Some of the best opportunities hide in plain sight.

These aren't (usually) the flashy startups or speculative turnaround plays. Instead, they're established, resilient businesses with decades-long track records of rewarding shareholders. I’m talking about the Dividend Aristocrats, an elite group of S&P 500 listed companies that have increased their dividends for at least 25 consecutive years.

And when companies from this list drift toward being oversold, trading near their recent lows, it can create a rare setup where stability meets timing. That is exactly the type of opportunity I’m looking for today.

How I came up with the following stocks

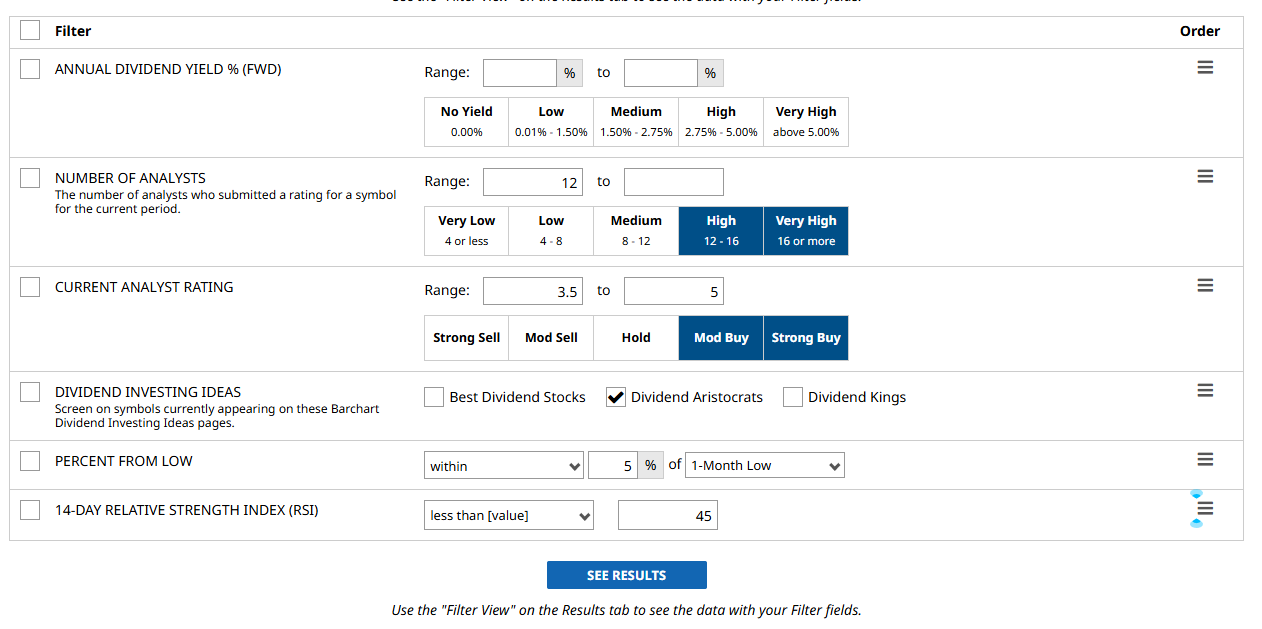

Using Barchart’s Stock Screener, I selected the following filters to get my list:

- Annual Dividend Yield % (FWD): Left blank so I can sort it later from highest to lowest.

- 14-Day Relative Strength Index (RSI): Less than 45%. RSI less than 30 is “oversold”, while above 70% is “overbought”. Setting the maximum at 45% can be a sweet spot to capture potential reversals or the early stages of a bounce-back.

- Precent From Low: Set within 5% of the 1-month low to filter early bouncing stocks.

- Current Analyst Rating: Moderate to Strong Buy.

- Number of Analysts: 12 or higher. The greater the coverage, the better.

- Dividend Investing Ideas: Dividend Aristocrats.

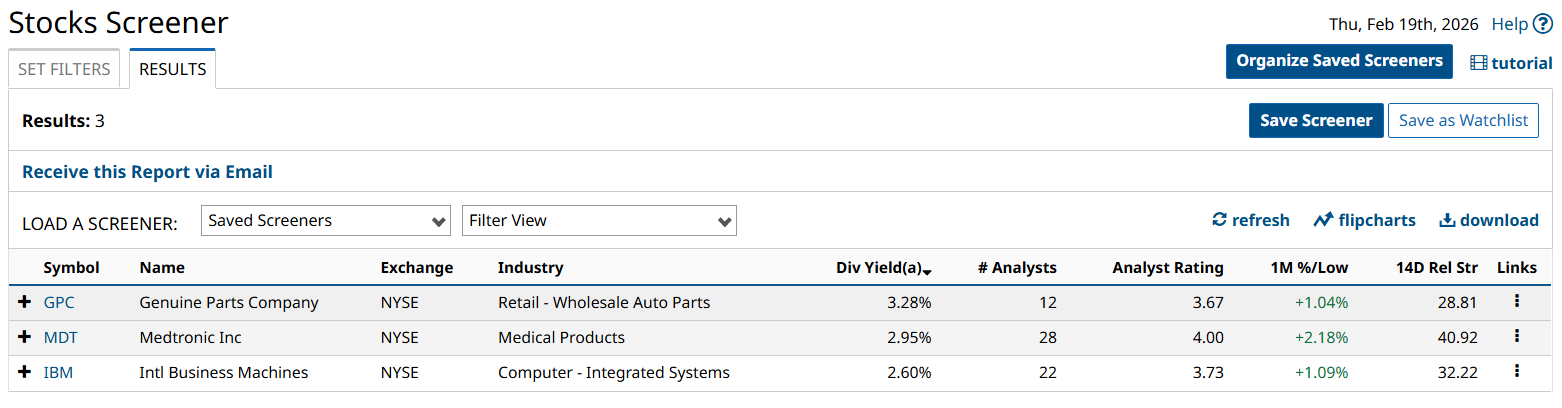

I set the screen, hit results, and exactly three results.

Let’s kick off this list with the first Dividend Aristocrat:

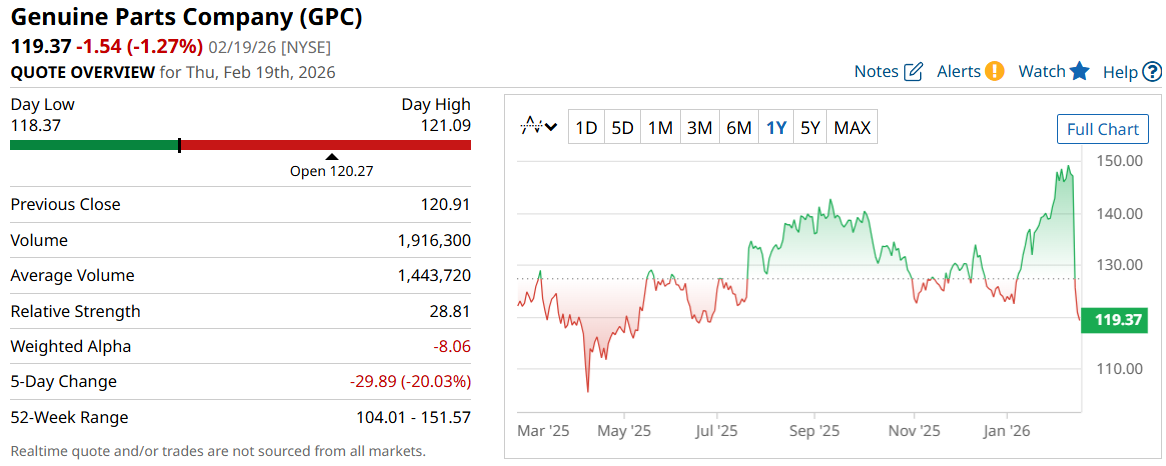

Genuine Parts Company (GPC)

The first Dividend Aristocrat is Genuine Parts Company, a global distributor of automotive and industrial replacement parts, better known for its NAPA brand, a parts and equipment supplier to automotive repair shops, retailers, and industrial customers worldwide.

In its most recent financials, the company reported sales were up 5% YOY to $6.3 billion, while net income softened 0.2% to $226 million on the back of higher operating costs and margin pressure. However, I see it as being a short-term headwind. What keeps me interested is that Genuine Parts increased its dividends for 70 straight years. Today, it pays a forward annual dividend of $4.12, translating to a yield of around 3.28%

Genuine Parts stock trades at approximately $119, with an RSI of 29, just below oversold levels. It is also up 1% from its 1-month low.

Meanwhile, a consensus among 12 analysts rate the stock a “Moderate Buy,” while the $190 high target price suggests there's as much as a 51% potential upside if reached.

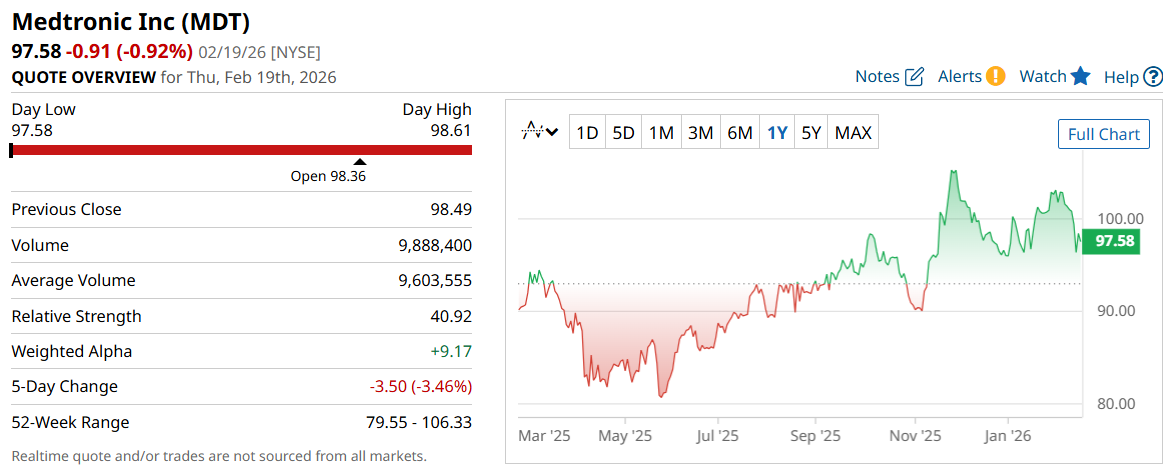

Medtronic Inc (MDT)

Medtronic Inc is a global medical technology company that develops devices to treat chronic diseases and manage heart conditions, diabetes, chronic pain, and neurological disorders. Hospitals and healthcare providers rely on Medtronic’s pacemakers, insulin pumps, surgical systems, and other life-saving medical technologies every day.

In its recent quarterly financials, the company reported sales rose almost 7% YOY to ~$9 billion. Net income was also up 8% to $1.4 billion.

Medtronic has increased its dividends for 48 consecutive years, and it currently pays a forward annual dividend of $2.84, translating to a yield of approximately 3%.

MDT stock trades at around $97, with an RSI of 40, which is near the oversold levels. Meanwhile, it is up almost 1% from its 2-month low, signaling a potentially compelling investment opportunity before a rebound.

Finally, a consensus of 28 analysts rates the stock a “Moderate Buy,” with as much as 28% upside if it reaches its high target of $125.

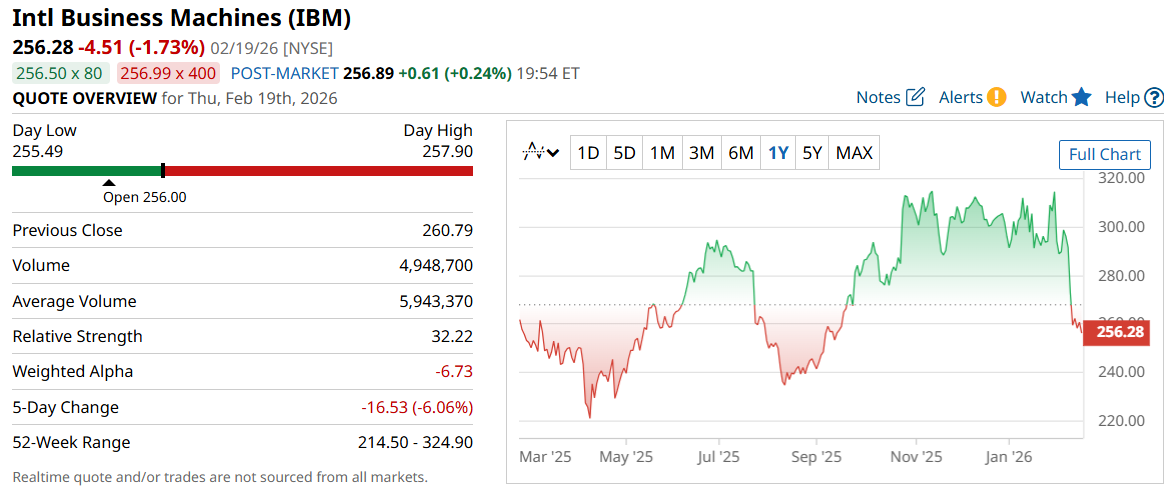

International Business Machines (IBM)

The last Dividend Aristocrat on my list is International Business Machine, better known as IBM. This is the company that likely made your first personal computer tick if you were using them in the late 80s and 90s. Today, it has evolved into a global technology provider focused on hybrid cloud computing, artificial intelligence, and enterprise IT services for businesses and governments worldwide.

In its recent quarterly financials, the company reported sales rising 12% YOY to $19.7 billion, while net income increased 92% to $5.6 billion.

Dividend growth investors will be pleased to know that IBM has increased its dividends for over 30 straight years and today pays a forward annual dividend of $6.72, translating to a yield of approximately 2.6%

At the time of publication, the stock trades at around $256, with an RSI of 32- making it almost oversold. It’s also up 1% from its 1-month low.

Meanwhile, a consensus among 22 analysts rates the stock a “Moderate Buy,” suggesting as much as a 48% potential upside.

Final Thoughts

These three Dividend Aristocrats offer consistency, income reliability, and a potentially attractive entry to capture an eventual recovery. While there is no assurance of their performance, these companies have proven their ability to thrive even amid market headwinds, making them an attractive addition to any portfolio.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- These 3 Dividend Aristocrats Look Ready to Rebound in 2026. Should You Buy Them Now?

- This Stock Lets You Collect a Dividend While on Vacation

- This High-Yield Dividend King Has 56 Years of Raises and Wall Street Is Screaming ‘Buy’

- Kraft Heinz Pauses Its Breakup Plans. Should You Buy the High-Yield Dividend Stock Here?