It’s inevitable that, on any given day, Wall Street is mispricing a publicly traded security’s option premium. Specifically, the standard Black-Scholes model effectively states the following for debit-based transactions: assuming the stock moves randomly with constant volatility and no memory, the fair price of a call option is the expected discounted payoff of owning the stock above the strike price at expiration.

As such, the model provides a clean template as a reference point but without much contextual backing. Before I get flooded with emails from angry pedants ready to defend Black-Scholes’ honor, let’s really consider the trifecta of why I made the above statement. We know that:

- Stock movements are not random (as we observe autocorrelation and clustered behavior).

- Volatility is not constant (as it typically expands and contracts depending on underlying catalysts).

- Stocks do have memory (as what happened before impacts what may happen next).

Indeed, the last point about market memory is one of the philosophical foundations of the Markov property. Under this framework, a system’s future state is determined solely by its current state. In other words, under Markovian reasoning, the fulcrum of transitional logic centers on the immediate behavioral state. Under Black-Scholes, no behavioral states — whether in the immediate frame or in the deep past — are considered.

To be clear, this lack of calculation doesn’t make the Wall Street standard pricing mechanism wrong — but it does make the outputted projections potentially suboptimal. That’s because under Black-Scholes, since state context is not considered, risk is largely defined in proportion to distance away from spot. That’s like saying that a three-pointer is harder to make than a layup, which is typically a reasonable statement.

However, in real game conditions, the path to the layup could be heavily defended. In that case, the open player standing outside the arc may have the easier shot, even though the distance is greater. That’s basically the Markov property. It’s a second-order analysis that derives probabilities from context rather than model presumption.

Palo Alto Network (PANW)

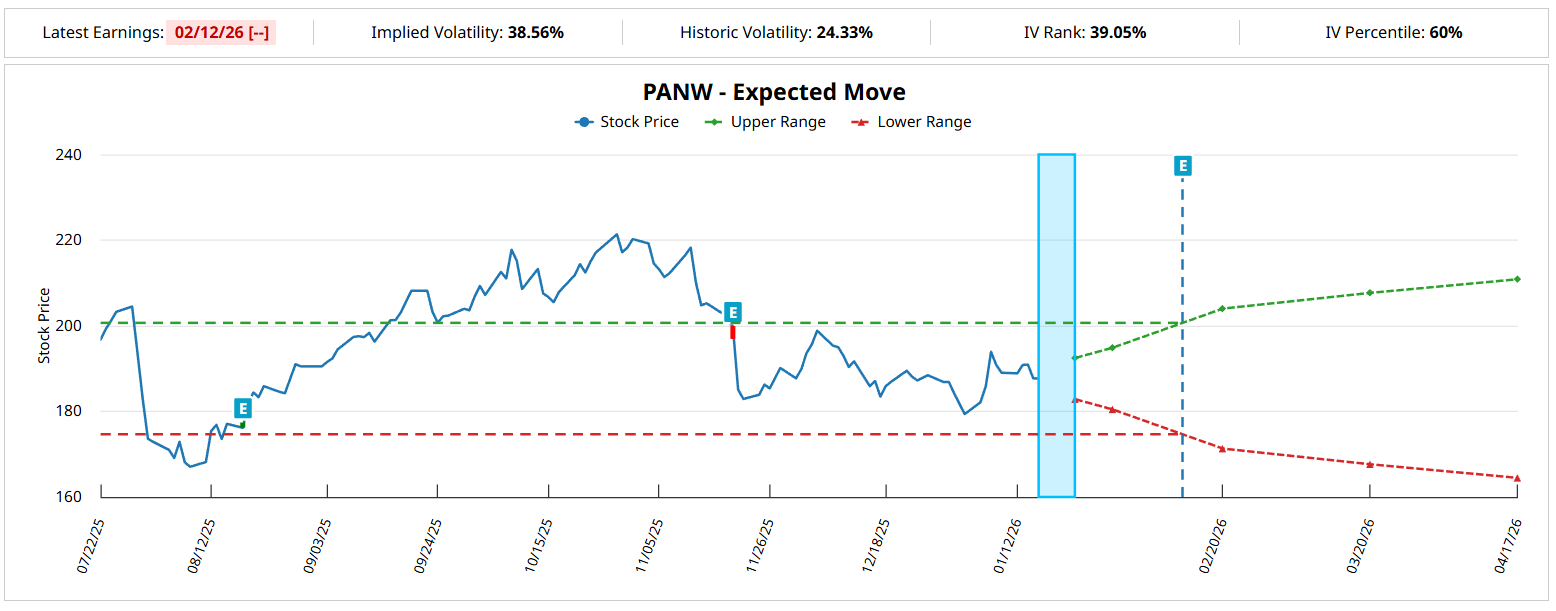

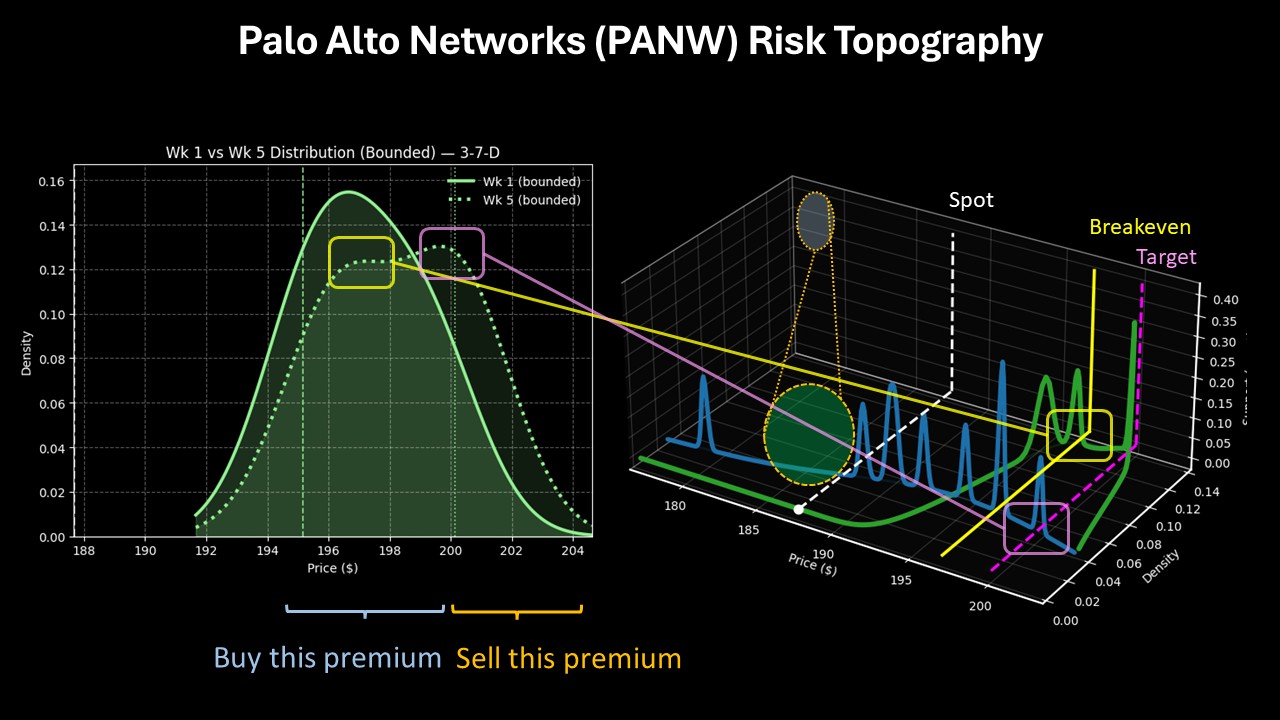

Let’s get down to business. Palo Alto Networks (PANW) features a spot price of $187.68 at time of writing. Under the Black-Scholes-based Expected Move calculator, for the options chain expiring Feb. 20, PANW stock would be expected to land between $171.31 and $204.01. Given that this range represents a perfectly symmetrical high-low spread of 8.71%, you can see the potential suboptimal nature of the price dispersion.

Basically, if we assume no contextual bias, then PANW stock should disperse along the projected spectrum. However, what we’re saying is that PANW most definitely does have bias. Heading into the weekend, the security printed only three up weeks out of the last 10 weeks, thereby leading to an overall downward slope. Therefore, Palo Alto is entering the weekend on a pessimistic note.

Nevertheless, history shows that under 3-7-D conditions, PANW stock tends to reflexively swing higher. Over the next five weeks, we may expect probability density to peak between $196 and $200. Using data provided by Barchart Premier, the 195/200 bull call spread expiring Feb. 20 is enticing. Should PANW stock rise through the $200 strike at expiration, the max payout stands at over 156%.

NetEase (NTES)

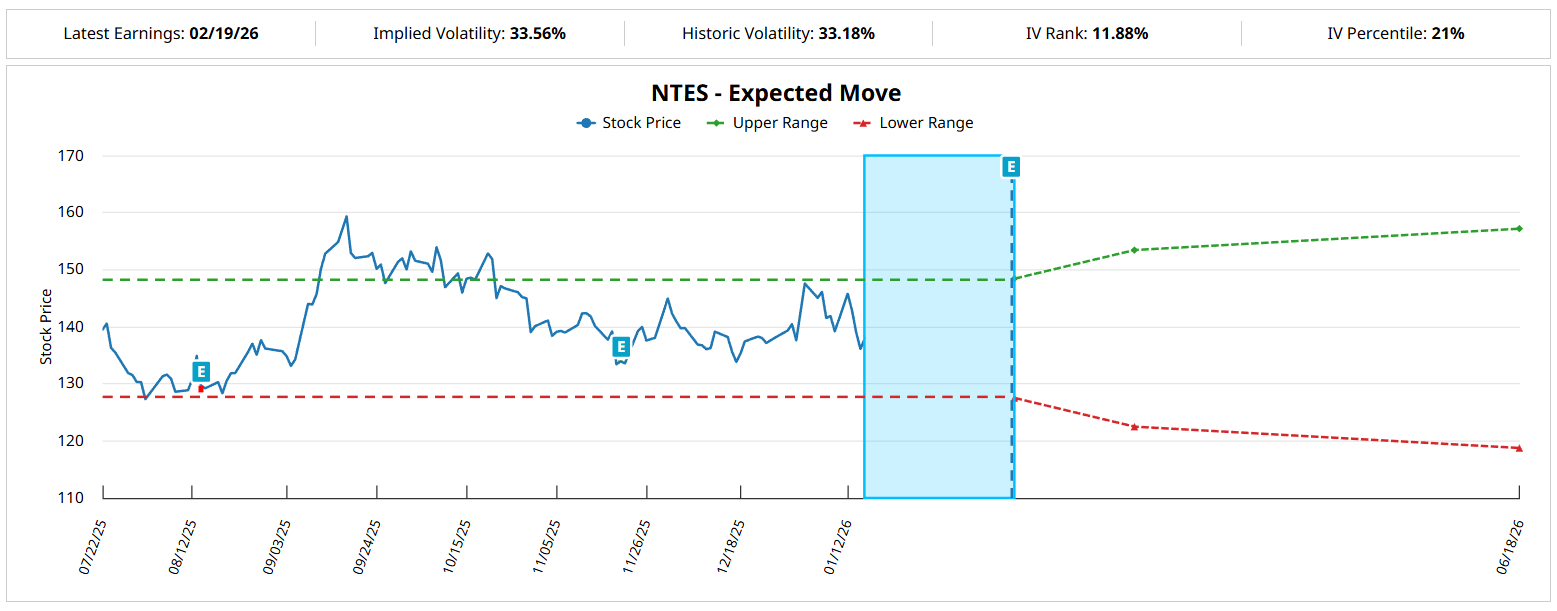

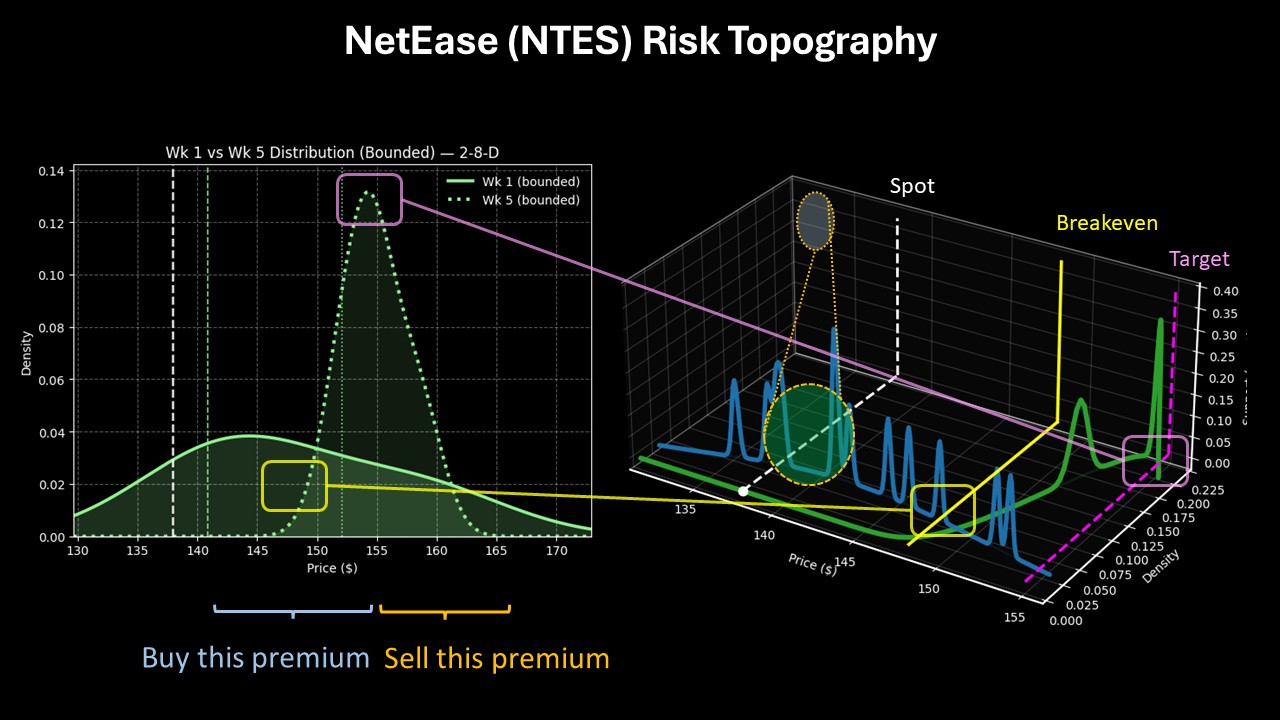

A China-based internet technology firm, NetEase (NTES) features a spot price of $137.98 at time of writing. Using the Expected Move calculator, the market is expecting a dispersion between $127.52 and $148.43 for the Feb. 20 options chain. This is a first-order dispersion based on implied volatility and days to expiration but it does not take into account market context.

And what is that context? In the last 10 weeks, NTES stock only printed three up weeks, leading to a downward slope. Typically, this 3-7-D sequence would carry negative implications for investors as it implies that the bears have full control. However, when this quantitative signal flashes, past data shows that NTES tends to resolve upward.

By using the Markov property under a hierarchical lens, we can calculate that over the next five weeks, probability density will likely peak around $155. Therefore, I’m really liking the 145/155 bull call spread expiring Feb. 20. Should NTES stock rise through the second-leg strike at expiration, the max payout would be 212.5%.

Dick’s Sporting Goods (DKS)

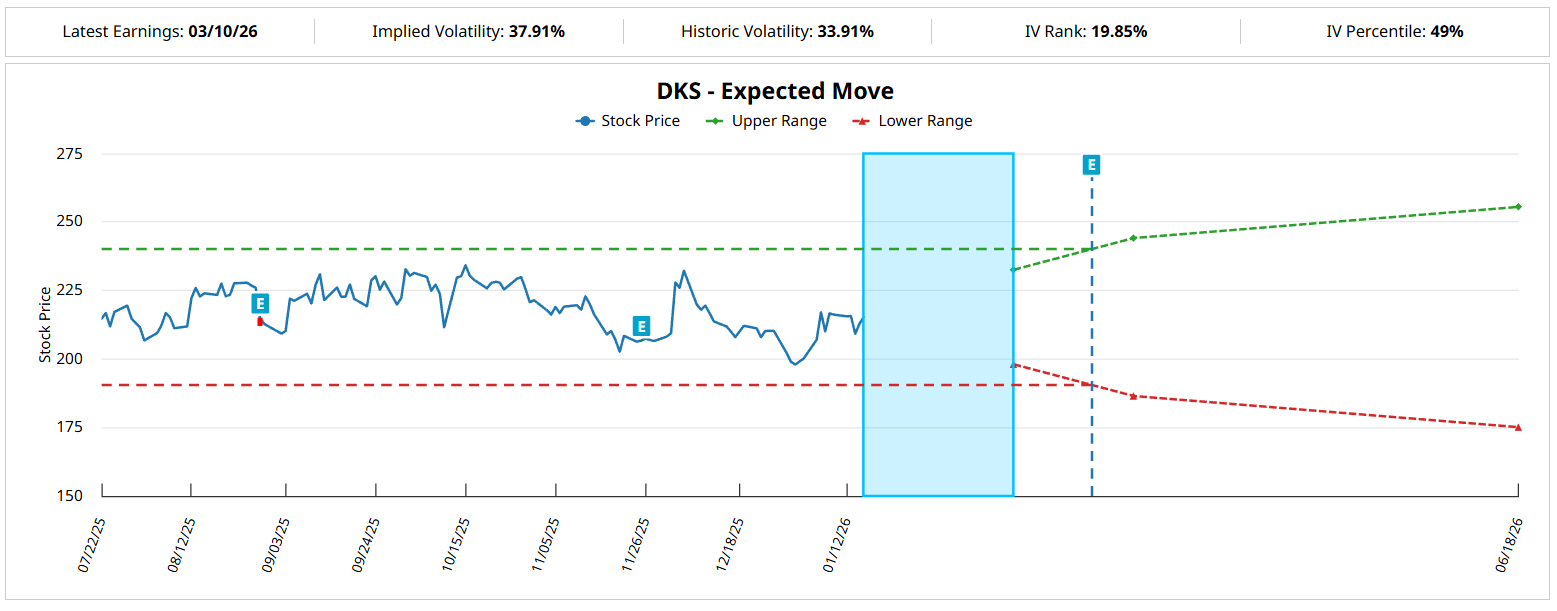

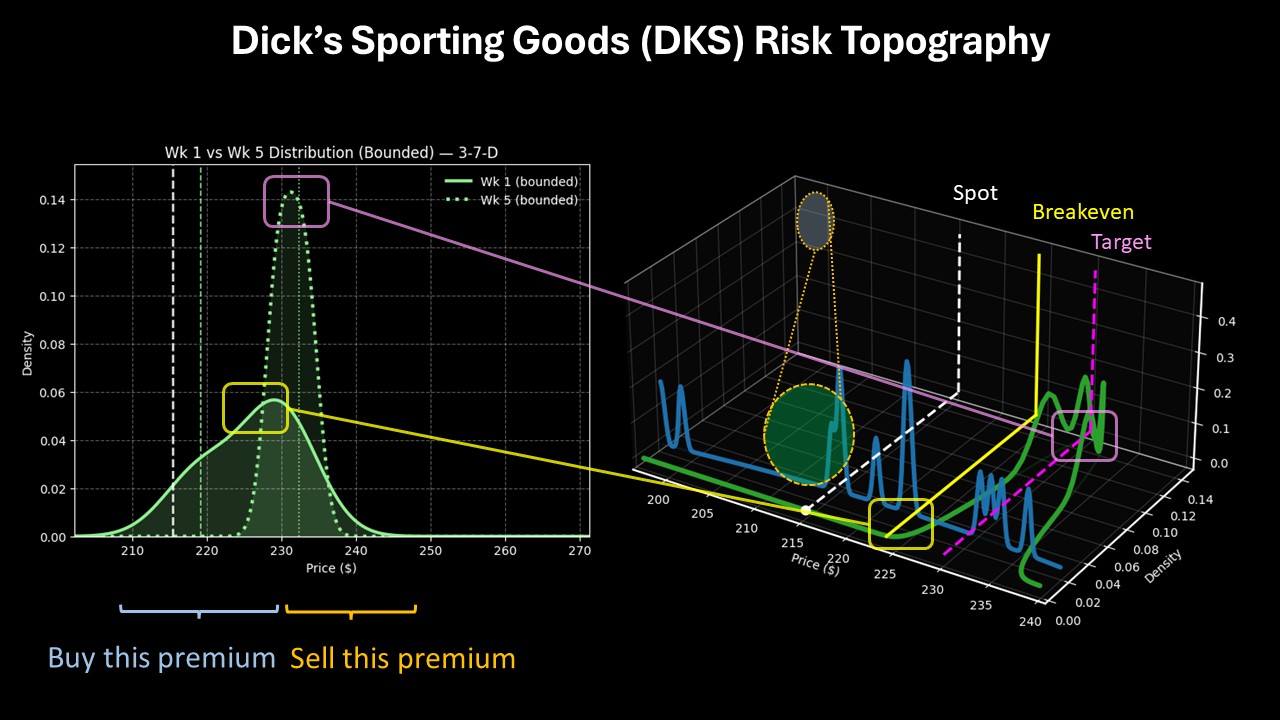

Sporting goods retailers don’t typically make for great trading ideas these days but that could change for Dick’s Sporting Goods (DKS). At the moment, DKS stock carries a spot price of $215.32. Under the Expected Move calculator, the market is anticipating a dispersion of $198.07 to $232.57 by the Feb. 20 options chain. As we said earlier, this assessment provides a clean template without second-order context.

To get a better idea of where in the dispersion DKS stock may land over the next five weeks, we would apply the Markov property. Currently, DKS is flashing a 3-7-D sequence, which naturally has negative implications. However, under this context, the security tends to resolve higher — and that’s what we’re going to bank on.

Using past analogs of the 3-7-D sequence, we can calculate that probability density would likely peak at $230. From an optimal speculation standpoint, the 220/230 bull call spread expiring Feb. 20 would seem to make the most sense. If DKS stock rises through the second-leg strike at expiration, the maximum payout would be 150%.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Saturday Spread: Using the Markov Property to Find Mispriced Opportunities (PANW, NTES, DKS)

- Intel Reports Earnings on January 22. Here Is Where Options Data Says INTC Stock Could Be Trading Next.

- Why Selling Costco and 3 Other Unusually Active Puts Could Save You From Overpaying

- McDonald's Is Worth Even More, Say Analysts - MCD Stock Looks Cheap Ahead of Earnings