A recent article in Barron’s showed the publication’s work in creating a 10-security portfolio that tries to replicate as much as possible the holdings of Berkshire Hathaway (BRK.A) (BRK.B). That’s the conglomerate that Warren Buffett led for decades before departing as CEO last week.

But is that all there is to it? Sure, we can see from public disclosure which stocks are owned. And their portfolio includes one ETF that covers the industrial sector, because that fund, the S&P 500 Industrial Sector SPDR (XLI), has some of Berkshire’s favorites. So the ETF is a surrogate for owning several of the stocks in it. The article discussed XLI only briefly, stating that “We’ve given the ETF a 25% weighting to approximate the value of Berkshire’s industrial and other businesses.”

And that is what prompted me to write this article. That, and a nudge from my outstanding editor, Sarah Holzmann, who has a knack for finding stories that fit right into my wheelhouse.

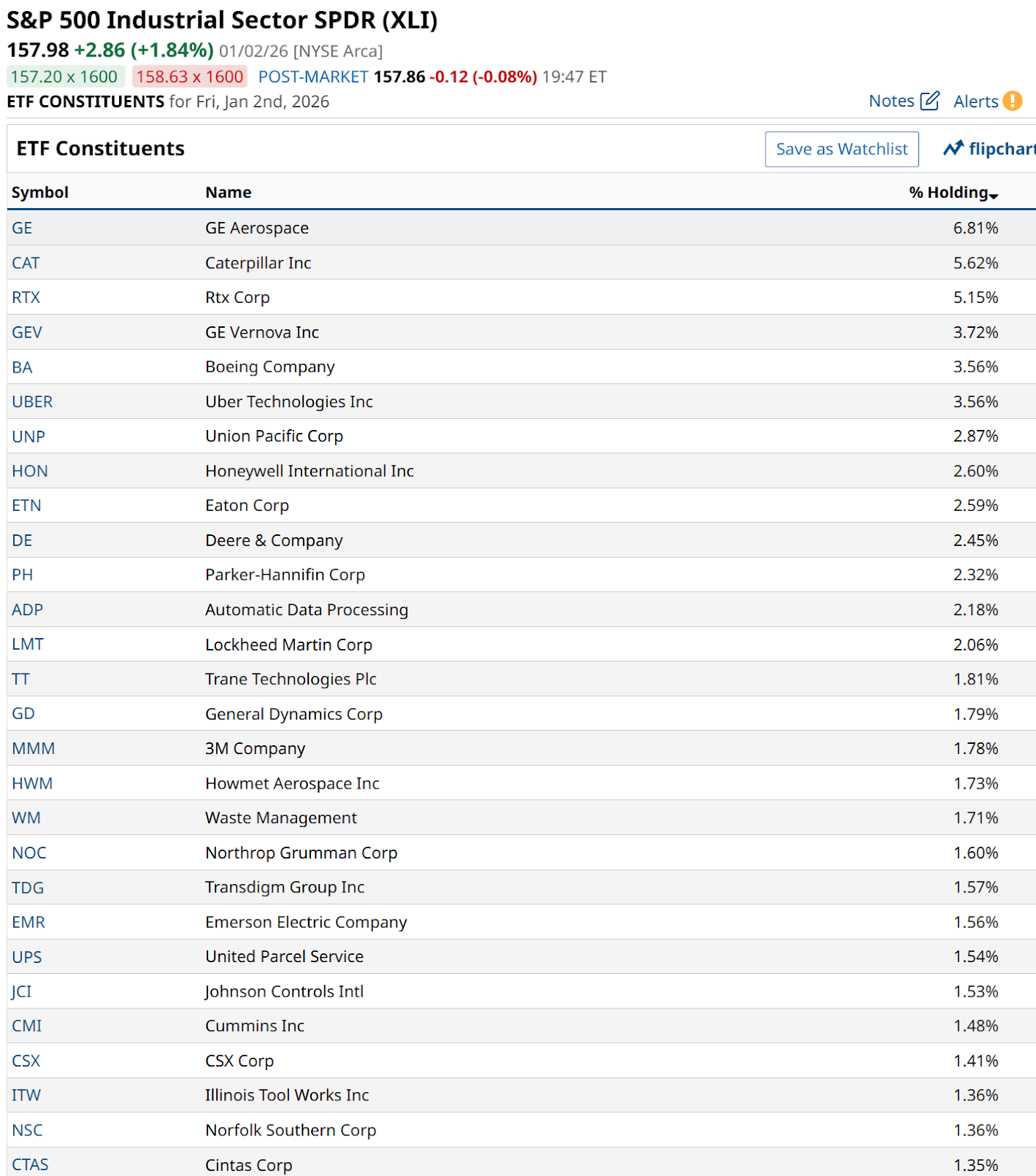

XLI is so different from other sector ETFs because it is diversified. Which in this top-heavy stock market, is a rare feat. Check out the highest weighted set of its 80-plus stocks. About one-third of them are listed here.

And while there are few at the top which are oversized versus the rest, it is far less focused than most other sectors. For instance, just three stocks make up nearly 40% of technology, two account for more than 40% of consumer discretionary, and the top two in the energy sector comprise more than 40% as well. It’s like when you see someone who lost a lot of weight and you exclaim “What happened to the rest of you?”

XLI Could Be a Leader in 2026

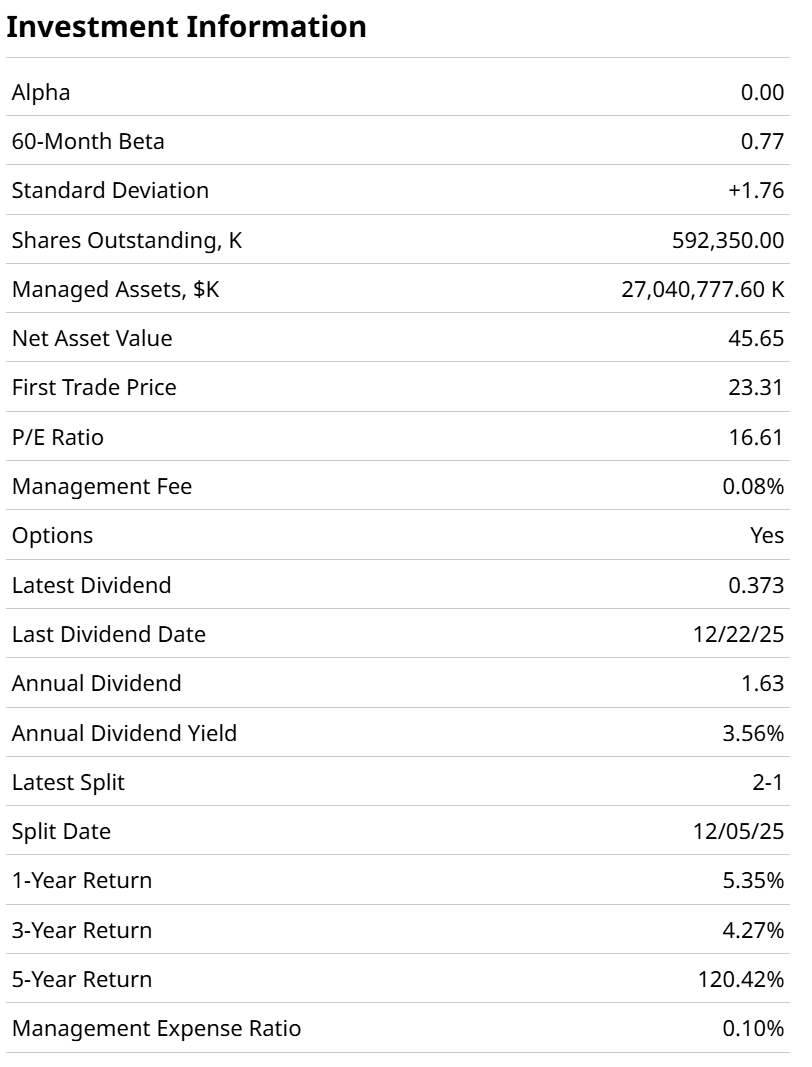

XLI is pound for pound my favorite consideration as a “long-term investment” among the 11 sector ETFs run by State Street, which have allowed us to track that level of the market for decades.

It’s done well, but again, the more even-handed nature of it is what stands out. That and the fact that there’s diversification within the many segments of industries, from transportation to aerospace, to a range of specialized machinery and other industrial businesses.

The other appeal is what I always say about stock ETFs. Even if you don’t want to buy the sector as a whole, you can go shopping for some good names within it. The list of holdings and position weights is updated daily.

XLI sells at 16x earnings, and my suspicion is that if the stock market holds up well this year, it will be a leader, not a laggard. But if things go south for tech leaders, my base case is that no sector will thrive. That’s the high correlation problem for the S&P 500 Index heading in 2006.

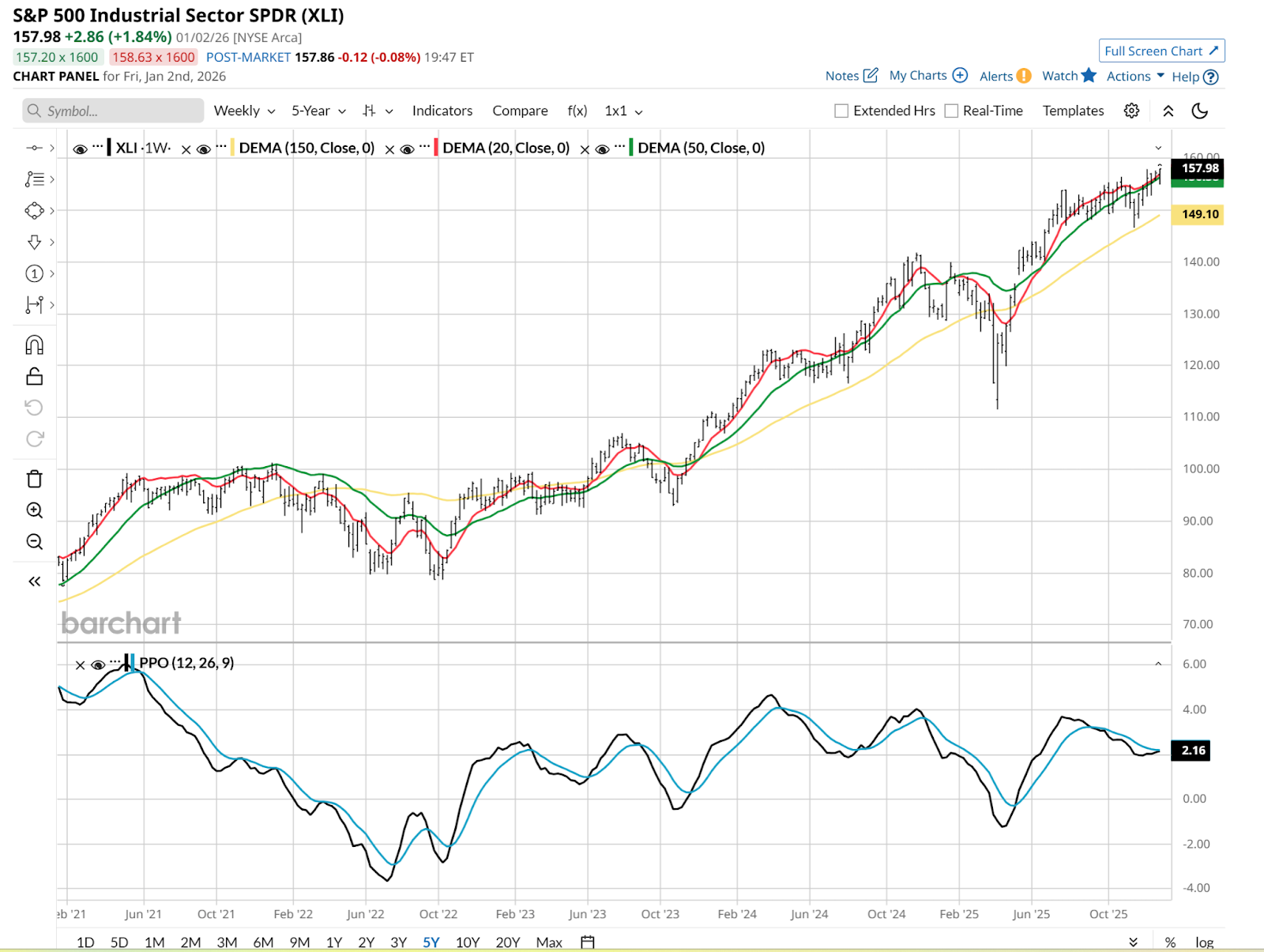

The chart above is not anything special to me, but the valuation makes me think it is likely to be a steadier performer in the year ahead. And, the 20-week moving average is still strong.

For Berkshire Hathaway, industrials are more of a heavy theme than a neat collection of securities to match an index. But Mr. Buffett’s penchant for that sector is not lost on me, and it shouldn’t be on you either.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer. For more of Rob’s research and investor coaching work, see ETFYourself.com on Substack. To copy-trade Rob’s portfolios, check out the new Pi Trade app.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Betting on Popular 2025 ETFs Could Produce Wicked Results in 2026. Don’t Get Caught Chasing the Hype.

- Warren Buffett’s Legacy Includes an Emphasis on Industrials. This ETF Reminds Us Why.

- How the 5 Major Asset Classes Stack Up on the Charts: A Year in Review

- 3 Stocks to Short in Early 2026, and 3 ETFs That Make Betting Against Them Even Easier