Washington, D.C., Oct. 30, 2024 (GLOBE NEWSWIRE) -- American Conservative Values ETF (ACVF) the leading conservative-principles investment fund marks its fourth anniversary proving a powerful point: investors don't have to choose between conservative principles and market returns. Since its October 2020 launch, ACVF has performed in lock step with the S&P 500(1) while aggressively boycotting companies that actively promote the liberal woke corporate agenda at the potential expense of shareholder value. Since its launch ACVF has raised over $100 million in assets. [Factsheet]

"Our performance validates our core thesis - you don't have to sacrifice returns to invest in your values," states ACVF CEO and co-founder William Flaig. "By strategically boycotting 37 companies that represent 29% of the S&P 500, we're giving conservative investors a powerful way to advocate with their dollars."

"We're fighting back against the wasteful misuse of shareholder capital by woke corporate America," explains Tom Carter, ACVF's president and co-founder. "Our performance proves that avoiding politically active companies isn't just about values - it's about protecting shareholder value."

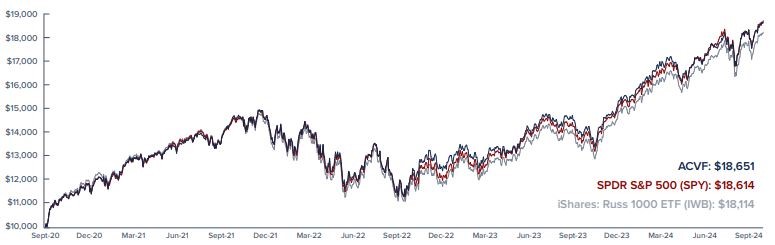

GROWTH of $10K vs comparable ETFs (2) (As of September 30th, 2024)

ACVF has performed in lock step with comparable ETFs since its inception.

“It’s a moral imperative to stop and roll back the left’s takeover of corporate America,” states ACVF CEO and co-founder William Flaig. Adding, “Giving conservative investors the power to fight back and invest with integrity is why we built ACVF.”

ACVF's approach targets corporations undermining conservative values through:

- Big Tech and Banking elites silencing conservative voices and services

- Corporate "woke-ism" prioritizing DEI and Net Zero over shareholder returns

- Media companies spewing liberal propaganda

- CEOs pushing their political agendas and bankrolling socialist causes.

- Companies undermining religious freedom, Second Amendment rights, and the sanctity of life.

Tom Carter reiterated, “We do not want to give the companies that are eagerly working to destroy conservative values our hard-earned investment dollars, and neither should you. Companies like Walt Disney, Blackrock, Google, Amazon, Warner Bros. Discovery, Paramount and others.”

"Conservative investors are increasingly asking why they should invest in companies actively working against their values," notes Flaig. "ACVF offers them a genuine alternative - professional management that aligns with their principles while delivering competitive returns."

ACVF, launched in October 2020, aims to provide investors with an alternative to traditional large-cap funds by avoiding companies that, in the view of its’ managers, The 37 companies that ACVF currently excludes from the portfolio represent 29% of the S&P 500.

The funds’ managers emphasize their focus on companies they believe prioritize meritocracy and shareholder value. "We aim to avoid investing in companies that we perceive as putting political agendas ahead of financial performance," Flaig stated.

For more information about ACVF (Ticker: ACVF), including its investment approach and full list of holdings, please visit InvestConservative.com

About American Conservative Values ETF (ACVF)

ACVF is an exchange-traded fund designed to reflect conservative political values in its investment strategy. ACVF is based on the conviction that politically active companies may negatively impact their shareholder returns, as well as support issues and causes which conflict with conservative political ideals, beliefs and values.

Key Points:

Performance is shown net of fees. The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (888) 909-6030.

As of October 29th, 2024, the fund holds 0.00% of Walt Disney, Blackrock, Google, Amazon, Warner Bros. Discovery, and Paramount Global

The 37 companies currently excluded from the portfolio represent 29% of the S&P 500.

The fund's holdings are subject to change. For current holdings, please visit https://acvetfs.com/fund/etf-fund/#holdings

Note:

(1) The S&P 500® is a broad-based unmanaged index, which is widely recognized as representative of the equity market in general.

(2) This comparison uses two widely used large-cap blend ETFs which track the benchmarks used in the performance table. The SPDR® S&P 500® ETF Trust (Ticker:SPY) seeks to provide investment results that, correspond generally to the price and yield performance of the S&P 500® Index [Link to SPY Fees and Performance] The iShares Russell 1000 ETF (Ticker:IWB) seeks to track the investment results of an index composed of large- and mid-capitalization U.S. equities. [Link to IWB Fees and Performance]

To schedule an interview with Mr. Flaig or Mr. Carter, please contact:

wflaig@ridgelineresearch.com 301-685-7121

tcarter@ridgelineresearch.com 301-685-7122

For current holdings, fund factsheet, and more information, please visit www.acvetfs.com

SOURCE: American Conservative Values ETF

Important Information

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s prospectus and summary prospectus, which may be obtained by visiting ACVETFS.com. Read the prospectus and summary prospectus carefully before investing.

An investment in the Fund is subject to risks, including the possible loss of the principal amount invested. Overall stock market risks may affect the value of individual securities in which the Fund invests. The Fund is actively managed, and the adviser’s investment decisions impact the Fund’s performance. The Fund and adviser are new, and the ETF has only recently commenced operations. This Fund may not be suitable for all investors.

The equity securities in which the Fund invests will generally be those of companies with large market capitalizations. Exchange-Traded Funds (ETFs) trade like stocks, are subject to investment risk, and will fluctuate in market value. Transactions in shares of ETFs will result in brokerage commissions, which will reduce returns. Unlike typical exchange-traded funds, there are no indexes that the Fund attempts to track or replicate. Thus, the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager. There is no assurance that the investment process will consistently lead to successful investing. The Fund is new and has a limited operating history.

The ACVF Fund is distributed by Foreside Fund Services, LLC. Foreside is not affiliated with Ridgeline Research, LLC, the Fund’s Investment Adviser.

The Fund is structured as an ETF and as a result, is subject to special risks. Shares are bought and sold at market price (closing price) not net asset value (NAV) and are not individually redeemed from the Fund. Market price returns are based on the midpoint of the bid/ask spread at 4:00 p.m. Eastern Time (when NAV is normally determined) and do not represent the return you would receive if you traded at other times.

Attachment

Name: William Flaig Email: wflaig@ridgelineresearch.com Job Title: Founder and CEO