Arista Networks, Inc. (ANET), headquartered in Santa Clara, California, develops, markets, and sells data-driven, client-to-cloud networking solutions for data center, campus, and routing environments. Valued at $176.5 billion by market cap, the leading tech company offers Ethernet switches, pass-through cards, transceivers, and enhanced operating systems. It also provides host adapter solutions and networking services.

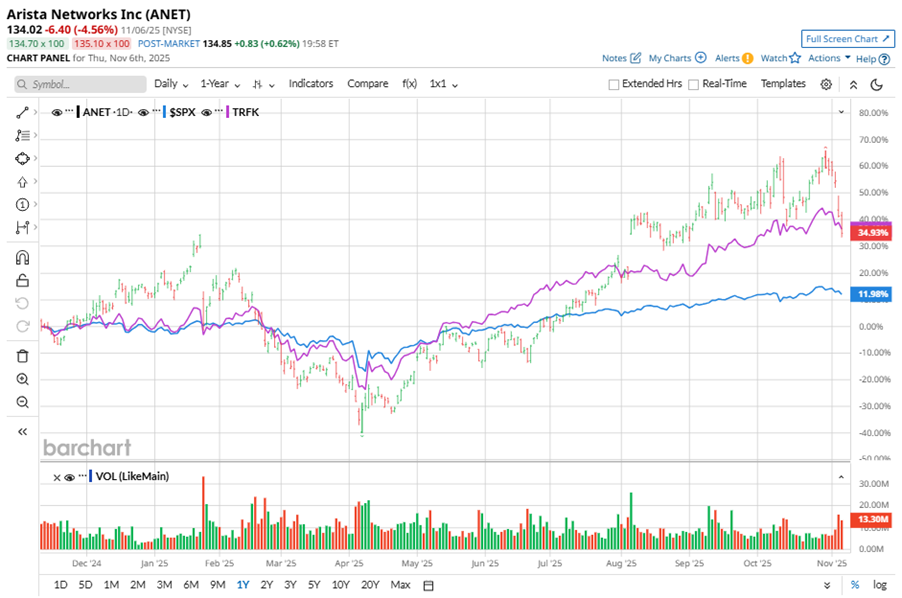

Shares of this cloud networking giant have outperformed the broader market considerably over the past year. ANET has gained 26.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 13.4%. In 2025, ANET stock is up 21.3%, surpassing SPX’s 14.3% rise on a YTD basis.

Narrowing the focus, ANET’s underperformance is apparent compared to Pacer Data and Digital Revolution ETF (TRFK). The exchange-traded fund has gained about 39.9% over the past year. Moreover, the ETF’s 38.2% returns on a YTD basis outshine the stock’s gains over the same time frame.

On Nov. 4, ANET shares closed down by 2.6% after reporting its Q3 results. Its adjusted EPS of $0.75 topped Wall Street expectations of $0.72. The company’s revenue was $2.31 billion, beating Wall Street forecasts of $2.26 billion. For Q4, ANET expects revenue in the range of $2.3 billion to $2.4 billion. The shares have subsequently plummeted by 13.1% over the following two trading sessions, signaling a downtrend.

For the current fiscal year, ending in December, analysts expect ANET’s EPS to grow 24.8% to $2.57 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

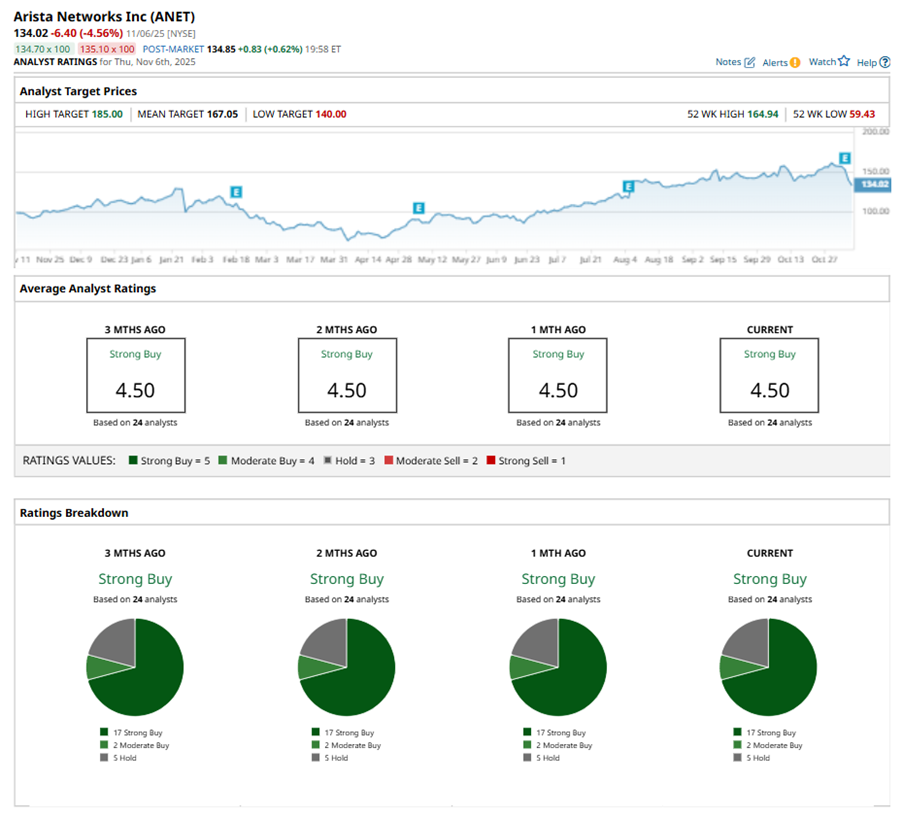

Among the 24 analysts covering ANET stock, the consensus is a “Strong Buy.” That’s based on 17 “Strong Buy” ratings, two “Moderate Buys,” and five “Holds.”

The configuration has been consistent over the past three months.

On Nov. 5, Piper Sandler Companies (PIPR) kept a “Neutral” rating on ANET and raised the price target to $145, implying a potential upside of 8.2% from current levels.

The mean price target of $167.05 represents a 24.6% premium to ANET’s current price levels. The Street-high price target of $185 suggests an ambitious upside potential of 38%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia Stock 2026 Prediction: Can NVDA’s Gravity-Defying Rally Continue?

- These 3 Tech Stocks Have Been Red-Hot in 2025 but Their Charts Are Screaming ‘Danger’

- Stock Index Futures Slip as Valuation and Economic Concerns Persist, U.S. Confidence Data on Tap

- Verizon Is Getting an Amazon Data Center Boost. Should You Buy the High-Yield Dividend Stock Here?