Semiconductor stocks tend to move in powerful cycles, often swinging between boom and bust as demand for chips rises and falls. When the cycle turns higher, earnings momentum and analyst upgrades can quickly follow, drawing investors back into the space ahead of key catalysts like earnings reports.

That setup is forming right now for Micron Technology (MU). The memory chip maker is back in focus ahead of earnings, scheduled for Dec. 17, after Stifel sharply raised its price target. The investment bank says strengthening AI infrastructure demand has become a tipping point for memory pricing, with conditions improving faster than expected into year-end.

If Micron delivers the upside guidance analysts are anticipating, the stock could be entering a powerful new leg of its cyclical rebound, making this a pivotal moment for investors considering MU shares.

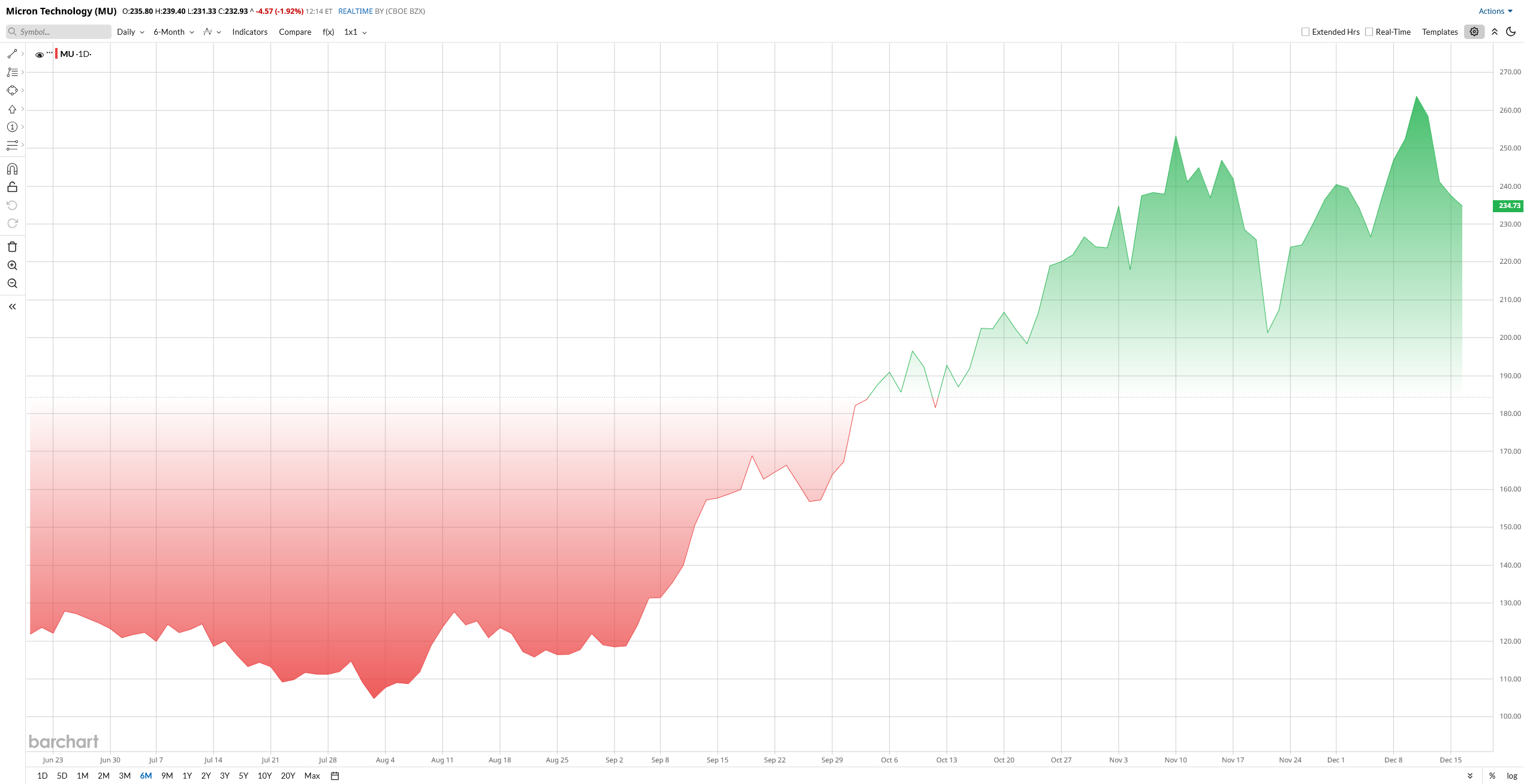

Micron Stock Performance

Founded in 1978, Micron Technology is a leading U.S. manufacturer of semiconductor memory and storage products. The company produces DRAM and NAND flash chips, solid-state drives, and related components for servers, PCs, mobile devices, and automotive systems. Micron is a Fortune 500 company whose technology is central to AI data centers, mobile computing, and emerging markets like automotive.

Valued at $271 billion by market cap, Micron shares have exploded higher in 2025 on booming memory demand. Year-to-date (YTD), MU is up roughly 180%, far exceeding the semiconductor sector and major peers. The rally reflects a clear turnaround in the memory market. Prices for both DRAM and NAND have recovered after a long downturn, helping lift Micron’s earnings outlook.

At the same time, the company has been gaining market share. Micron’s share of the global DRAM market had risen to around 25.7%, and its data center memory business reached record revenue levels.

After the recent run-up, Micron’s stock remains relatively attractively valued on a forward-earnings basis. Its next-12-month price/earnings (P/E) ratio is around 14x, significantly below the 24x median for the broader semiconductor industry. However, other metrics suggest a premium. Micron’s price-to-sales ratio is currently on the high side, roughly 7.3x, versus an industry median near 3.0x. In fact, MU’s P/S is higher than about 75% of semiconductor companies, reflecting its exceptional revenue growth.

What to Expect From the Upcoming Report

Micron is set to report earnings this week, and expectations on Wall Street are firmly tilted toward a solid beat. Heading into the fiscal first-quarter report, consensus estimates call for about $3.65 in EPS, representing year-over-year (YoY) growth of more than 125% on roughly $12.8 billion in revenue, slightly above the company’s own midpoint guidance. Analysts point out that DRAM and NAND prices continued to firm through the quarter, supporting both revenue and margins.

Micron’s own outlook for the fiscal first quarter of 2026, which ended in November 2025, was also strong. Management guided to around $12.5 billion in revenue, plus or minus $300 million, and EPS of about $3.75, with a $0.15 range. That suggests roughly 35% sequential growth and close to 47% YoY revenue growth, with gross margins expected to exceed 50%.

Looking beyond the quarter, analysts see momentum carrying into the full year. Morgan Stanley, for example, estimates Micron could earn about $6.08 per share in fiscal 2026. With memory markets still tight, many on the Street view current forecasts as conservative, reinforcing expectations for a potential “beat and raise” cycle.

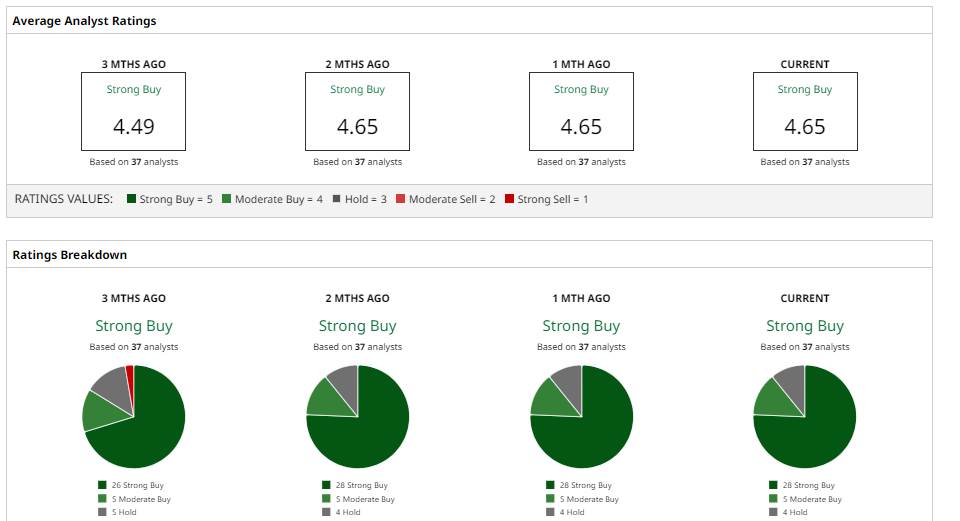

Analyst Ratings and Price Targets

Wall Street opinions remain overwhelmingly bullish. Stifel helped set the tone with a bullish upgrade, set a new price target of $300, up from $195, and reiterated a “Buy” rating, reinforcing the view that Micron’s earnings momentum is not a one-off. Even after the stock pulled back on the news, Stifel argued that improving memory pricing and AI-related demand should continue to support results, keeping the longer-term outlook intact.

Morgan Stanley, meanwhile, stayed firmly positive. The firm reiterated its "Overweight" rating and raised its price target to $338 from $325 in late November, pointing to strengthening DRAM fundamentals and Micron’s expanding presence in data center memory as key drivers.

Taking a more measured stance, Goldman Sachs lifted its target to $205 from $180 while maintaining a "Hold" rating. Analyst James Sheehan acknowledged the improving cycle but suggested much of the near-term optimism is already reflected in the stock.

On the bullish end, UBS reaffirmed its "Buy" rating and increased its target to $275 from $245, citing Micron’s market-share gains and a tight supply backdrop.

Overall, the consensus from 37 analysts is “Strong Buy.” However, the stock is trading just below the mean price target of $245.38, showing that the stock is already priced for perfection.

The Bottom Line on MU Stock

Micron’s upcoming report is expected to be strong. The company has “set the stage” for another beat, both through its guidance and the analyst consensus. If Micron exceeds even its high targets, it could validate the rally.

Overall, despite the stock’s sharp rise, investors and analysts foresee a continuation of the growth trend into early 2026. However, investors should note that, given the cyclical industry, near-term macro risks, like a sudden demand drop, remain possible, but most forecasts assume robust demand will persist.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart