The bottom line regarding the US-Venezuela situation is the former now has more crude oil supplies to both refine and sell on the global market.

There is an argument being made that this will increase the domestic US crude oil price while lowering prices for gasoline and diesel over time.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.Both the WTI and Brent markets are in position to see increased noncommercial buying interest early this week.

What does the US-Venezuela situation mean for crude oil markets, both global Brent and domestic (US) West Texas Intermediate (WTI)? We know the US president stated Venezuela would now “give” the US 50 million barrels of oil, an amount roughly valued at $3 billion. According to a story on CNBC, the US president added, “the money will be controlled by me…”[i]. What a shock, right? For now, let’s try to set all this aside and focus on crude oil’s market structure, and how it might change during 2026.

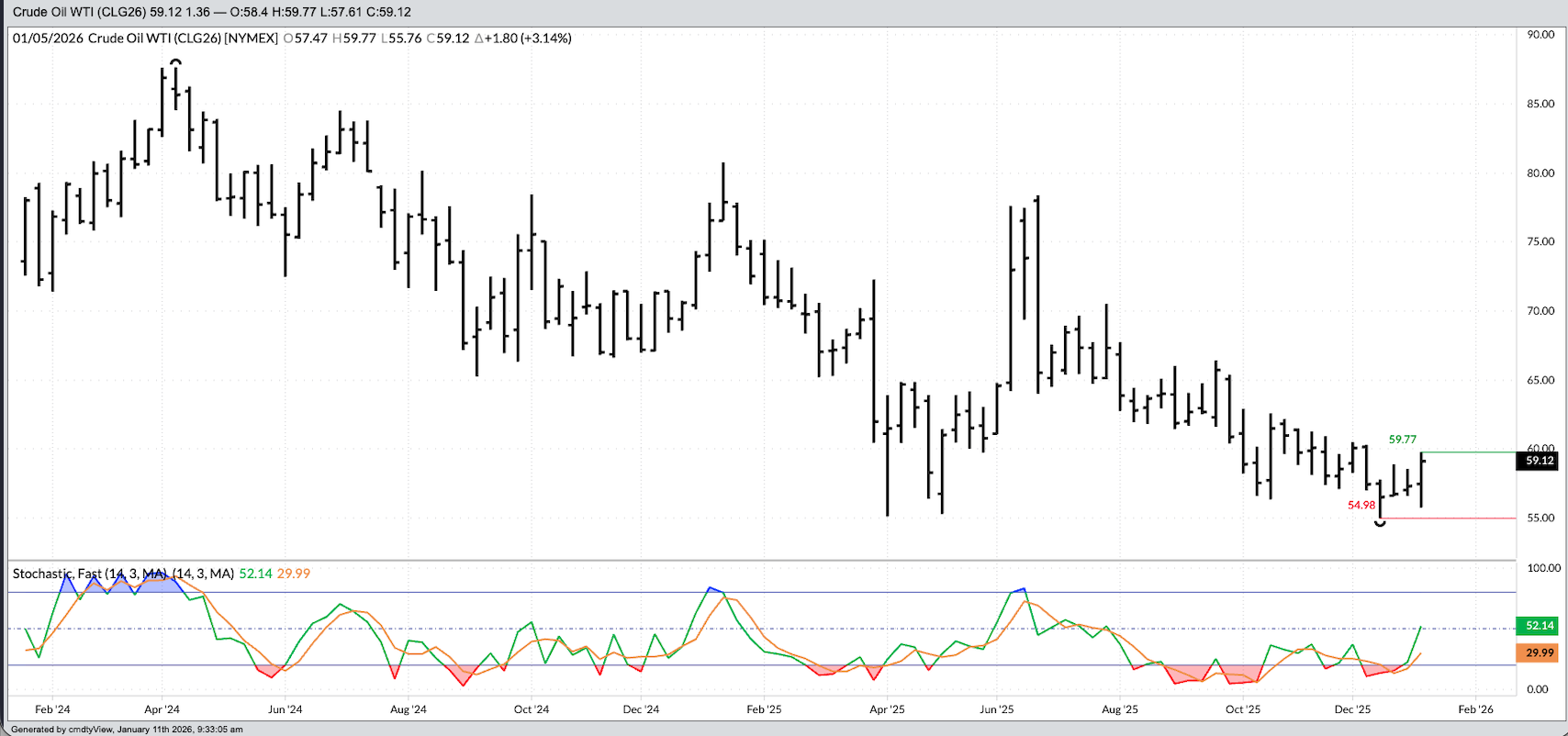

Let’s start with the noncommercial side. Applying Newton’s first law of motion to markets we know a trending market will stay in that trend until acted upon by an outside force, with that outside force usually the flow of investment money. A look at the chart for WTI crude oil futures created by pulling CFTC Commitments of Traders report (legacy, futures only) numbers and we see the flow of investment money has not change. Back in early February 2018 funds held a net-long futures position of 739,100 contracts. This included long futures of 862,100 contracts. Fast forward to the latest update, for the week ending Tuesday, January 6, and we see funds held a net-long of 57,352 contracts, a decrease of 7,239 contracts from the previous week. The chart also shows us the net-long futures position is within sight of its recent low of 39,800 from October 21, 2025. This sets the stage for a possible change in the outside force. But the investment side needs a fundamental reason to change its mind[ii], creating the debate over if we could now view crude oil’s supply and demand situation as bullish.

A friend from central Illinois called last week raising the question of a more bullish fundamental picture for US crude oil. Supplies that will be “given” to the US from Venezuela are heavy crude, the type used by Gulf Coast refineries, meaning more oil will be turned into gasoline and diesel. And if the US is turning more toward a petroleum-based economy, and away from “green” energy, then theoretically it would increase demand for heavy crude oil, possibly lifting the price of crude in relation to RBOB gasoline and distillates (diesel, jet fuel, heating oil, etc.) futures.

But here’s the thing, if the US uses the Venezuelan crude oil it was “given” not only for its own refining but to also sell on the global market, then global supplies will increase at a time when global demand continues to decrease. This could be what the lack of buying interest in the WTI futures market could be telling us, though stock prices of energy companies jumped last week. Why? Because those same companies will now have unfettered access to Venezuela’s vast oil reserves with an invitation to move in, use cheap local labor, and pump out as much oil supply as possible, increasing corporate profits.

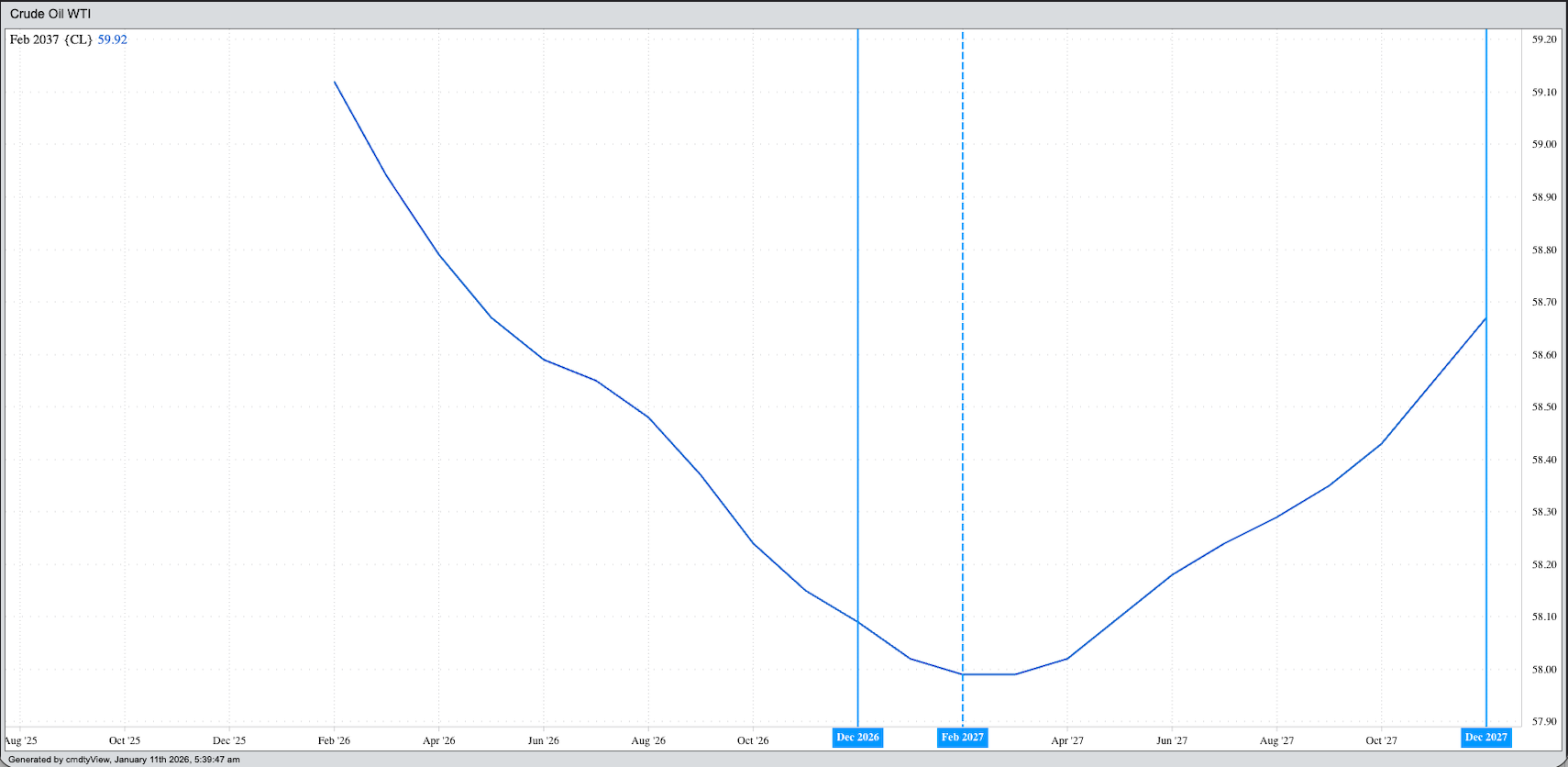

As you can tell, I remain skeptical of a bullish change to US and global crude oil fundamentals, despite forward curves for both WTI and Brent continuing to show backwardation through the February 2027 futures contract. But, if algorithms still see a backwardated forward curve and the equation tells them this means bullish fundamentals, regardless of headlines, again with the existing net-long futures position near its recent smallest level, crude oil could see a round of fund buying. We could know shortly after the market opens Sunday evening given the new 4-week high[iii] headed into this week’s trade is last week’s mark of $59.77, with the spot-month WTI contract (CLG26) closing Friday at $59.12. Over in the Brent market the 4-week high is last week’s mark of $63.91 with Friday’s close at $63.34 (QAH26).

If the crude oil market starts to rally on renewed fund buying, while remaining fundamentally bearish, the result will be a Rubber Band Disposition. As we know, these tend to end with markets snapping back to fundamentals. But that’s a story for another day.

[i] Story by Dan Mangan of CNBC.com from January 6: (LINK)

[ii] Newsom’s Market Rule #6: Fundamentals win in the end.

[iii] Based on the technical momentum indicator of the 4-Week Rule: Buy when a market hits a new 4-week high, sell when the market hits a new 4-week low.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart