79% of surveyed investors expect their advisor to offer banking and insurance products and 59% have inquired about ESG investments, with younger generations the most interested in these areas

North American investors increasingly expect their financial advisors to provide comprehensive and more-personalized wealth offerings, with products that cut across wealth, insurance and banking and align more with their social values, according to a new report from Accenture (NYSE: ACN).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210824005209/en/

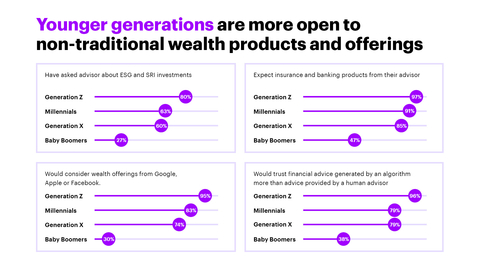

Investors’ advisor and investment preferences vary greatly by generation (Graphic: Business Wire)

The report, titled “The New State of Advice,” is based on a survey of 1,000 investors in the U.S. and Canada who have a financial advisor. The report revealed that while financial advisors have made strides in providing a hybrid advice experience that combines digital, virtual and human interaction, they may not be as effective in delivering the right advice and products at the right moments for investors.

This is especially true for investors under the age of 60 — including Gen Xers, millennials and Gen Zers — whose advice needs and preferences differ from baby boomers. For example, while four in five surveyed investors (79%) overall expect their advisor to offer banking and insurance products, 85% of Gen Xers, 91% of millennials and 97% of Gen Zers, respectively, expect such services, compared with less than half (47%) of baby boomers.

Younger investors are also more likely to be interested in products that align with their lifestyle preferences, including sustainability. For instance, while six in 10 investors overall (59%) have asked their advisors about ESG or socially responsible investments, Gen Zers, millennials and Gen Xers were more than twice as likely as baby boomers to have done so (80%, 63% and 60%, respectively, versus 27%). Five in six (84%) of these respondents who inquired about sustainability investments plan to purchase them in the next year.

The report also shows that investors want more personalized advice from their advisors that covers all aspects of their financial portfolios. For example, more than half (55%) of respondents think that the advice they receive is too generic — including half (50%) of affluent investors (with personal wealth between US$250,000 to $1 million) — and another 55% of respondents think that they could do a better job investing themselves. Similarly, 56% consider a wealth offering that includes advice, risk protection and lending products to be essential.

“Our research findings show that investors expect a deeper level of engagement with their advisor that goes beyond pure portfolio management,” said Scott Reddel, who leads Accenture’s wealth management group in North America. “The wealth managers who thrive in the years ahead will embrace AI, data and analytics and cloud-computing to power their advisors with the intelligence and tools to offer holistic, personalized and integrated wealth advice.”

Tech threats and intergenerational wealth transfer loom

The report’s findings create a heightened sense of urgency for wealth managers, with trillions in investable assets expected to be passed down to younger generations over the next 30 years. Six in 10 respondents (58%) expect to inherit a significant amount of money or an estate from their parents, with more than one-quarter (26%) planning to select a new advisor to oversee all of their assets upon inheritance, including half (51%) of applicable mid-high-net-worth investors (with personal wealth of $10 million and above). When asked what offerings would make them entrust more assets to their current advisor, 53% said greater and more diversified products and services and one-third (34%) said a hyper-personalized experience.

In addition, the findings reveal that younger investors are more receptive to financial advice from non-traditional sources outside of wealth management. For example, 95% of Gen Zers, 83% of millennials, and 74% of Gen Xers said they would consider wealth products and services offered by Google, Apple and Facebook, compared with only three in 10 baby boomers (30%). Younger investors are also at least twice as likely as older investors to trust financial advice generated instantly by an algorithm more than advice provided by a human advisor (cited by 96% of Gen Zers and 79% of both millennials and Gen Xers, versus only 38% of baby boomers).

“The days of tailoring the level of service to fit the size of an investor’s portfolio are over; the average investor expects the same level of service and personalization as someone in the high-net-worth bracket,” said Rachel Silver, a managing director in Accenture’s North America wealth management group. “Wealth management firms should reimagine their advice offerings at scale to provide a seamless client experience with curated recommendations and a purpose-driven product suite that reflects investors’ social interests and key life moments.”

Some other key findings of the report include:

- 71% of investors want to engage with an advisor whose values are aligned with their own, while 69% want an advisor who interacts with and considers input from their spouse.

- Nearly one in five respondents (17%) switched advisors in the last year, lured by better technology offerings (49%) and better investment product offerings (49%).

- Almost four in ten (39%) wanted to hear from their advisor more proactively and nearly one-third (29%) are willing to take more meetings.

More information on the report can be found here.

About the Research

For the report, Accenture surveyed 1,000 investors across the U.S. and Canada who have a financial advisor to better understand what investors want from their wealth managers in terms of financial advice, products and planning. Respondents were split evenly by gender, wealth segment, and generation, among other factors. Respondents ranged in age from 20 to 93 and in personal wealth from retail (less than US$250,000), affluent (US$250,000 - $1 million), lower-high-net-worth (US$1 million - $10 million), and mid-high-net-worth (US$10 million and above). The survey was conducted online between March and April 2021.

About Accenture

Accenture is a global professional services company with leading capabilities in digital, cloud and security. Combining unmatched experience and specialized skills across more than 40 industries, we offer Strategy and Consulting, Interactive, Technology and Operations services — all powered by the world’s largest network of Advanced Technology and Intelligent Operations centers. Our 569,000 people deliver on the promise of technology and human ingenuity every day, serving clients in more than 120 countries. We embrace the power of change to create value and shared success for our clients, people, shareholders, partners and communities. Visit us at www.accenture.com.

Accenture’s Capital Markets industry group helps wealth and asset managers, investment banks and exchanges rethink their business models, manage risk, redefine workplace strategies and improve operational efficiency to prepare for the digital future. To learn more, visit www.accenture.com/CapitalMarkets.

Copyright © 2021 Accenture. All rights reserved. Accenture and its logo are registered trademarks of Accenture

View source version on businesswire.com: https://www.businesswire.com/news/home/20210824005209/en/

Contacts

Michael McGinn

Accenture

+1 312 693 5707

m.mcginn@accenture.com