With a market cap of $87.2 billion, U.S. Bancorp (USB) delivers a wide range of banking, lending, payment, investment, and trust services to individuals, businesses, institutions, and government entities. It operates across multiple segments, including consumer and business banking, wealth management, payment services, and corporate and institutional banking.

Shares of the Minneapolis, Minnesota-based company have outpaced the broader market over the past 52 weeks. USB stock has increased 16.9% over this time frame, while the broader S&P 500 Index ($SPX) has returned 14.3%. Moreover, shares of the company are up 5.2% on a YTD basis, compared to SPX’s 1.4% gain.

Focusing more closely, shares of the financial services giant have outperformed the State Street Financial Select Sector SPDR ETF’s (XLF) 3.2% rise over the past 52 weeks.

U.S. Bancorp released Q4 2025 results on Jan. 20. The company posted stronger-than-expected EPS of $1.26 and total revenue of $7.37 billion, supported by record consumer deposits of $515.14 billion, an improved net interest margin of 2.8%, and solid capital metrics including a 10.8% CET1 ratio. However, the stock fell marginally on that day.

For the fiscal year ending in December 2026, analysts expect U.S. Bancorp’s EPS to grow 8.4% year-over-year to $5.01. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

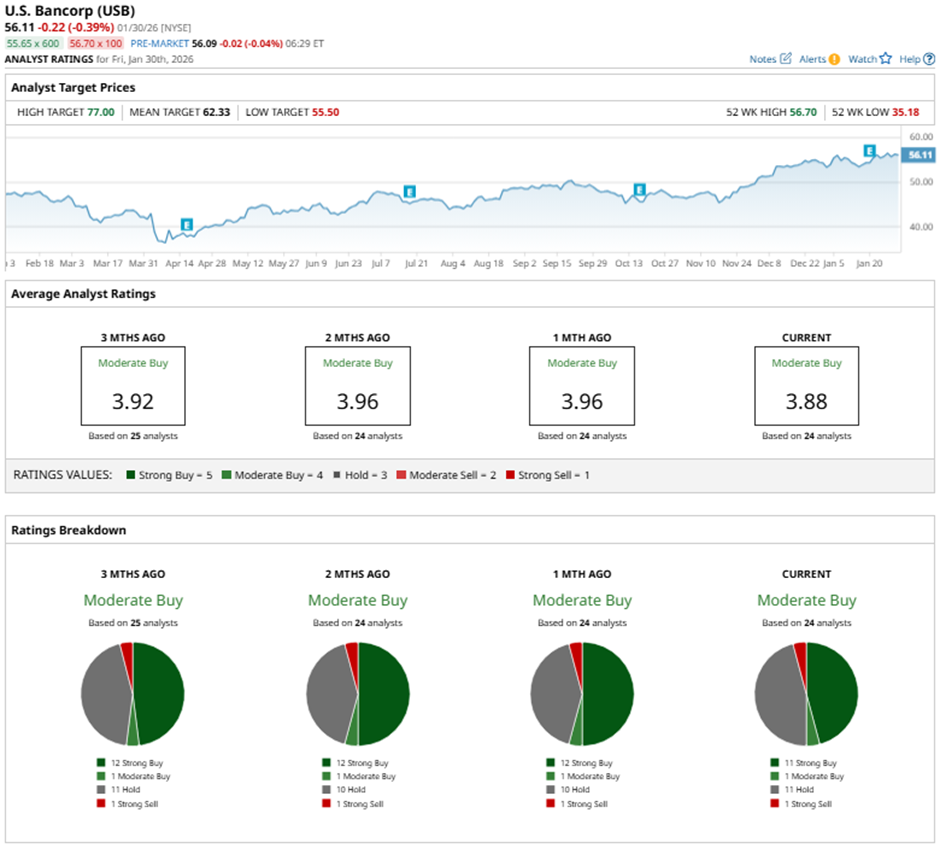

Among the 24 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings, one “Moderate Buy,” 11 “Holds,” and one “Strong Sell.”

On Jan. 21, RBC Capital raised its price target on U.S. Bancorp to $59 and maintained an “Outperform” rating.

The mean price target of $62.33 represents a 11.1% premium to USB’s current price levels. The Street-high price target of $77 suggests a 37.2% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart