With gains of nearly 65%, Alphabet (GOOG) (GOOGL) was by far the best-performing “Magnificent 7” stock last year. It was the second-best year overall for the stock, and it delivered higher returns only in 2009, when U.S. markets soared following the brutal selloff in the previous year.

To be sure, not many expected GOOGL to have such a splendid performance last year. It was a combination of factors that supported the stock’s rally.

Why Did GOOGL Stock Rise 65% in 2025?

To begin with, GOOGL entered 2025 with quite tepid valuations as markets questioned its ability to protect its turf from artificial intelligence (AI) upstarts, particularly OpenAI. Depressed valuations laid the groundwork for a rally, which was bolstered by the company’s strong performance across its various businesses.

Its search and cloud businesses performed quite well last year, with the latter continuing to gain market share at Amazon’s (AMZN) cost. At the end of September, Alphabet had a cloud backlog of $155 billion, representing a 46% year-over-year (YoY) increase.

Alphabet’s Tensor Processing Units (TPUs) emerged as a key growth driver last year, and Anthropic announced plans to buy a million of these. Reports suggest that Meta Platforms (META) is also in talks to buy chips worth billions of dollars from Alphabet.

Alphabet’s progress in AI also accelerated last year with Gemini 3 gaining ground, which reportedly prompted OpenAI CEO Sam Altman to declare a “code red” at the world’s most valuable startup.

Apart from this, Alphabet won a major reprieve in the Department of Justice antitrust case. District Judge Amit Mehta allowed it not only to retain Chrome and Android but also to continue its partnership with Apple (AAPL) that makes it the default choice on iPhones.

Alphabet received another boost after Berkshire Hathaway (BRK.A) (BRK.B) disclosed a multi-billion-dollar stake in the company in Q3. While it isn’t known whether the investment was made by Warren Buffett, who has now retired as the CEO, handing over the baton to Greg Abel, it was nonetheless a major vote of confidence for the search giant.

Alphabet Stock 2026 Forecast

The bar is set quite high for Alphabet now, unlike last year when markets had somber expectations from the company. In contrast to 2025, Alphabet enters 2026 with a sense of optimism. It has proved its mettle by maintaining the search leadership while simultaneously impressing with the execution of its AI initiatives. The company has also dismissed fears over AI monetization, and during the Q3 2025 earnings call, Chief Business Officer Philipp Schindler said that AI is helping Alphabet “understand and predict intent like never before, unlocking entirely new commercial pathways to provide valuable new consumer connections and helping us monetize even more efficiently.”

Alphabet’s subscription business is also growing fast, and it had 300 million paying subscribers between YouTube and Google One at the end of September. TPU sales could potentially become the next big business for Alphabet as companies try to reduce reliance on Nvidia (NVDA). Even as the Jensen Huang-led company continues to lead that market, it likely will continue to do so for the near foreseeable future.

Meanwhile, while Alphabet has often traded at a discount to the S&P 500 Index ($SPX) over the last couple of years, at a forward price-to-earnings (P/E) multiple of nearly 30x, it now commands a significant premium over the average index constituent.

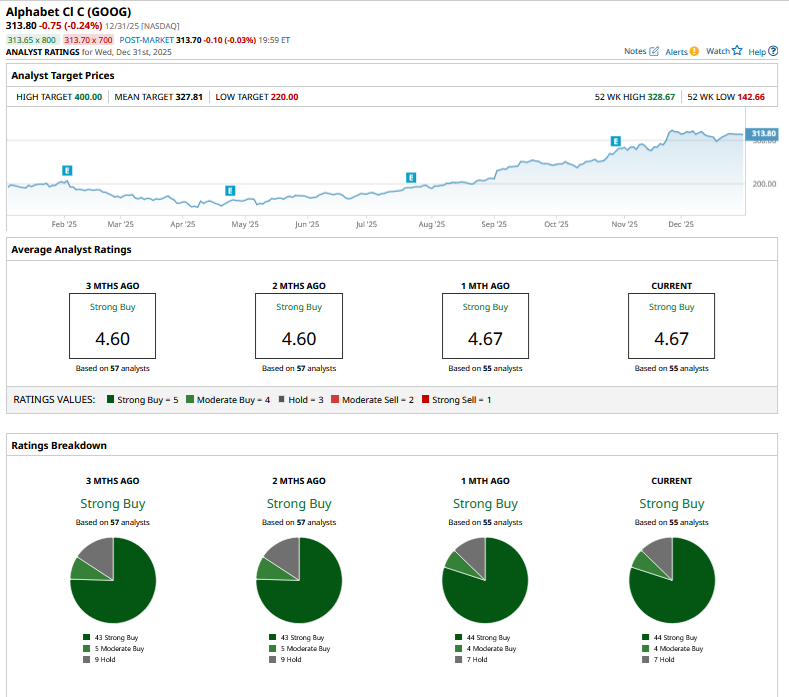

As things stand today, sell-side analysts have a consensus target price of $327.81 on GOOGL, which is only about 4.5% higher than current levels. To be sure, the targets are bound to be revised as the year progresses, but for now, I am not too sold on the stock’s risk-reward given the rich valuations and the rising AI capex. This would hurt the company’s earnings and free cash flows in the short term.

While I remain invested in Alphabet, I don’t find the current valuations enticing enough to trigger a fresh purchase. While Alphabet should still rise from these levels, I expect the returns to be much more muted than last year.

On the date of publication, Mohit Oberoi had a position in: AAPL , GOOG , BRK.B , META , AMZN , NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart