With a market cap of $76.3 billion, O'Reilly Automotive, Inc. (ORLY) is a leading retailer and supplier of automotive aftermarket parts, tools, equipment, and accessories across the United States, Puerto Rico, Mexico, and Canada. It offers a wide range of products and services for both do-it-yourself and professional automotive repair, including maintenance items, accessories, professional tools, and enhanced programs such as battery testing, recycling, and custom hydraulic hose services.

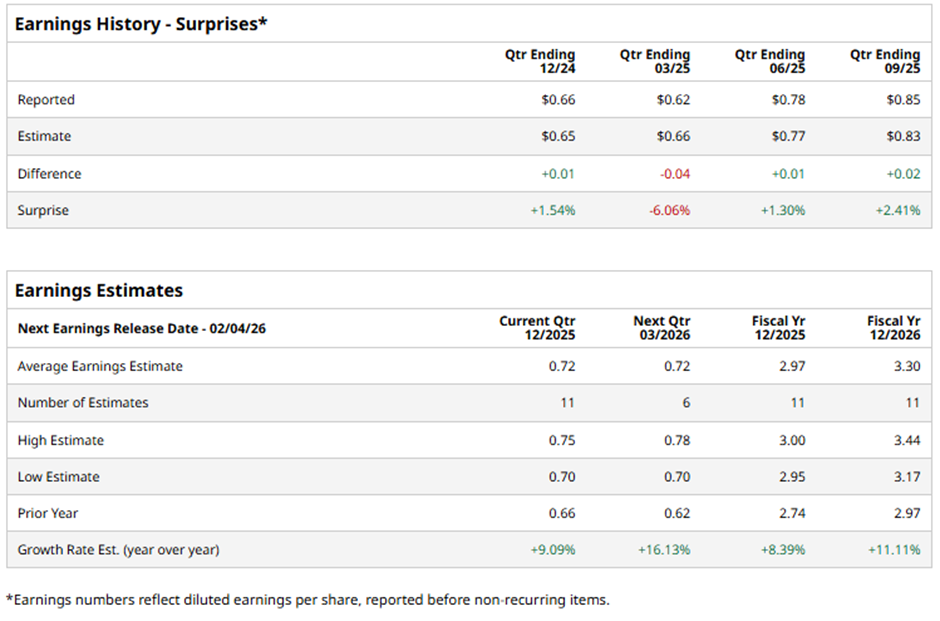

The Springfield, Missouri-based company is set to announce its fiscal Q4 2025 results soon. Analysts predict ORLY to report an EPS of $0.72, a 9.1% rise from $0.66 in the year-ago quarter. It has surpassed Wall Street's earnings estimates in three of the last quarters while missing on another occasion.

For fiscal 2025, analysts forecast O'Reilly Automotive to post an EPS of $2.97, a growth of 8.4% from $2.74 in fiscal 2024. Moreover, EPS is anticipated to increase 11.1% year-over-year to $3.30 in fiscal 2026.

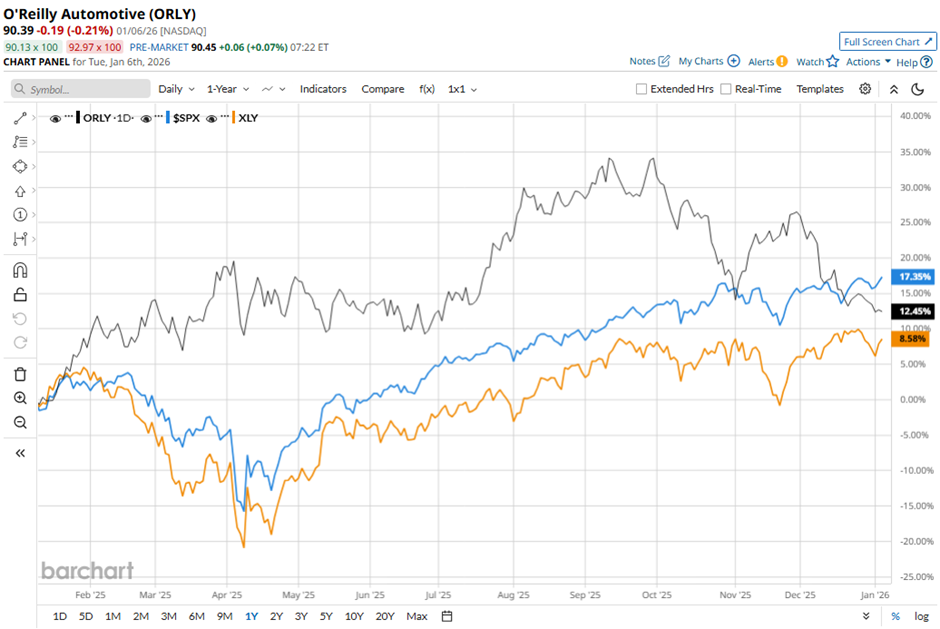

Shares of O'Reilly Automotive have returned 12% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 16.2% gain. However, the stock has outpaced the State Street Consumer Discretionary Select Sector SPDR ETF's (XLY) 6.8% rise over the period.

O'Reilly Automotive reported stronger-than-expected Q3 2025 earnings of $0.85 per share and revenue of $4.71 billion on Oct. 22. The company also raised the lower end of its full-year revenue forecast to $17.6 billion - $17.8 billion. The gains were driven by strong demand for replacement auto parts as consumers repair older vehicles amid tariffs on new cars. Nevertheless, the stock fell 2.9% the next day.

Analysts' consensus view on ORLY stock is bullish, with a "Strong Buy" rating overall. Among 28 analysts covering the stock, 21 recommend "Strong Buy," three give "Moderate Buy," and four indicate “Hold.” The average analyst price target for O'Reilly Automotive is $112.08, suggesting a potential upside of nearly 24% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart