Saint Louis, Missouri-based Emerson Electric Co. (EMR) is a global technology and engineering company providing innovative solutions for customers in industrial, commercial, and residential markets. With a market cap of $78.6 billion, Emerson operates through Final Control, Measurement & Analytical, Discrete Automation, Safety & Productivity, Control Systems & Software, and Test & Measurement segments.

The stock has lagged behind the broader market in 2025, but significantly outperformed over the past year. EMR has surged 12.6% in 2025 and soared 28% over the past year, compared to the S&P 500 Index’s ($SPX) 16.3% gains on a YTD basis and 17.7% returns over the past year.

Narrowing the focus, EMR has also lagged behind the Industrial Select Sector SPDR Fund’s (XLI) 17.7% gains in 2025 and outperformed XLI’s 14.5% returns over the past year.

Emerson Electric’s stock prices dropped 4.7% following the release of its mixed Q3 results on Aug. 6. The drop can primarily be attributed to Emerson’s net sales of $4.6 billion missing the Street’s expectations by 60 bps. However, the sales figure was up almost 4% year-over-year, and the company’s overall performance remained resilient. The quarter was marked with strong profitability and cash flows despite the chaotic macro environment. Emerson’s adjusted EPS increased 6.3% year-over-year to $1.52, surpassing the consensus estimates by 66 bps. Further, the company generated solid free cash flows of $970 million during the quarter.

For the full fiscal 2025, which ended in September, analysts expect EMR to deliver an adjusted EPS of $6, up 9.3% year-over-year. Further, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

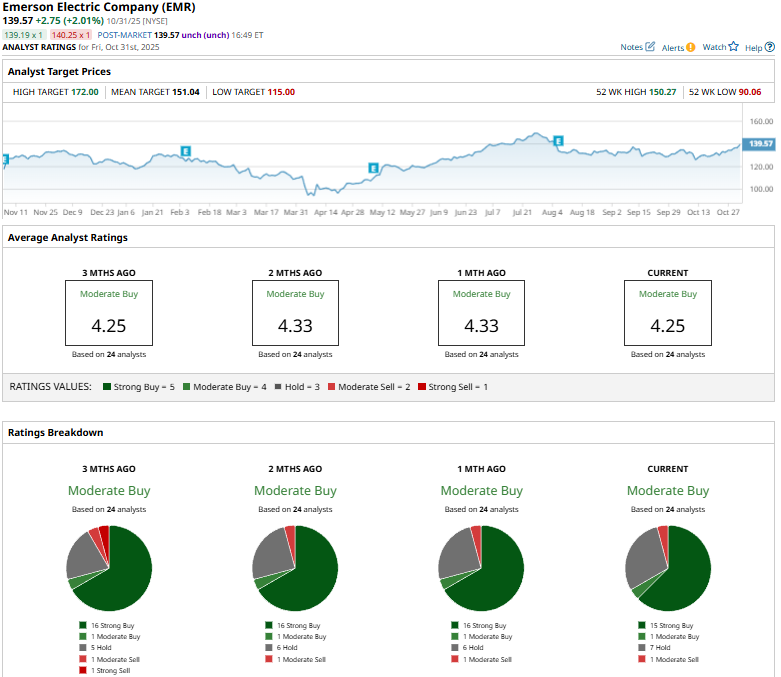

Among the 24 analysts covering the EMR stock, the consensus rating is a “Moderate Buy.” That’s based on 15 “Strong Buys,” one “Moderate Buy,” seven “Holds,” and one “Moderate Sell.”

This configuration is slightly less optimistic than a month ago, when 16 analysts gave “Strong Buy” recommendations.

On Oct. 15, JP Morgan (JPM) analyst Stephen Tusa maintained a “Neutral” rating on EMR and raised the price target from $135 to $151.

EMR’s mean price target of $151.04 suggests an 8.2% upside potential. Meanwhile, the street-high target of $172 represents a notable 23.2% premium to current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart