Frost & Sullivan has conducted comprehensive research on the medical aesthetic injection products industry and published the “2025 Blue Book on the Industry Development Status and Future Trends of Medical Aesthetic Injection Products”. The blue book aims to provide a comprehensive analysis of the current landscape, market prospects, challenges, and opportunities for Chinese medical aesthetic injection products. (To read the 2025 Blue Book on the Industry Development Status and Future Trends of Medical Aesthetic Injection Products, visit: https://hub.frost.com/current-status-and-trends-of-medical-aesthetic-injection-products/)

With the continuous upgrading of the medical aesthetics industry, injectable products have become a major market focus. A range of injectable products has already gained broad consumer recognition, with hyaluronic acid, collagen, and botulinum toxin-based injectables being particularly popular. At the same time, new materials such as hydroxyapatite, agarose, and elastin are advancing through R&D and regulatory pathways, expanding product choices.

In recent years, improved regulatory policies have accelerated the overall development of the medical aesthetics industry, creating opportunities across the entire value chain. Medical aesthetic injectable products are becoming increasingly diversified, driven by innovation in raw materials, manufacturing processes, and application strategies. With continued technological progress and more sophisticated consumer demand, further innovation in medical aesthetic injectable products is expected.

Medical aesthetic injectables mainly include hyaluronic acid-based, collagen-based, regenerative materials such as polylactic acid, and botulinum toxin-based products. Hyaluronic acid, collagen, and regenerative materials are regulated as medical devices, while botulinum toxin is classified as a medical toxic drug. The emergence of materials such as hydroxyapatite, agarose, and elastin highlights the growing diversity of injectable products.

As China’s medical aesthetics market matures, companies are placing greater emphasis on brand strength and quality control. Leading brands continue to expand market share through strong R&D and reliable product quality. Competition now extends beyond product performance to innovation capability, service quality, and marketing, driving more differentiated brand positioning.

Taking hyaluronic acid products as an example, Haohai Biological Technology has launched its fourth-generation organically crosslinked HA product, Hyalumatrix® YUEBAI. By using lysine, a natural amino acid, as the crosslinking agent, the product offers improved long-term safety.

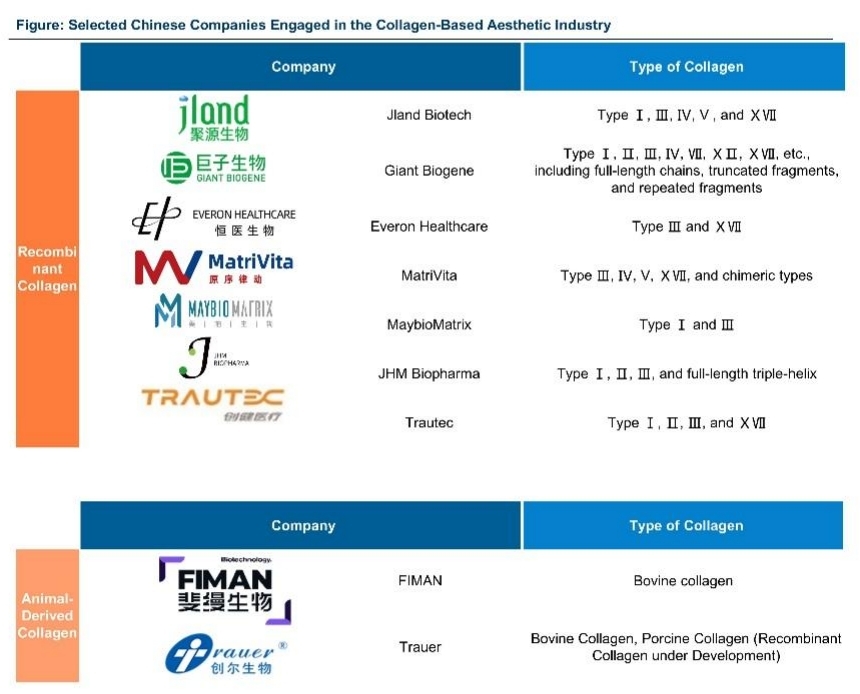

Collagen-based products are also developing rapidly. Recombinant collagen, produced via synthetic biology, features virus-free safety, low immunogenicity, and high purity, making it suitable for injectable applications. Animal-derived collagen, sourced from natural tissues, offers proven biocompatibility and tissue repair performance based on long-term clinical use.

Currently, multiple companies are expanding their presence in the collagen segment, strengthening both technological innovation and production capacity. As demand continues to rise, more collagen-based products are expected to enter the market, offering broader choices for consumers.

In the botulinum toxin segment, clinical research activity remains strong. More than ten companies in China currently have injectable botulinum toxin products in clinical development. Among them, JHM Biopharma is advancing recombinant type A botulinum toxin for both therapeutic and aesthetic indications, aiming to improve safety and efficacy.

Its recombinant type A botulinum toxin for adult upper limb spasticity has completed Phase II clinical trials and is preparing for Phase III. Significant improvements in MAS scores have been observed across multiple muscle groups compared with baseline.

For moderate to severe glabellar lines, JHM Biopharma is also conducting Phase III clinical trials. At the same dose level, the recombinant product has shown better efficacy and longer duration than the positive control, with a comparable safety profile.

The 2025 Blue Book on the Industry Development Status and Future Trends of Medical Aesthetic Injection Products highlights the following:

- Chapter 1: Overview of Medical Aesthetic Injection Products

- Chapter 2: Status and Trend Analysis of the Hyaluronic Acid Industry in Medical Aesthetic Injection Products

- Chapter 3: Status and Trend Analysis of the Collagen Industry in Medical Aesthetic Injection Products

- Chapter 4: Status and Trend Analysis of Regenerative Materials

- Chapter 5: Status and Trend Analysis of the Botulinum Toxin Industry in Medical Aesthetic Injection Products

- Chapter 6: Status and Trend Analysis of Exosomes in Medical Aesthetic Injection Products

- Chapter 7: Status and Trend Analysis of Other New Medical Aesthetic Injection Materials

- Chapter 8: Selected Companies in the Medical Aesthetic Injection-Related Fields

Key Topics Covered:

1. Overview of Medical Aesthetic Injection Products

a. Definition of Medical Aesthetics

b. Definition and Classification of Medical Aesthetic Injection Products

c. Industry Chain Analysis of Medical Aesthetic Injection Products

d. Policy and Regulation of Medical Aesthetic Injection Products in China

e. Analysis of China’s Medical Aesthetic Injection Market

f. Analysis of Drivers for the Development of China’s Medical Aesthetic Injection Products Industry

2. Status and Trend Analysis of the Typical Medical Aesthetic Injection Products - Hyaluronic Acid, Collagen, Regenerative Materials, Botulinum Toxin, Exosomes, Other New Materials including Hydroxyapatite, Agarose, Silk Protein, Chitosan, etc.

a. Definition, Structure, and Classification

b. Applicational Advantages

c. Development History

d. Mechanism of Action

e. Current Industry Status and Key Products

f. Market Analysis

g. Future Development Trends

3. Selected Companies in the Medical Aesthetic Injection-Related Fields

About Frost & Sullivan

Frost & Sullivan, the Growth Partnership Company, works in collaboration with clients to leverage visionary innovation that addresses the global challenges and related growth opportunities that will make or break today's market participants. For more than 60 years, Frost & Sullivan has been supporting the Global 1000, emerging businesses, the public sector, and investors in developing growth strategies.

Media Contact

Company Name: Frost & Sullivan

Contact Person: Qian Li

Email: Send Email

Country: China

Website: http://www.frostchina.com