear put spread can be used in the same scenario. It's also called a put debit spread and consists of two trades or legs. The first leg consists of buying a put option. The second leg consists of selling a put option at a lower strike price. In this trade, you must pay a net debit rather than receive a net credit as you would with a bear call spread. Profits are made when the stock falls below the long put strike price and are capped at the short put strike price. The maximum gain is made if the stock falls under the short put price. Max loss is capped and limited to the debit you paid for the trade.

For example, XYZ is trading at $35. We execute a bear put spread by buying one XYZ $35 put and selling 1 XYZ $30 put. The $35 long put cost $5, and selling the $30 put results in a $2 credit, costing us $3 for the trade. The maximum profit is between the strikes of $5 minus the $2 paid for the trade or $300.

The maximum loss is the $200 cost of the trade if XYZ closes at $35 or higher. The breakeven price is the long put strike price of $35 minus the $2 credit, resulting in $33.

When and How to Use Bear Call Spread and Bear Put Spread

When determining when to use the bear put spread vs bear call spread, it pays to look at the context of the market and the underlying stock. While both strategies can be implemented when you believe the underlying stock price will fall, they also have nuances to consider.

When to Use

You can use a bear call vs bear put spread when you believe the market or stock price is decreasing. A bear call spread enables you to profit from Theta or time erosion. Time is on your side with these. You can gain from both the time erosion and stock price decline.

Bear call spreads can usually be considered when the implied volatility is low, which results in more premiums for selling the call and a lower premium for buying the long call.

A bear call spread can profit even if the stock is neutral to slightly bearish. You may also prefer to receive a net credit in your account rather than have to pay a net debit. However, a bear call spread can result in a larger maximum loss than the credit received since the loss equals the spread between the strike prices minus your credit received.

A bear put spread can be used when implied volatility is higher since time is not on your side. Theta erosion makes your long puts lose value quicker as expiration approaches. With bear put spreads, you benefit from sharp spikes in volatility as that bumps up your extrinsic premium. Bear put spreads are preferred when you expect a stronger selloff. While you will pay a net debit for the trade, your max profit can be larger than your max loss. Your max loss is limited to the debit you paid to execute the trade.

How to Use

Let's review how to use both strategies using the daily candlestick chart for Intel Co. (NASDAQ: INTC) in the computer and technology sector as an example.

Let's say we expect INTC stock price to fall due to the falling relative strength index (RSI) slipping under the 50-band. INTC is trading around $42.80. We select the April 12, 2024, expiration day, 29 days away.

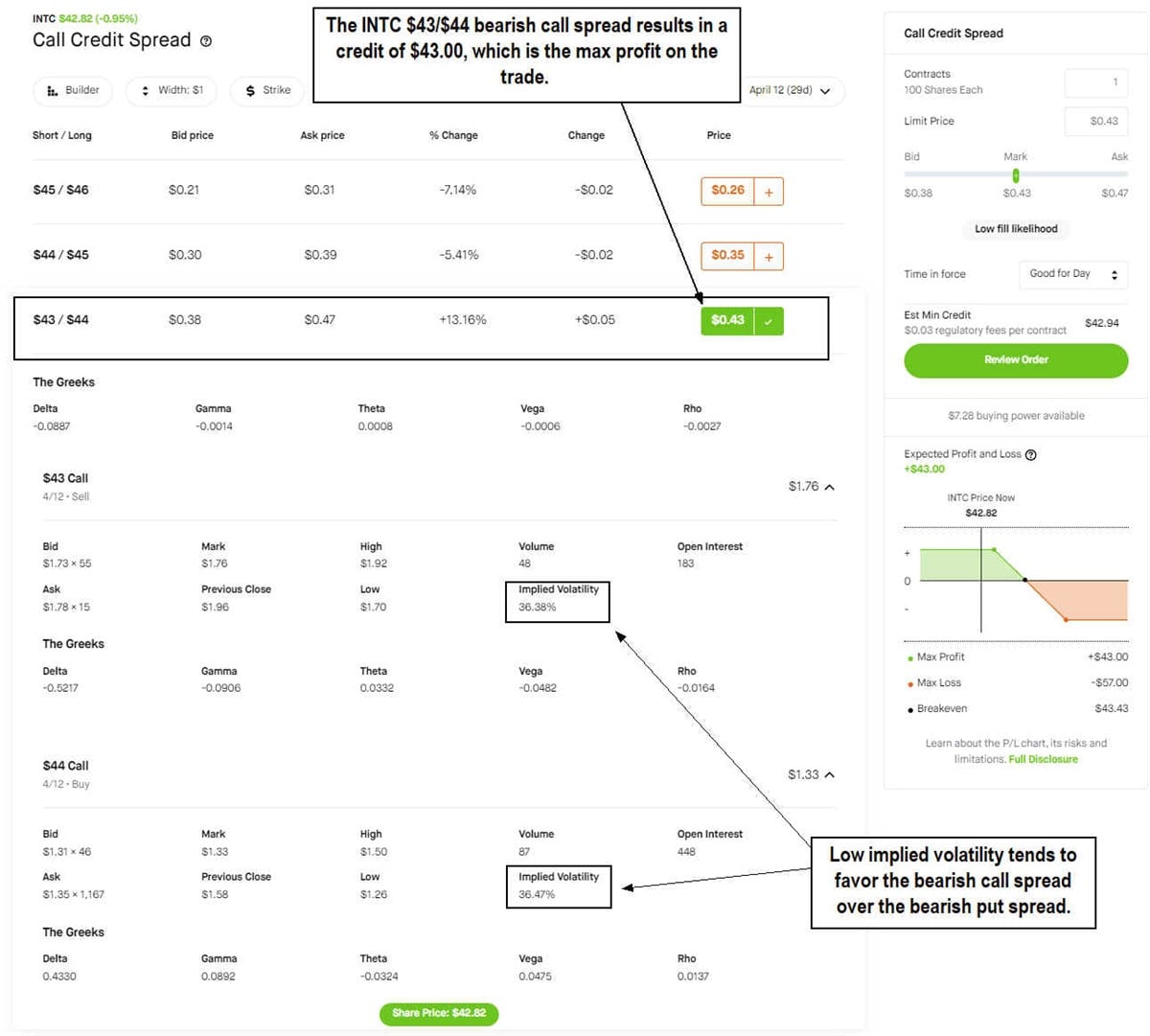

For a bear call spread, we would sell short one INTC $43 call and buy long one INTC $44 call. The implied volatility is considered historically low when it is under 50%. The implied volatility for the calls are around 36.5%, which is low.

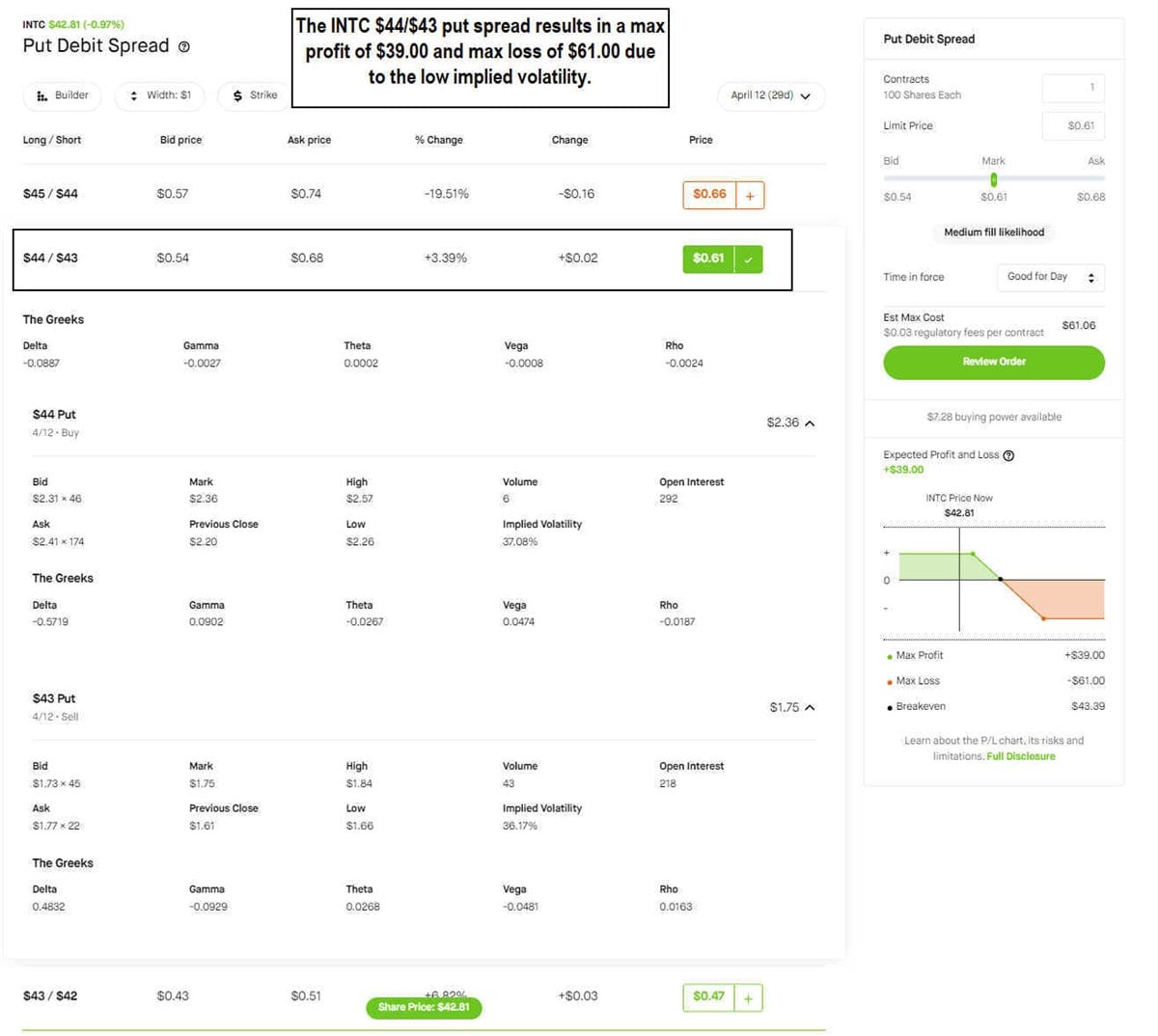

For a bear put spread, we would buy long one INTC 44 put and sell short one INTC $43 put. These puts also have historically low implied volatility, ranging from 36.17% to 37.08%.

Based on the low implied volatility, it would be more beneficial to consider taking an INTC $43/$44 bear call spread over an INTC $44/$43 bear put spread.

Compare Risks and Rewards (Bear Call Spread vs Bear Put Spread)

Now, let’s compare some risks and rewards.

Risks

Bear call spreads and bear put spreads share risks if the underlying stock price rises. A bear call spread starts to lose money when the underlying stock rises above the long call strike price. A bear put spread starts to lose money when the underlying stock rises above the short put strike price.

In the INTC $43/$44 call credit spread example, the trade loses money when the price rises above the $43.43 breakeven price level. The maximum

Rewards

The reward for a bear call spread is the net premium credit collected when the trade is executed. You get paid upfront first; from there, it can only go down.

The reward for a bear put spread is the difference in the strike prices minus the net spread costs of the trade.

Maximum Profit Scenario

The INTC $43/$44 bear call spread provides the maximum profit if INTC falls under $43.00 on expiration. The maximum profit would be $43. The breakeven price for INTC is $43.43. At this level, the trade breaks even.

The INTC $44/$43 bear put spread provides a maximum profit of $39 if INTC falls below $43 on expiration. The breakeven price level for INTC is at $43.39. Anything above there, and the trades start to lose money.

Maximum Loss Scenario

The maximum loss for the bear call spread is the difference between the strike prices minus the credit paid out. That results in $1 minus 43 cents for a max loss of $57 if INTC rises above the $44 strike price on expiration.

The maximum loss for a bear put spread is the debit you paid for the trade. Since the trade cost $61 to execute, that maximum loss is $61.

While both the bear call spread and bull call spread seek to profit on INTC falling under $43 on expiration, the low implied volatility gives the edge to the bear call spread as the trade with a higher max profit of $43 and lower max loss at $57 versus the bear put spread with a lower max profit of $39 and max loss of $61.

Watch the Implied Volatility to Select the Better Strategy

In this article, we reviewed what is a bear call spread and a bear put spread. While they both seek to profit from falling stock prices, a bearish call spread tends to benefit more with lower implied volatility, while a bearish put spread is preferred during higher implied volatility. While the historical high and low implied volatility levels can be viewed, a basic rule of thumb would be under or over 50% and by how much. The INTC example illustrated implied volatility between 36% to 37% across both calls and puts, which is historically low.

This is why the bearish call spread trade results in higher max gains and lower max losses. The implied volatility can be your main indicator to decide which strategy to execute, either a bear call vs bear put spread, when you're feeling bearish on a stock, exchange-traded-fund (ETF) or market. Bear markets are suitable for bear spreads if you're following the downtrend.

FAQs

Here are some of the most common frequently asked questions.

What is the difference between a call spread and a put spread?

A call spread provides you with a credit and involves buying a call option at a lower strike price and selling a call option at a higher strike price. A put spread requires you to pay a debit and involves buying a put option at a higher strike price and selling a put option at a lower strike price.

Both strategies utilize the same stock and expiration dates and are intended to capitalize on the underlying stock price falling. A bear call spread vs bull put spread use different call and put options for different directions.

Are bear call spreads profitable?

Bear call spreads can be profitable if the underlying stock closes below the breakeven price level upon expiration. The breakeven price consists of the strike price of the short call at the lower strike plus the net premium credit received. The maximum profit is achieved when the underlying stock closes below the lower strike price of the short call option.

What is the difference between a bull put spread and a bear spread?

A bull put spread is a bullish strategy intended to profit from a rising underlying stock price. It's comprised of shorting a put option with a high strike price and buying a put option at a lower strike price. A bear spread is a general strategy to profit from the falling underlying stock price.

Traders can decide to implement either a bear call spread for a credit or a bear put spread for a debit. A bull put spread vs bear call spread seek opposing directions for the underlying stock price, just as a bull call spread vs bear put spread.