Chipotle Mexican Grill (CMG), the popular American fast-casual restaurant chain best known for made-to-order burritos, bowls, tacos, and other Mexican-inspired foods, introduced new items rich in protein on Dec. 23, as well as a restaurant-first snack offering. The initiative responds to strong consumer demand for protein-rich, convenient meals and snacks, influenced by broader health trends (like macro-nutrient focus and GLP-1 diet preferences).

The high-protein menu includes servings such as the Double High Protein Bowl (81g protein), the High Protein-Low Calorie Salad (36g protein) and Adobo Chicken Taco (15g protein), among others. Meanwhile, Chipotle’s first-ever snack offering is a High Protein Cup, which contains a 4-ounce serving of fresh grilled, hand-cut Adobo Chicken (32 g protein, ~180 calories) priced around $3.50-$3.82 depending on location.

About Chipotle Mexican Grill

Founded in 1993 and based out of California, Chipotle operates over 4,000 restaurants across the U.S. and internationally, with presence in Canada, the UK, France, Germany, Kuwait, the UAE, and others. Chipotle emphasizes fresh ingredients, simple preparation, and customizable orders, often made visible to customers.

Valued at a market cap of $49.8 billion, CMG stock is down 37.1% on a YTD basis. In fact, since ex-CEO Brian Nicol, often credited for structurally overhauling the struggling restaurant chain, left the company in August 2024, CMG stock is down 32.4%. Needless to say, the former COO and current CEO of the company, Scott Boatwright, has a big job ahead of him.

However, with the new menu introductions and an attention towards health-conscious consumers, CMG stock could start sizzling again.

Financials Are Neither Good Nor Bad

Chipotle’s financials are bland, a stark contrast to its offerings, which are exciting and full of flavors. Over the past 10 years, Chipotle’s revenue and earnings have increased at compound annual growth rates (CAGRs) of 9.93% and 11.25%, respectively, which is decent but nothing to drool over.

The results for the most recent quarter painted a similar picture as well. Revenues for the third quarter ended Sept. 30, 2025, came in at $3 billion. This denoted a yearly growth of 7.5% with the core Food and Beverage revenue going up by 7.6% in the same period to $2.99 billion. However, comparable restaurant sales remaining flat was a concern as inflationary pressures continued to hit discretionary spending of consumers. Consequently, the number of permanent closures in the September quarter rose to 4 from just 1 in the year-ago period. Thus, Chipotle guided that for 2025, the full-year comparable restaurant sales will decline in the low single-digit range.

This, along with increasing operating expenses, resulted in a decline in the company's earnings to $0.29 per share from $0.28 per share in the year-ago period. Notably, this came in line with the consensus estimate, with the company impressively reporting no earnings misses for more than two years now.

Meanwhile, cash flow from operations also remained solid for the first nine months of 2025. Net cash from operating activities in the first nine months of the year was $1.69 billion, higher than the previous year’s figure of $1.58 billion. Overall, the company ended the quarter with a cash balance of $698.7 million, exceeding its short-term debt of approximately $293 million.

However, even after such a subdued share price performance for more than a year now, CMG continues to trade at levels much above the industry average. Its forward P/E, P/S and P/CF of 32.53x, 4.18x, and 24.59x are all above the sector medians of 17.78x, 0.96x, and 12x, respectively.

Footprint Expansion Key to Growth

Chipotle is counting on international markets to offset the slowdown in U.S. sales, even though executives remain steadfast about its core market, stating that there’s still room to roughly double the domestic count to about 7,000 stores someday. The plan for 2026 calls for 350 to 370 new openings, which comes to around 9% more locations overall.

Meanwhile, the early international bets are paying off so far. Franchise spots in the Middle East and company-run stores in Canada are seeing good customer turnout, showing the brand can take root in new. South Korea and Singapore are up next in 2026, with more markets likely to follow. That kind of steady push abroad should add real staying power to the growth outlook.

At home, Chipotle is trying several things to get back on a firmer footing. Starting next year, limited-time items will roll out three or four times with a bigger lineup of sauces, dips, and sides to pull in new customers and get people ordering more often. The app and loyalty setup are also getting reworked to better connect with younger crowds. Lastly, catering and group orders, areas that haven’t been tapped much, are also getting more focus. Layer on continued store additions here and overseas, and these steps should keep sales trending up over time.

For margins, a couple of projects stand out as ways to improve profitability in the long term. The primary one is the high-efficiency equipment package (HEAP), already in place at around 175 locations. It’s delivering steadier food prep, more satisfied guests, and better staffing during rushes, with overall volume handling climbing. The double-sided grill that cuts protein cook times in half is the big win, clearing kitchen jams and letting stores manage busy periods without chaos. As HEAP gets rolled out chain-wide over the next few years, those labor efficiencies should build up and give margins a lift.

Faster service and consistent quality when it’s busiest should also keep customers loyal, adding another boost to the top line.

Analyst Opinion

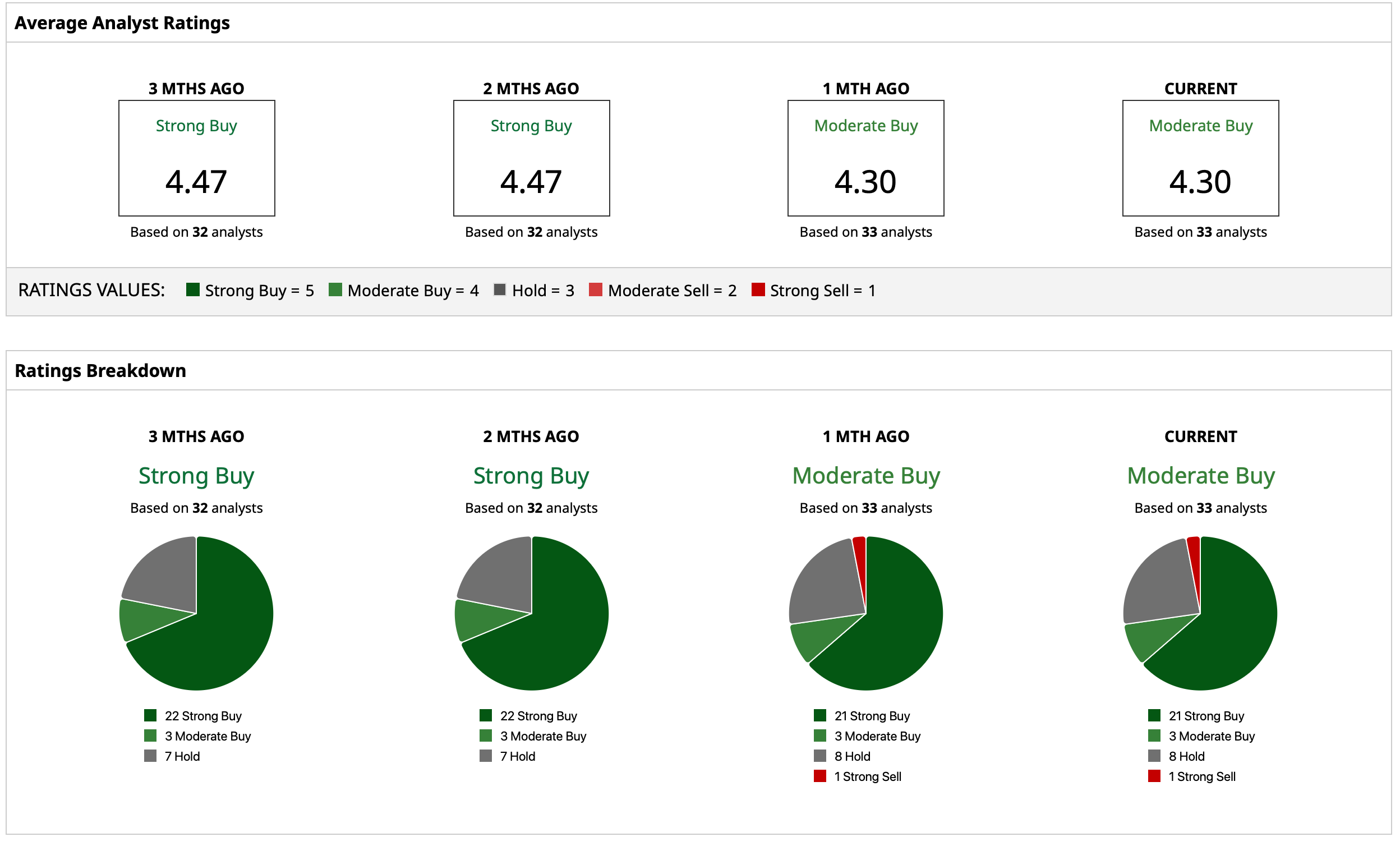

Taking all of this into account, analysts have assigned an overall rating of “Moderate Buy” for the stock, with a mean target price of $44.39. This indicates upside potential of about 19% from current levels. Out of 33 analysts covering the stock, 21 have a “Strong Buy” rating, three have a “Moderate Buy” rating, eight have a “Hold” rating, and one has a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Super Micro Computer Stock Tumbles, But Investors are Piling into Its Call Options - Time to Buy SMCI?

- Chipotle Just Launched a New Protein-Packed Menu. Should You Buy CMG Stock for 2026?

- Cathie Wood Is Selling DraftKings Stock. Should You?

- Dan Ives Is Betting That Apple and Google Will Partner in 2026. Should You Buy AAPL Stock First?