With a market cap of $9.7 billion, Molina Healthcare, Inc. (MOH) delivers managed healthcare services to low-income individuals and families. It serves members through Medicaid, Medicare, and state insurance marketplace programs.

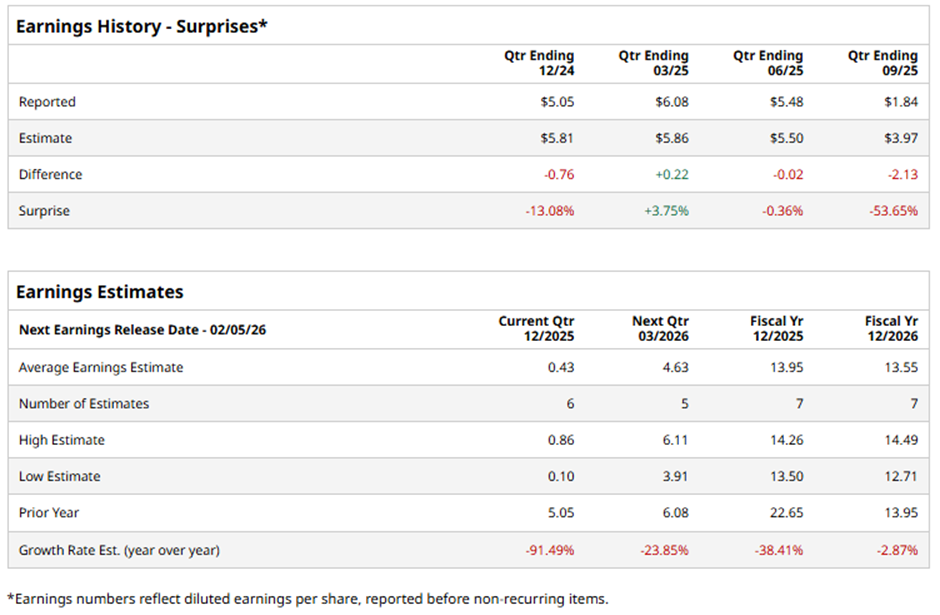

The Long Beach, California-based company is slated to announce its fiscal Q4 2025 results after the market closes on Thursday, Feb. 5. Ahead of the event, analysts expect MOH to report an adjusted EPS of $0.43, down 91.5% from $5.05 in the year-ago quarter. It has surpassed Wall Street's bottom-line estimates in one of the past four quarterly reports while missing on three other occasions.

For fiscal 2025, analysts forecast Molina Healthcare to post adjusted EPS of $13.95, a decrease of 38.4% from $22.65 in fiscal 2024.

Shares of Molina Healthcare have dropped 38.1% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 16.2% rise and the State Street Health Care Select Sector SPDR ETF's (XLV) 13.7% gain over the same period.

Shares of MOH tumbled 17.5% following its Q3 2025 results on Oct. 22 as its adjusted EPS slid to $1.84 from $6.01 due to elevated medical costs. The company disclosed that roughly half of the underperformance came from the Marketplace segment. Additionally, Molina slashed its full-year 2025 adjusted profit forecast to about $14 per share, citing continued pressure from higher-than-expected healthcare utilization, particularly in Medicare and Marketplace plans.

Analysts' consensus rating on MOH stock is cautious, with a "Hold" rating overall. Among 18 analysts covering the stock, three recommend a "Strong Buy,” 12 give a "Hold" rating, one suggests a "Moderate Sell,” and two have a "Strong Sell.” As of writing, it is trading above the average analyst price target of $167.67.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- S&P 500, MidCap 400, and SmallCap 600 Welcome New Members as Indexes Rebalance for 2026

- We ‘Can't Determine Whether We are Dealing With a Pet Rock or a Barbie’: Warren Buffett Warns Investors to Only Invest In Industries They Know

- LCID Stock Crashed Last Year, But Will Robotaxis Save the Day for Lucid in 2026?

- 'Robots & Rockets Aren’t Made from Hopes & Wishes,' and How the AI Revolution is Shaping the Next Metals Bull Market