Mid-America Apartment Communities, Inc. (MAA) is a large, S&P 500–listed multifamily REIT that owns, operates, develops, and redevelops apartment communities across the United States. Valued at a market cap of $16.3 billion, its primary focus lies on high-growth Sun Belt and Mid-Atlantic markets. Headquartered in Germantown, Tennessee, the company manages a diversified portfolio of more than 100,000 apartment units and operates a vertically integrated platform, handling property management, acquisitions, and development in-house.

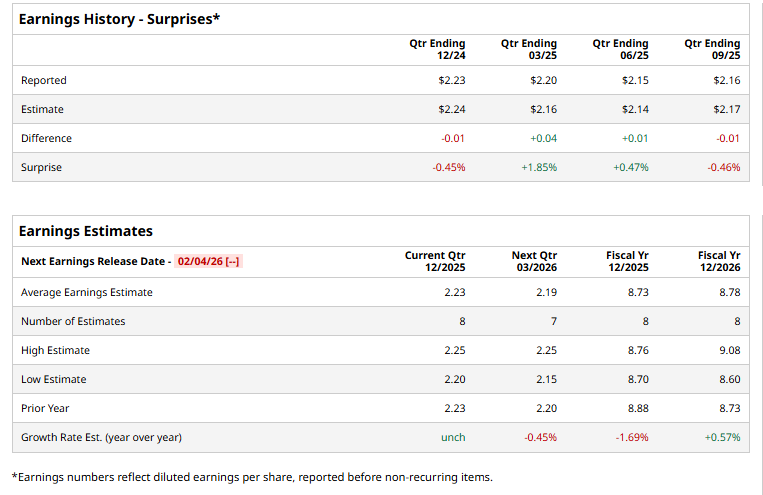

The REIT is scheduled to announce its fiscal Q4 earnings soon. Ahead of this event, analysts expect this residential REIT to report an FFO of $2.23 per share, unchanged from the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in two of the last four quarters, while missing on the other two occasions.

For fiscal 2025, analysts expect MAA to report an FFO of $8.73 per share, down 1.7% from $8.88 per share in fiscal 2024. Nonetheless, its FFO is expected to grow marginally year over year to $8.78 in fiscal 2026.

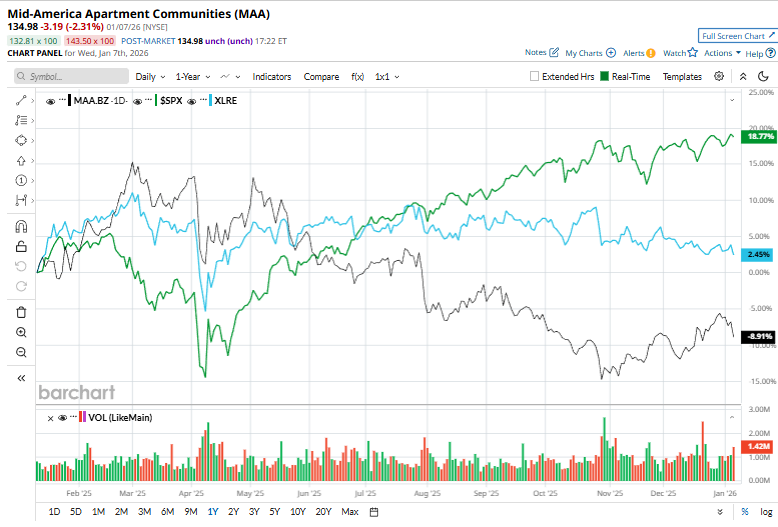

MAA has declined 9% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 17.1% return and the Real Estate Select Sector SPDR Fund’s (XLRE) marginal uptick over the same time frame.

On Dec. 17, MAA shares rose 2.9% after the company announced that its board had approved a quarterly dividend of $1.53 per share, payable on January 30, 2026, to shareholders on record as of January 15, 2026. The increase lifts the annualized dividend to $6.12 per share, reflecting a compounded growth rate of 8.3% over the past five years and marking the company’s 16th consecutive year of dividend increases.

Wall Street analysts are moderately optimistic about MAA’s stock, with a "Moderate Buy" rating overall. Among 28 analysts covering the stock, nine recommend "Strong Buy," two indicate "Moderate Buy," 14 suggest "Hold,” and three advise “Strong Sell.” The mean price target for MAA is $157.56, indicating a 9.3% potential upside from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart