2025 is now drawing to a close, and U.S. stocks are set to deliver double-digit returns for the third consecutive year. It was a volatile year for the automotive industry, which battled the steep tariffs that President Donald Trump imposed on imports of cars and auto parts. The electric vehicle (EV) industry also faced a setback after the tax credit was withdrawn.

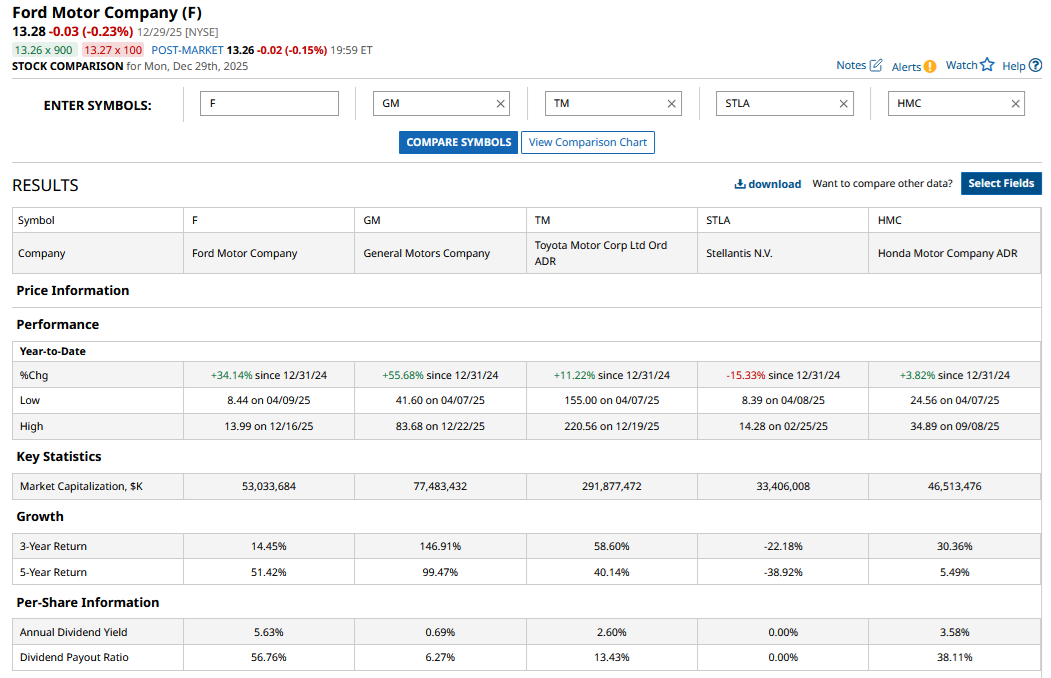

Looking at the price action, General Motors (GM) is outperforming other auto stocks by a wide margin this year. Ford (F), too, is up 34% for the year, and while the gains are lower than GM, they are better than other auto names like Stellantis (STLA), Honda Motor Company (HMC), and Toyota Motors (TM).

Meanwhile, when it comes to dividends, Ford stands out with its dividend yield of 4.5%, based on a regular quarterly dividend of 15 cents. The actual dividends have been even higher, as Ford has been paying special dividends to help reach its distribution target of between 40% and 50% of annual free cash flows. This year, Ford paid a supplemental dividend of $0.15 to mark the company’s third consecutive special dividend, after dishing out $0.18 last year. Ford paid a special dividend of $0.65 in 2023, after it booked a windfall gain on its investment in electric vehicle startup Rivian (RIVN).

Ford Should End Up Overshooting Its Payout Target in 2025

As things stand today, a supplemental dividend for 2026 is something we can rule out. In fact, looking at Ford’s adjusted free cash flow guidance of between $2 billion and $3 billion, it barely has the money to cover the base dividend at the midpoint. Notably, Ford’s 2025 cash flows took a hit from the fire incident at key supplier Novelis. There was also the tariff impact, which is more of a recurring issue rather than a one-off, unless these are waived.

Looking ahead, Ford’s cash flows would be under pressure over the next couple of years at least. The company announced a massive $19.5 billion charge in its EV business earlier this month. Of this, $5.5 billion would be in cash, which the company expects to incur over the next two years, with the majority coming in 2026.

I believe the best-case scenario for Ford investors would be the company maintaining its current payout, even as that might mean it overshoots the payout targets. Companies cut dividends only in dire scenarios, as was the case in 2020 when both Ford and General Motors suspended their dividends altogether.

GM Prioritized Buybacks Over Dividends

Ideally, Ford should have cut dividends and instead used the free cash to either cut down debt or repurchase shares aggressively, as GM did. Notably, one of the reasons GM outperformed Ford is because of the divergence in their capital allocation strategies. While the Blue Oval has preferred dividends, its Detroit rival has prioritized buybacks, which, as I have said multiple times, made perfect sense given the tepid valuations.

There is the unstated “family element” in Ford’s capital allocation strategy, as the Ford family still owns around 40% of voting powers through Class B shares. The family does not intend to sell its holdings and might prefer a dividend over a buyback, and that’s precisely what has been happening at Ford.

F Stock Forecast

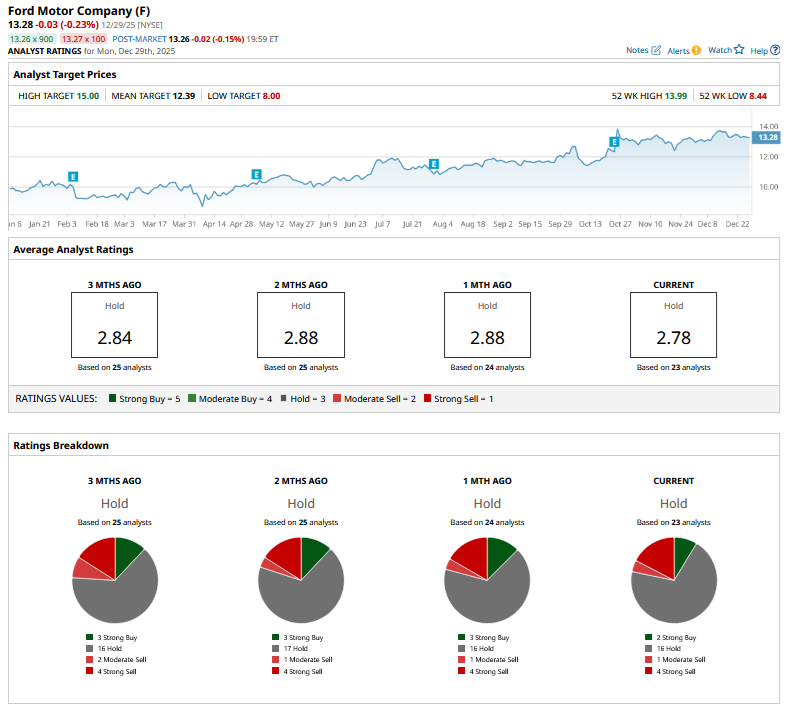

Ford has a consensus rating of “Hold” from the 23 analysts polled by Barchart, while its mean target price of $12.39 is lower than current price levels. Even the Street-high target price of $15 is just about 13% higher.

Is Ford Stock a Buy for 2026?

I share Wall Street’s pessimism and am not too bullish on Ford heading into 2026, and instead used the recent rise to trim my positions in the stock. Ford has disappointed on multiple fronts, ranging from execution, frequent and frustrating recalls, where it shattered its own decade-old record this year with 152 recalls, and less-than-optimal capital allocation. Ford’s EV strategy has also been literally all over the place, and while I don’t entirely blame the company, given the industry-wide headwinds, the company’s EV performance and strategy leave a lot to be desired.

This divergence between Ford and GM is well-articulated by their price action, where the latter has outperformed the Blue Oval for the second consecutive year. All said, while I don’t see Ford’s prospects as terribly bad for 2026, I would rather bet fresh capital on another name rather than Ford, given the company’s recent record on execution.

On the date of publication, Mohit Oberoi had a position in: F , GM , RIVN . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is Ford a Dividend Stock Worth Buying for 2026 After Its 34% Rise This Year?

- This Dividend-Yielding Gold Stock Is Up 184% in 2025. Should You Bet on Higher Gold Prices in 2026?

- The Ultimate Buy and Hold Dividend ETF for Any Market

- High Yield Meets High Conviction: 3 Dividend Stocks Built for Any Market