After nearly twenty-six years in the wilderness, Cisco Systems (CSCO) has finally closed the loop on its own history. The stock has climbed above its dot-com era intraday peak, rewriting the legacy of a company once crowned the poster child of internet excess. This renewed relevance increasingly centers on artificial intelligence (AI).

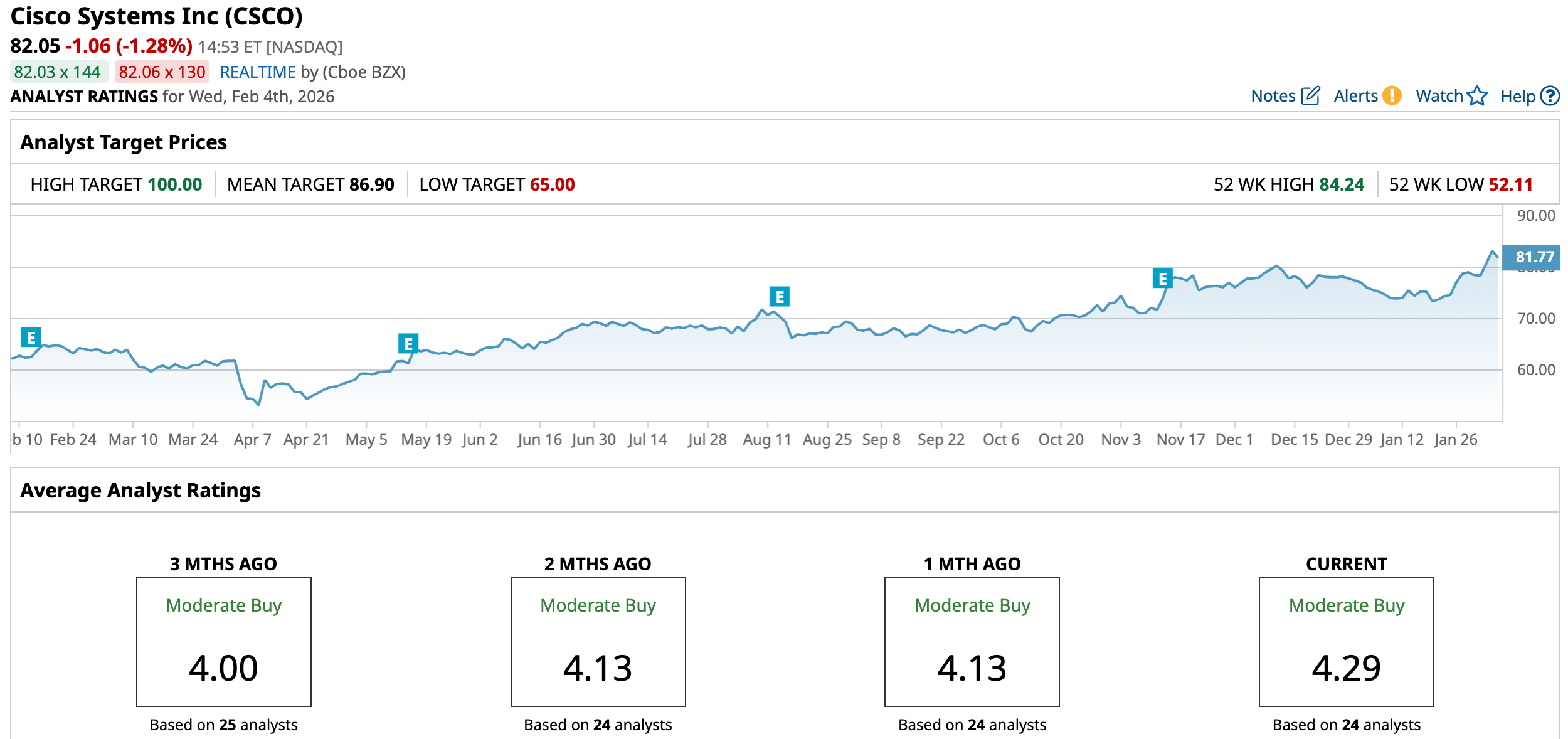

Nevertheless, its shares reached an almost 20-year high on Feb. 1 and followed with a fresh 52-week high today of $84.24, supported by enterprise network refresh cycles and rising investment in AI-ready infrastructure.

Momentum has carried through. In just the past five trading days, the stock gained roughly 3.3%, signaling growing confidence in Cisco’s ability to extract value from its core networking franchise while scaling emerging AI opportunities.

In fact, even the management is reinforcing this optimism with numbers. CEO Chuck Robbins expects Cisco to generate $3 billion in AI infrastructure revenue from hyperscale customers in fiscal 2026, after booking more than $2 billion in AI-related orders last year.

Given this backdrop, Cisco now stands at a point that demands a forward-looking stance on the stock.

About Cisco Stock

Headquartered in San Jose, California, Cisco builds and sells technologies that keep the internet and enterprise networks running with precision. With a market cap brushing $328.4 billion, Cisco delivers connectivity, cybersecurity, collaboration, cloud operations, and application performance solutions.

Over the past 52 weeks, Cisco’s shares skyrocketed almost 33%, while the last six months alone produced a 19.1% surge. Momentum intensified further, with the stock adding another 7.27% in just the past month.

Valuation still leaves room for appreciation. CSCO stock currently trades at 24.46 times forward adjusted earnings, positioning the stock below the industry average and signaling a relative discount.

The company complements this value proposition with consistency, raising dividends for 14 consecutive years and paying $1.64 per share annually, yielding 1.97%. It distributed its most recent quarterly dividend of $0.41 per share on Jan. 21 to investors of record as of Jan. 2.

Cisco Surpasses Q1 Earnings

On Nov. 12, 2025, Cisco unveiled its fiscal Q1 2026 results, owing to which the stock rose 3.14% that day and added another 4.62% in the following trading session. Revenue increased 7.5% year-over-year (YOY) to $14.88 billion, comfortably exceeding Street expectations of $14.78 billion.

Adjusted EPS came in at $1, rising 10% from the prior-year quarter and beating Wall Street estimates of $0.98. AI demand continued to lift nearly every part of the business. Future visibility also improved meaningfully. Cisco reported total remaining performance obligations (RPO) of $42.9 billion, up 7% YOY.

Product-related RPO rose 10%, while the long-term portion climbed 13% to $11.8 billion, highlighting sustained customer commitments and longer-duration demand. Recurring revenue trends moved higher as well. Annualized recurring revenue (ARR) ended the quarter at $31.4 billion, representing a 5% increase, while product ARR expanded 7%.

Looking ahead, Cisco’s management expects Q2 fiscal 2026 revenue of $15 billion to $15.2 billion, with non-GAAP EPS of $1.01 to $1.03. For the full fiscal year, they project revenue between $60.2 billion and $61 billion and non-GAAP EPS of $4.08 to $4.14.

The next checkpoint arrives on Wednesday, Feb. 11, after market close, when Cisco will report its fiscal Q2 2026 results. Analysts expect EPS to grow 6.5% YOY to $0.82 for the quarter. Longer term, they forecast fiscal 2026 earnings of $3.30, up 7.5%, followed by another 7% rise to $3.53 in fiscal 2027.

What Do Analysts Expect for Cisco Stock?

Evercore ISI analyst Amit Daryanani has upgraded CSCO stock to “Outperform” from “In Line” and raised his price target to $100 from $80, citing stronger growth visibility and a more compelling multi-year earnings trajectory.

The firm has identified multiple tailwinds, such as campus network refresh cycle, accelerating AI-related demand, recovering enterprise and telecom spending, and expanding EBIT margins, which could sustain high single-digit revenue growth and low-teens EPS expansion.

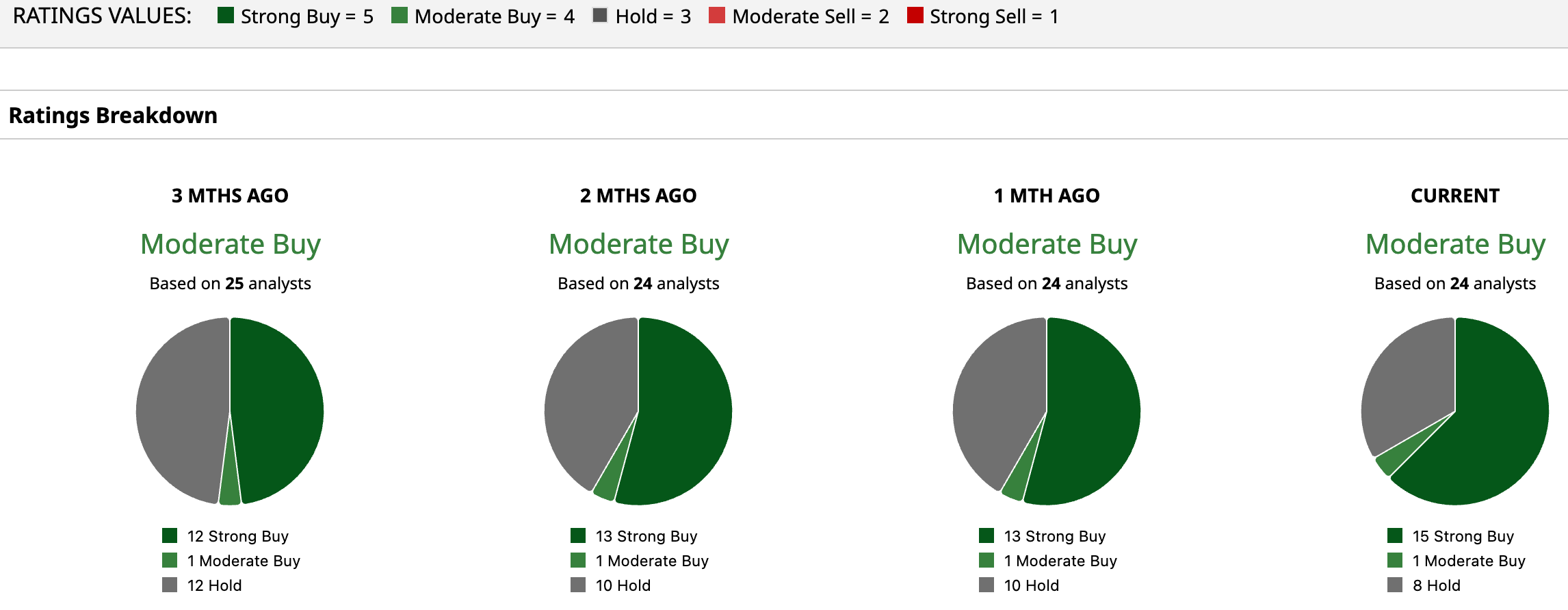

Overall, Wall Street assigns CSCO stock an overall “Moderate Buy” rating. Out of 24 analysts covering the stock, 15 recommend “Strong Buy,” one suggests “Moderate Buy,” and eight advise “Hold.”

The average price target of $86.90 implies potential upside of 5.9%, whereas the Street-high target of $100 suggests a gain of 15.07% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Enphase Energy Stock Just Shot Into Overbought Territory. Is It Too Late to Buy ENPH?

- Amazon Is Widely Launching Alexa+. Can That Move the Needle for AMZN Stock?

- As AMD Stock Breaks Below Key Support on Earnings Selloff, Should You Buy the Dip?

- ‘You Don’t Need to Have a PhD in Computer Science’ to Make a Great Living as AI Disrupts the Economy as We Know It. The Good and Bad of Nvidia CEO Jensen Huang’s Latest Prediction.