UnitedHealth (UNH) is among America's largest insurers and is a company that's become pretty divisive in the investing world among those who believe in the company's earnings growth potential and those who bemoan how the company earns those profits. Concerns around the company's denials program and other key issues have plagued the stock, following the murder of its former CEO. And while various practices have been put in place and the company appears to be reviewing how its operating model can best serve the public, that's worth prefacing before we dive into this name.

More recent headlines for UnitedHealth have centered around the company's other key operational push, to expand its Optum Rx model. This push allows the company to expand its cost-based pharmacy reimbursement model, allowing pharmacy services administration partners to take advantage of Optum Rx and potentially serve more customers in a wider range of communities. Additionally, this move is expected to improve “transparency and financial predictability to manage costs and brand-name drug prices and usage increase.”

Of course, we'll have to ultimately see how this expansion positively or negatively impacts UnitedHealth moving forward. But let's talk more about this recent announcement and how it may impact this healthcare giant's fundamentals and outlook.

What Does This Move Mean for UnitedHealth's Bottom Line?

Ultimately, the idea behind this expansion appears to be to capture more value in the pharmacy reimbursement value chain, with branded and generic drugs seeing large imbalances in pricing. UnitedHealth is touting this move as a way to essentially improve patient access to key drugs. But overall, this move may have a more pertinent impact on the company's bottom line if more revenue per vial can be brought in over time.

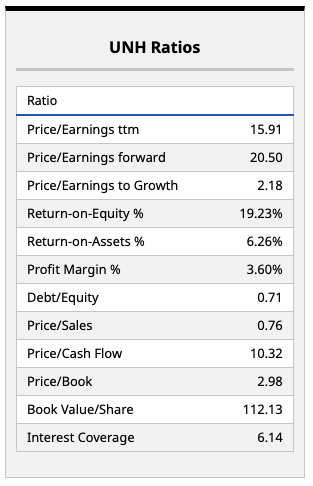

UnitedHealth's margins, shown above, have deteriorated somewhat to 3.6%. This move appears to be aimed at shoring up the company's core market profile to drive more cash flow and earnings growth down the line.

I think that certainly makes sense. Given rising prices for drugs overall, maintaining solid pricing and capturing more of the value created in this sector overall should bode well for investors over time. Whether this move will ultimately translate into lower costs for consumers—that's a key item up for debate.

UnitedHealth's other core metrics, from return on equity to return on assets, do appear to be okay. And at a forward price-earnings ratio of around 20 times (the cheapest in a while), it's difficult to make the argument that this insurance giant is overvalued here.

We'll just have to see what is to come on the growth front, where I'd argue most investors share some common concern around this particular name over the near- to medium-term.

What Does Wall Street Think About UnitedHealth?

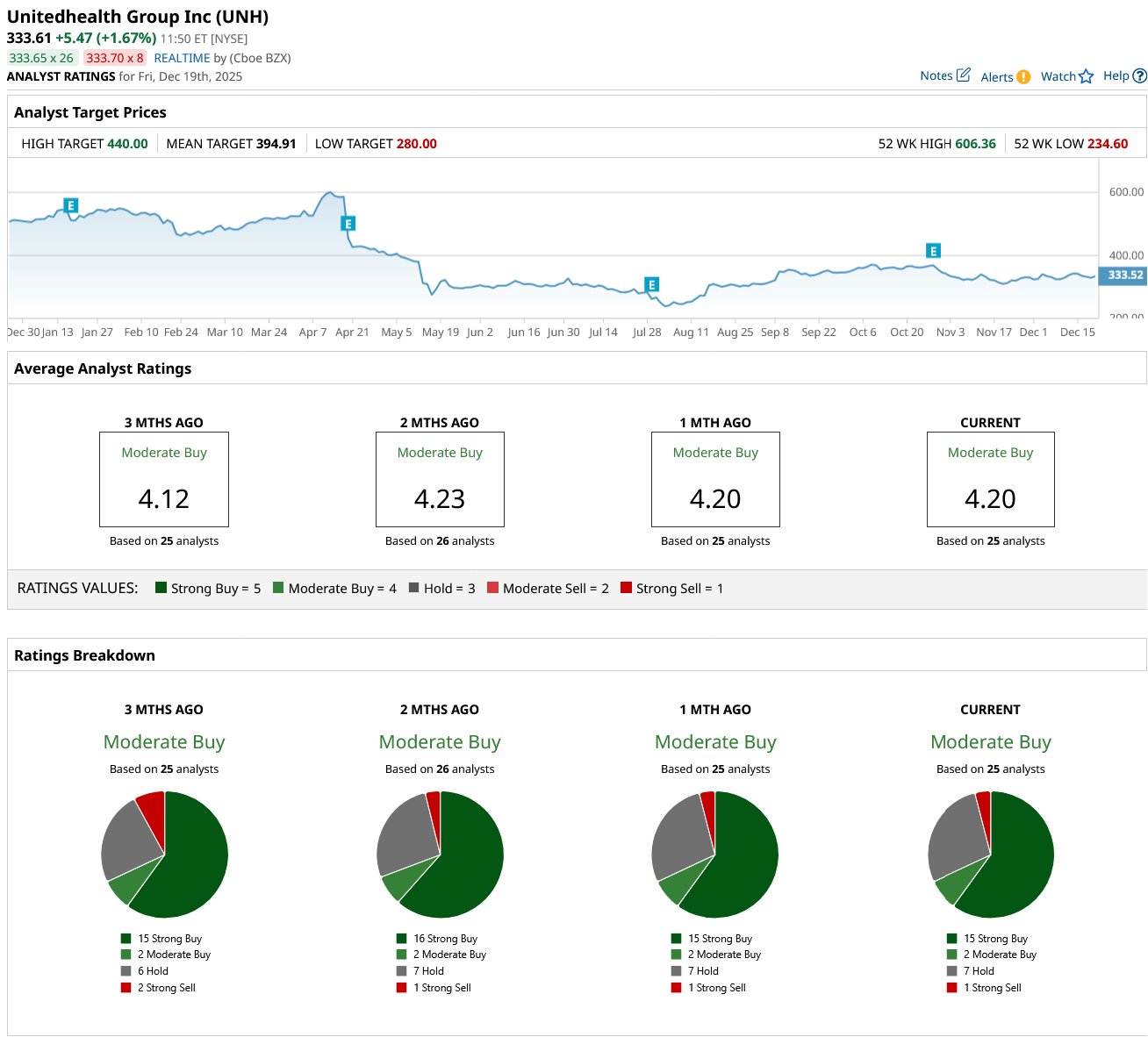

Overall, the 25 analysts covering UNH stock believe this is a company that should see significant upside from current levels. Indeed, after the stock's dramatic drop this year from a high of around $600 per share to current levels (almost cut in half), that's not an incredibly outlandish proposition.

The current consensus price target of $394.91 for UNH stock implies upside of approximately 18% from here. That would be a decent year for any stock, and one that investors could certainly feel comfortable with.

I think such a return is more likely than not, with investors looking to add more defensive exposure to their portfolios in 2026.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Micron Says ‘We Are More Than Sold Out.’ Should You Buy MU Stock After Earnings?

- IonQ Is Down More Than 30% Since September. What Happened to the Quantum Computing Leader?

- This Investor Is Betting $1 Billion on a Lululemon Stock Turnaround. Should You Buy the Dip Here in Hopes of Gains to Come?

- CoreWeave Stock Soars 19% on Genesis Mission, but Is It a Buy?