When it comes to income generation, investors look for high-yield and reliable dividend stocks. These three companies not only reward shareholders generously but also show resilience in challenging markets. Here are three high-yield stocks that let you earn while you sleep.

Dividend Stock #1: Altria Group (MO)

Dividend Yield: 6.8%

Among the high-yield dividend stocks, Altria (MO), the parent company of Marlboro and a leader in the U.S. tobacco industry, often is a solid choice for income investors. Despite operating in a mature, heavily regulated market, Altria pays an attractive dividend yield of around 6.8%, well above the consumer staples average of 1.8%. Altria’s steady cash flow has allowed it to return over $1.7 billion in Q3 and $5.2 billion to shareholders in the first nine months of 2025 via dividends.

Despite regulations getting stricter in the tobacco industry, Altria’s adjusted diluted EPS rose 3.6% year-over-year (YoY) to $1.45 in the third quarter. A disciplined pricing strategy and the expanding profitability of its smoke-free products segment led to this increase. For the full year, the company expects earnings to increase by 3.5% to 5%, while analysts expect earnings growth of 6.3%.

Altria’s story is not about explosive growth. It is about reliable wealth building through a steady income. The company announced a 3.9% increase in August. Its 60-year track record of annual dividend increases and status as a “Dividend King” support Altria's case as a reliable dividend stock.

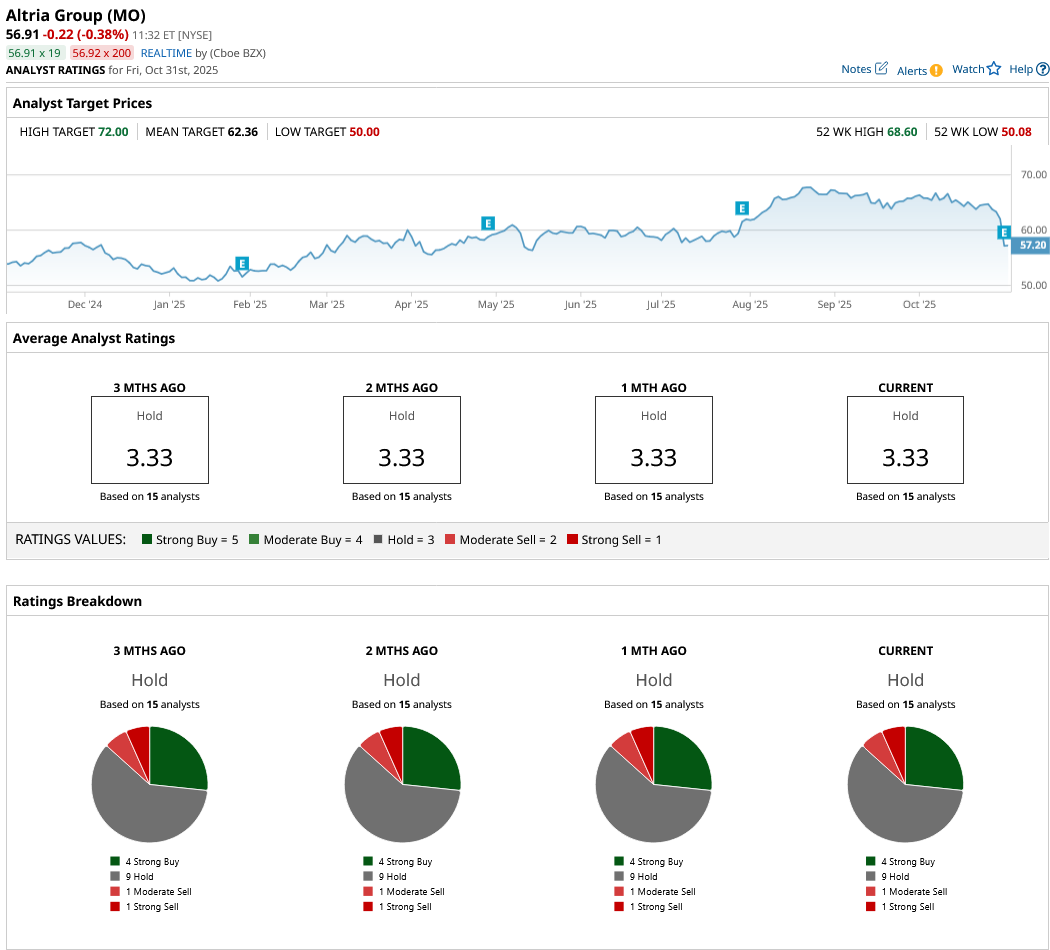

Overall, on Wall Street, Altria stock is a “Hold.” Of the 15 analysts covering the stock, four rate it a “Strong Buy,” nine rate it a “Hold,” one says it is a “Moderate Sell,” and one rates it a “Strong Sell.” Altria is trading about 10% short of its average target price of $62.36. However, its high price target of $72 implies the stock can climb 27% over the next 12 months.

Dividend Stock #2: Verizon Communications (VZ)

Dividend Yield: 6.8%

With its 6.8% dividend yield and decades-long record of uninterrupted dividend payouts, Verizon Communications (VZ) continues to stand out as one of the most dependable income-generating stocks in the U.S. telecom sector. The telecom leader has raised its dividend for 19 consecutive years, reflecting its disciplined approach to rewarding shareholders. Its forward payout ratio of roughly 57.3% reflects a good balance of returning substantial cash to investors while maintaining sufficient flexibility to reinvest in its operations and manage debt.

In the third quarter of 2025, Verizon reported $33.8 billion in consolidated revenue, up 1.5% YoY, while adjusted earnings per share rose 1.7% to $1.21. This growth was supported by a 2.1% increase in wireless service revenues and a surge of over 5.2% in wireless equipment sales. Free cash flow, widely seen as the ultimate measure of dividend sustainability, remained robust for the nine months ended Sept. 30 at $15.8 billion. For the full year, management expects earnings to increase by 1% to 3% and to generate free cash flow in the range of $19.5 billion and $20.5 billion. With a high yield and consistent earnings trajectory, Verizon is a solid choice in any dividend-focused portfolio.

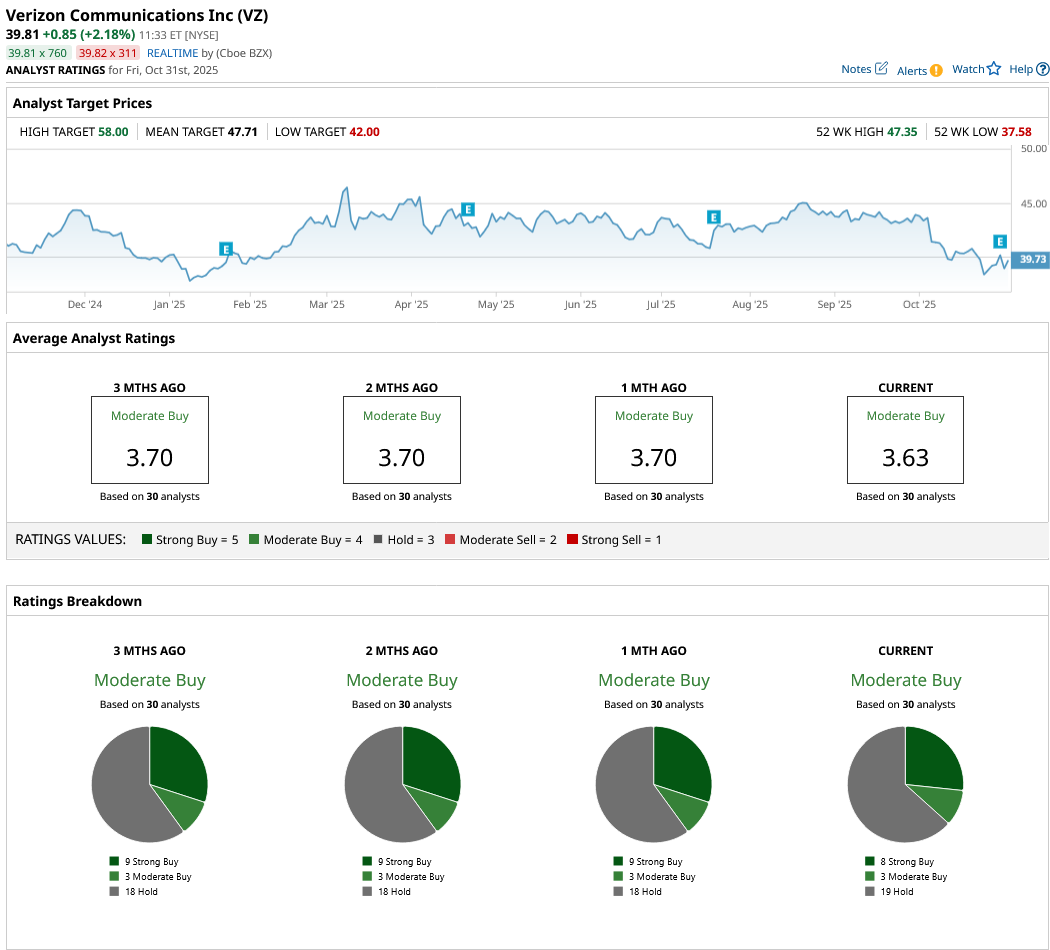

Overall, on Wall Street, Verizon stock is a “Moderate Buy.” Of the 30 analysts covering the stock, eight rate it a “Strong Buy,” three rate it a “Moderate Buy,” and 19 say it is a “Hold.” Its average target price of $48.06 suggests an upside potential of 21% over current levels. However, its high price target of $58 implies the stock can climb 46% over the next 12 months.

Dividend Stock #3: Enterprise Product Partners (EPD)

Dividend Yield: 7%

Enterprise Product Partners (EPD), the midstream energy giant, continues to deliver stable cash flows and one of the most attractive dividend yields in the sector, currently hovering near 7%. It operates one of the largest and most diversified portfolios of midstream assets in North America. The midstream powerhouse reported steady third-quarter 2025 results and unveiled a major $3 billion increase to its unit buyback authorization, bringing the total to $5 billion.

In Q3, Enterprise reported net income of $1.3 billion, or $0.61 per common unit, compared to $1.4 billion, or $0.65 per unit, a year earlier. While profits dipped slightly from last year, the company continued to deliver robust cash generation. Distributable cash flow (DCF) came in at $1.8 billion, covering its quarterly distribution 1.5 times and allowing Enterprise to retain $635 million for reinvestment. The company declared a distribution of $0.545 per unit for the quarter, a 3.8% increase YoY. With a payout ratio of just 58% (including both distributions and buybacks), Enterprise retains ample flexibility to fund growth and strengthen its already-sturdy balance sheet.

EPD remains a high-yield stock backed by real assets, rising cash flows, and management committed to rewarding shareholders for the long term.

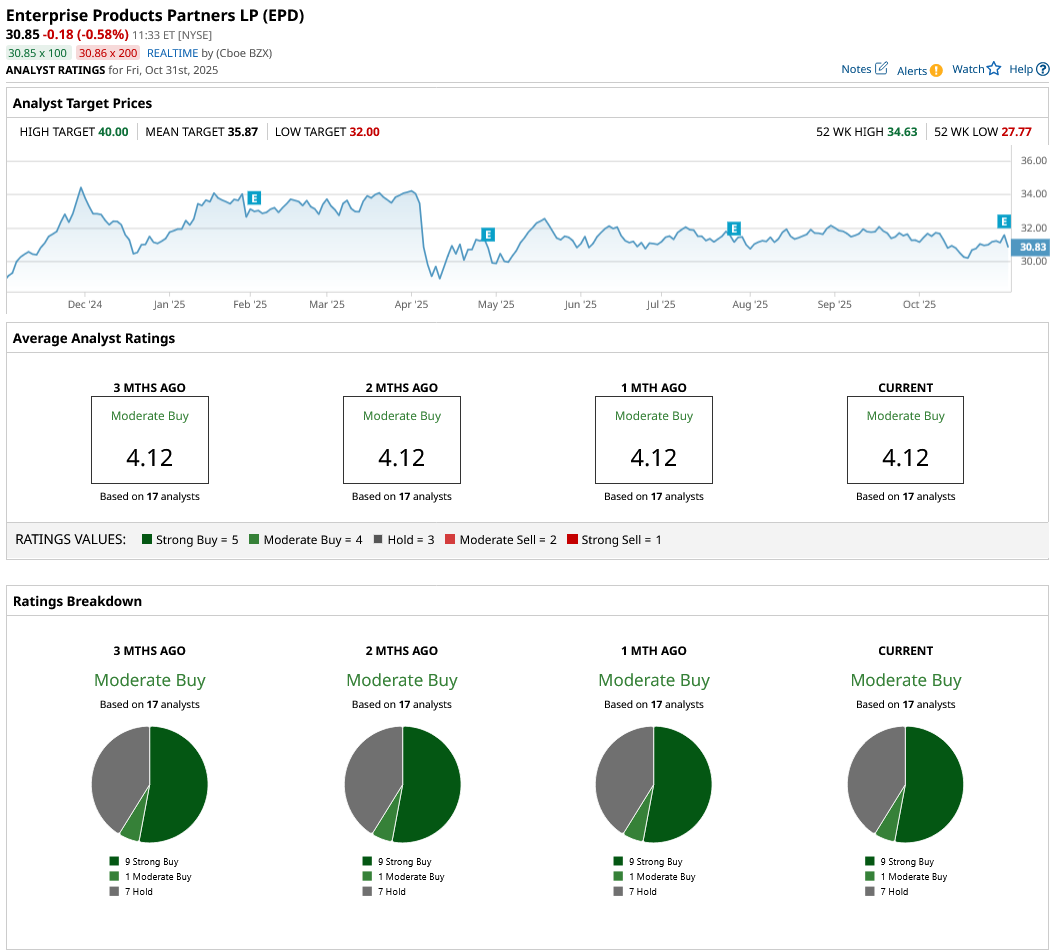

Overall, on Wall Street, EPD stock is a “Moderate Buy.” Of the 17 analysts covering the stock, nine rate it a “Strong Buy,” one rates it a “Moderate Buy,” and seven say it is a “Hold.” Its average target price of $35.87 suggests an upside potential of 16% over current levels. However, its high price target of $40 implies the stock can climb 30% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart