Quantum Computing (QUBT) is an integrated photonics and quantum technology company that develops quantum machines and photonic hardware for high‑performance computing, AI, cybersecurity, sensing, and imaging applications. The company’s portfolio includes thin-film lithium niobate optical chips, entropy-based quantum computers, quantum LiDAR, and photonic reservoir computing systems, aiming to deliver practical quantum and quantum-inspired solutions to commercial and government customers.

The company was initially named Ticketcard, with operations not relating to quantum computing, but had a significant pivot into the quantum computing industry under its current name, with its headquarters in Hoboken, New Jersey.

QUBT Stock Underperforms

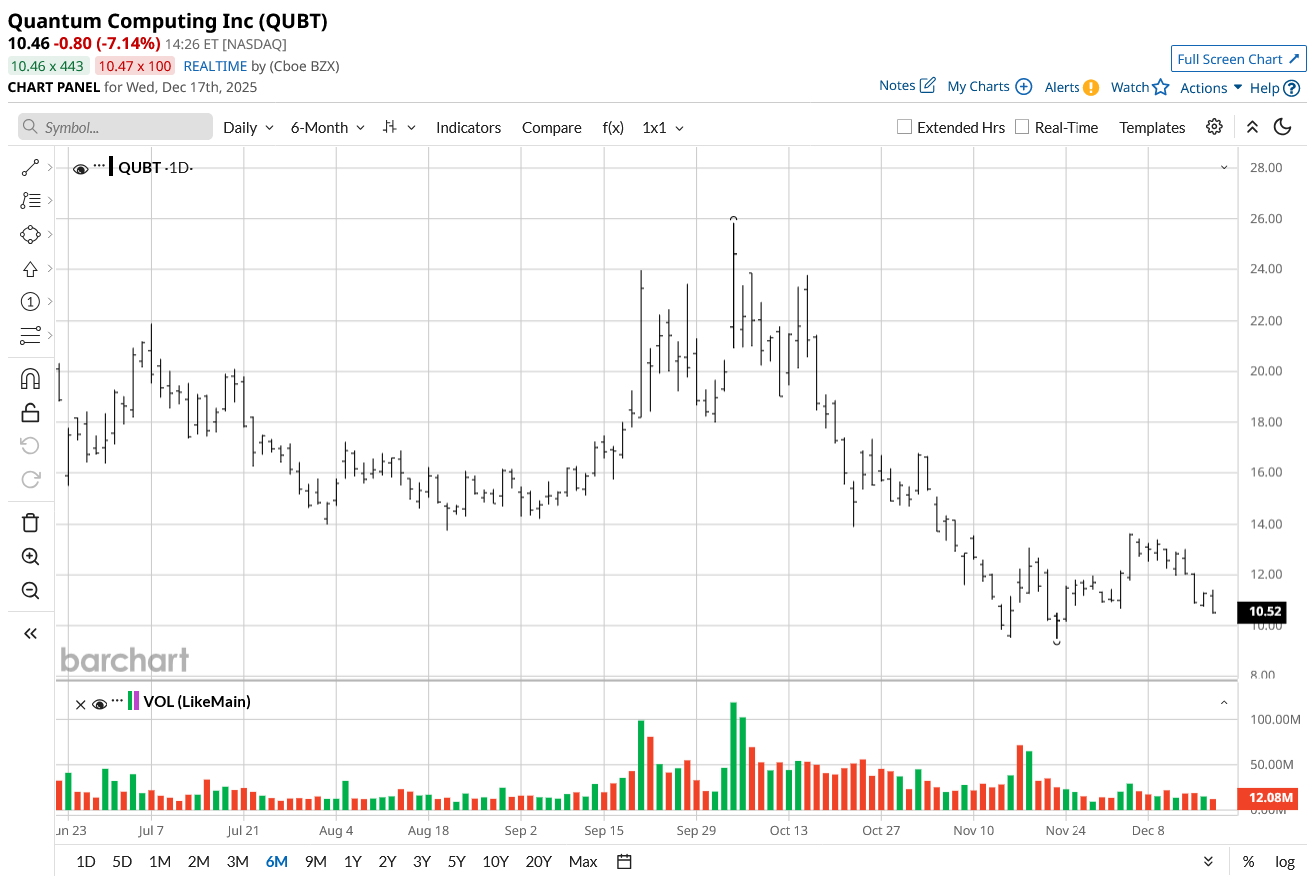

Quantum Computing has exhibited extreme volatility and largely underperformed the Nasdaq Composite ($NASX) over the long term. Over the last five days, the stock has been negative with a loss of 15%, and the one‑month performance is also in the red by 7%.

From a six‑month and one‑year view, QUBT remains deeply underwater, down more than 35–46%, significantly underperforming the Nasdaq Composite, which is modestly up over the same period. The shares trade below both 50‑day and 200‑day moving averages, highlighting a weak technical trend and elevated volatility relative to the broader tech index.

Quantum Computing Results

Quantum Computing reported Q3 2025 revenue of $384K, up about 280% year-over-year (YoY) from $101K and well above analyst expectations of $120K–$130K. The company delivered net income of $2.4 million, or $0.01 per basic share, versus a loss of $5.7 million, or -$0.06 per share, a year ago, beating estimates that had called for a loss and reflecting a sizable positive EPS surprise.

Gross margin improved sharply to 33% from 9% in Q3 2024 as higher‑margin R&D services and initial cloud access to the Dirac‑3 optimization platform contributed more to the mix. Operating expenses, however, rose to about $10.5 million from $5.4 million as the company continued to invest in R&D, engineering, and photonics manufacturing, leaving the underlying operating profit still negative despite the headline net income. The bottom-line swing was driven largely by non‑operating items, including a $9.2 million mark‑to‑market gain on a derivative liability and $3.5 million of interest income.

Liquidity remained a key strength, with cash and investments totaling roughly $800–$820 million (about $352 million in cash and $461 million in investments), while liabilities were only about $20 million, providing ample runway for Fab‑1 and Fab‑2 build‑outs and commercialization.

For Q4 2025 and beyond, management guided to continued YoY revenue growth as more R&D contracts, quantum cybersecurity deals, and cloud access to its optimization and LiDAR platforms ramp up. Though absolute revenue is expected to remain under $1 million per quarter in the near term. The company emphasized that operating losses will persist as it scales photonics fabs, expands go‑to‑market, and invests in productization. However, it reiterated a multiyear roadmap targeting higher recurring software and services revenue, expanding commercial pilots, and eventual operating breakeven once industrial‑scale deployments materialize.

Quantum to Acquire Luminar Semiconductors

A potentially powerful catalyst for Quantum Computing involves its acquisition of Luminar Technologies' (LAZR) Semiconductors subsidiary for $110 million as part of Luminar's Chapter 11 bankruptcy filing in the Southern District of Texas. The deal, triggered by Luminar's loss of its key Volvo AB (VLVLY) contract in November, is subject to higher or better offers during the court-supervised sale process.

This strategic purchase bolsters QUBT's photonics capabilities, integrating Luminar's 1550 nm lidar chip expertise, originally developed by founder Austin Russell since 2012, into its quantum and integrated photonics portfolio. Luminar, once a top LiDAR contender with OEM ties like Mercedes-Benz (MBGYY) and Tesla (TSLA), faced chronic cash burn and ADAS delays post its 2020 SPAC debut, leading to going-concern warnings.

QUBT eyes synergies in high-resolution sensing and autonomy hardware, leveraging its strong Q3 cash position of $800 million to fund the transaction while Luminar uses $25 million in cash for operations.

Should You Buy QUBT?

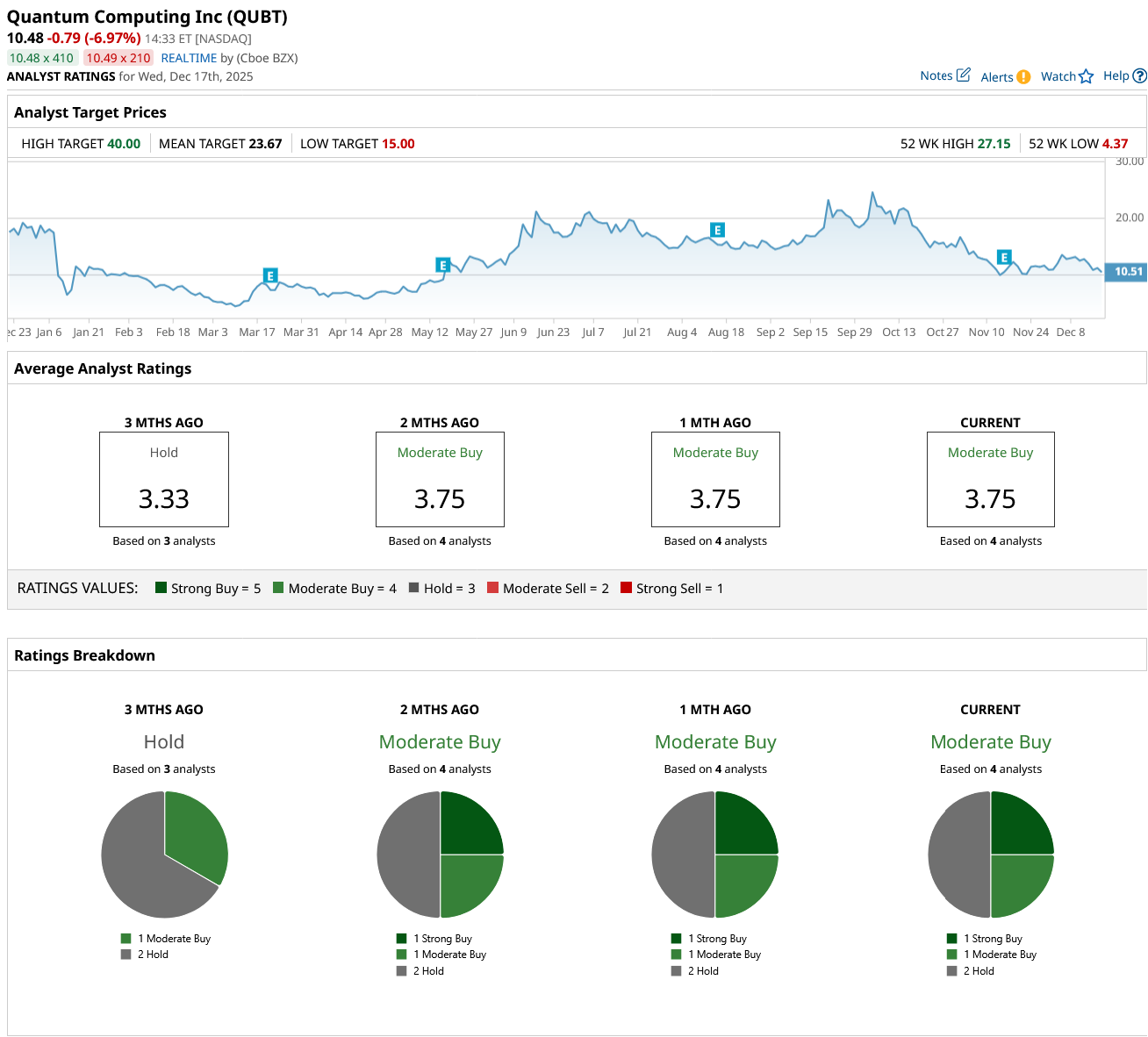

Despite the underperformance, QUBT stock has a consensus “Moderate Buy” rating on Wall Street with a mean price target of $23.67, reflecting an upside potential of 118% from the market rate.

The stock has been analyzed by four experts with one “Strong Buy” rating, one “Moderate Buy” rating, and two “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Barchart Stock Screeners to Help You Find Better Call Option Trades

- ‘You Didn’t Want to Be in Jamestown’: Elon Musk Warns Mars Won’t Be A Billionaire Vacation Spot; It Will Be ‘Very Dangerous’ and ‘You Might Die’

- Why You Need to Watch FedEx Stock This Week

- Dear BlackBerry Stock Fans, Mark Your Calendars for December 18