As far as innovators are concerned, it’s difficult for investors to get excited about Dell Technologies (DELL). Over the trailing year, DELL stock has lost about half-a-percent of value, dubiously earning it a rating of Weak Sell by the Barchart Technical Opinion indicator. While the company’s broad relevancies — which include PCs, servers and network security — keep the wheels turning, DELL just hasn’t managed to make the gains stick.

Still, with a trailing five-year performance of over 217%, there’s potential here. Further, the latest bout of weakness — where DELL stock lost about 11% in the past month — could present a contrarian opportunity. In short, a reflexive move where investors, fueled by perceptions of discounted value and reinforced through positive feedback loops, may help lift the tech giant to higher ground.

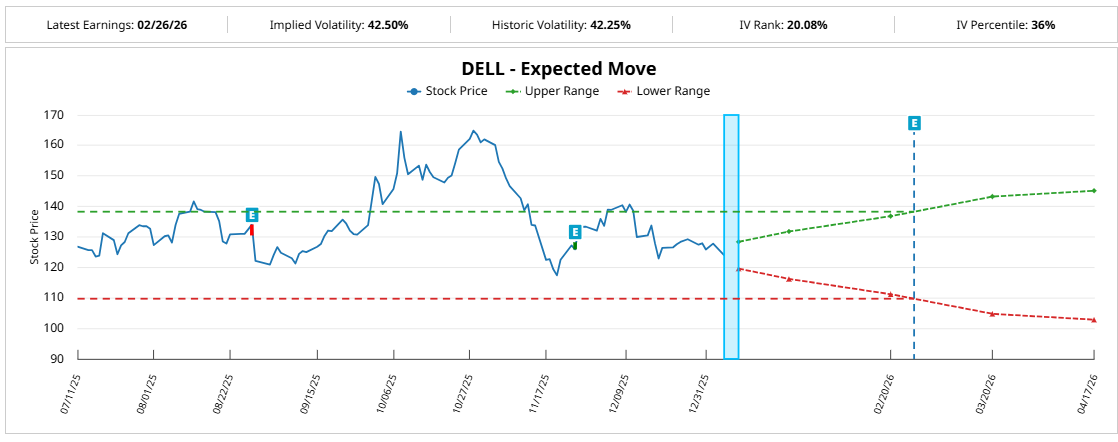

Granted, the options market doesn’t seem to be pricing in the greater probability of upside — but that could also be the opportunity. Right now, Barchart’s unusual options activity screener for DELL stock primarily shows dense volume and open interest around the $118 to $127 strike prices across multiple expiration dates. That tells us the derivatives market is pricing consolidation, not a breakout.

If options traders were anticipating a big directional move, you would likely see greater volume for deep out-the-money (OTM) contracts. Instead, you’re seeing strikes near the spot price of around $124. As such, the current consensus calls for DELL stock to be choppy but within a relatively defined range. Therefore, the emphasis of the smart money is on hedging and/or income structuring.

Now, what’s awesome about the options market is that it’s excellent at pricing known risks, not so much for pricing non-consensus expectations. Stated differently, there are transactions that are targeting upside for DELL stock but they’re only doing so in a controlled manner.

For us, that means the underlying implied volatility is not charging rent for potential upside exposure. However, the data suggests that this circumstance could soon change.

Exploiting a ‘Positive Flaw’ in the Risk Model for DELL Stock

Although it’s a given that retail traders are at a disadvantage when they place transactions on Wall Street — especially in the options market — this hindrance isn’t absolute in all cases. There’s one underappreciated “positive flaw” that is structurally embedded in the market and this dynamic allows us to potentially extract profitability at a much higher rate than would otherwise be expected.

Essentially, market makers must price risk monotonically, which means that risk rises in proportion to distance away from spot. In sports terms, a layup is easier to make than sinking a three-pointer, largely due to distance to the basket.

We see this positive flaw come up in the Black-Scholes model, where the “probability of profit” deteriorates the further the breakeven threshold moves away from the spot price. Under most circumstances, this assumption would never be challenged. Everyone knows that three-pointers are more difficult to make than layups.

But what if, in this particular play, the route to the layup was heavily defended? In this circumstance, the more probabilistically palatable move would be to pass the ball to the open player standing outside the arc. Suddenly, the more difficult shot on paper is — in the current context — the easier shot to make.

Structurally, Wall Street can’t be pricing stocks and options using unorthodox, non-monotonic risk models — but you can. Market makers have regulators to respond to. You don’t have to answer to anyone (well, expect maybe your significant other).

The point is, the market is never wrong. However, down the line, the pricing of risk will be suboptimal. That’s because Wall Street is taking a non-monotonic environment but pricing the risk monotonically. Therefore, our job as analysts is to identify these pockets of inefficiencies and provide an asymmetric trading idea.

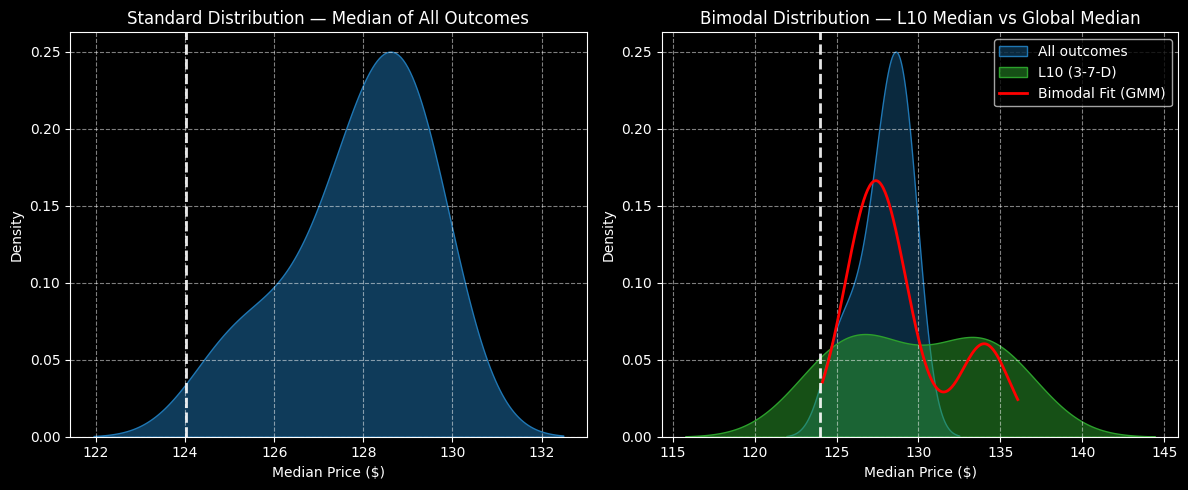

For DELL stock, in the past 10 weeks, the security printed only three up weeks, leading to an overall downward slope. This 3-7-D (three up, seven down, downward slope) sequence typically leads to a forward 10-week outcome that lands between $115 and $145 (assuming an anchor price of $124.01, Monday’s close).

However, what’s truly fascinating is that, under 3-7-D conditions, the probability decay from $125 to $135 clocks in at only 2.64% on a relative basis. Under the Black-Scholes model, the decay in probability of profit lands at 40.5%.

Again, I’m not saying the market is wrong and I’m not saying Black-Scholes is wrong. I’m arguing that, in this particular moment and for this particular stock, the monotonic risk assumption is suboptimal.

Using Risk Topography to Trade Dell Technologies Stock

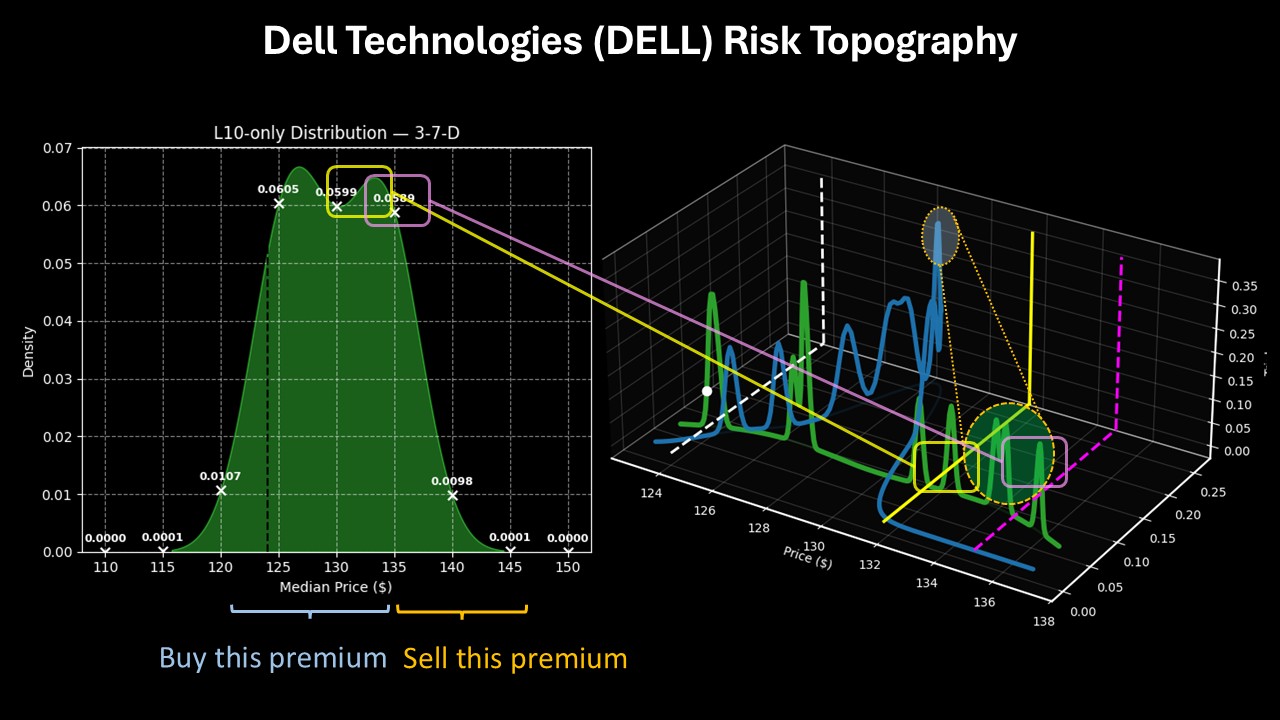

To further clarify our trading strategy, we can refer to risk topography, which is a three-dimensional view of demand structure encompassing expected (terminal) price, probability density and population occurrence. Risk topography helps answer three common questions that traders have: how much, how likely and how frequently?

Under 3-7-D conditions, probability density is most robust between $125 and $135. However, the third axis in risk topography — population occurrence — shows that heavy transitional activity is forecasted to materialize between $131 and $136. My speculation is that, following this activity, DELL stock may terminate at the top end of peak density curve.

As well, because probability decay is minimal between $125 and $135, rational traders are incentivized to maximize expected value over outright probability. That being the case, I’m a big fan of the 130/135 bull call spread expiring Feb. 20, 2026.

For putting $185 at risk, the maximum profit would come out to $315 if DELL stock rises through the $135 strike at expiration. Essentially, this wager would allow us to potentially exploit Wall Street’s anachronism for our own benefit.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart