With a market cap of $67.1 billion, CSX Corporation (CSX) is one of the largest freight railroad companies in the United States, operating an extensive rail network across the eastern U.S. Headquartered in Jacksonville, Florida, the company provides rail-based transportation services for a wide range of goods including chemicals, agricultural products, energy resources, automobiles, construction materials, and consumer goods.

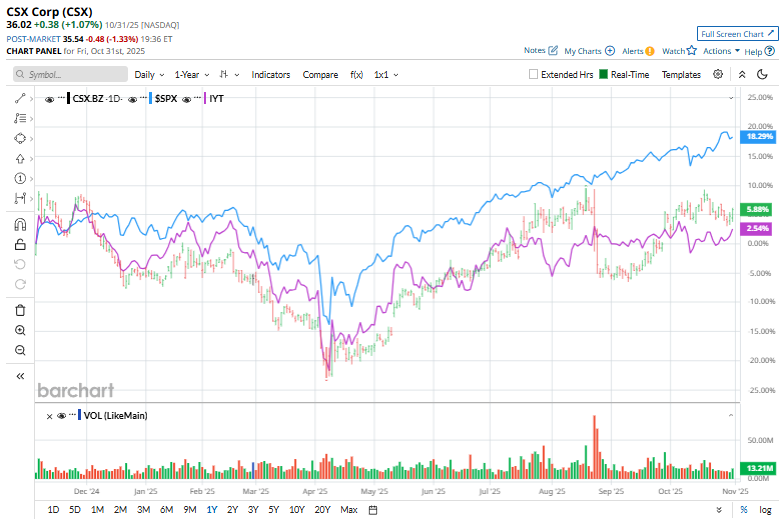

The transportation giant has notably lagged behind the broader market over the past year. CSX stock has gained 7.4% over the past year and 11.6% on a YTD basis. In contrast, the S&P 500 Index ($SPX) has surged 17.7% over the past year and has returned 16.3% in 2025.

Narrowing the focus, CSX has also outpaced the industry-focused iShares Transportation Average ETF’s (IYT) 1.8% uptick over the past year and 7.1% rally this year.

On Oct. 16, CSX reported its third-quarter earnings, and its shares popped 1.7% in the next trading session. While its adjusted EPS of $0.44 topped expectations, revenue of $3.59 billion slightly missed estimates. The company experienced modest volume growth, driven by intermodal demand, but its adjusted operating income decreased to $1.25 billion.

For the current year ending this December, analysts forecast CSX to report EPS of $1.65, reflecting a 9.8% decline from the prior year. The company’s recent earnings track record has been mixed, topping Wall Street’s profit expectations in two of the last four quarters while falling short in the other two.

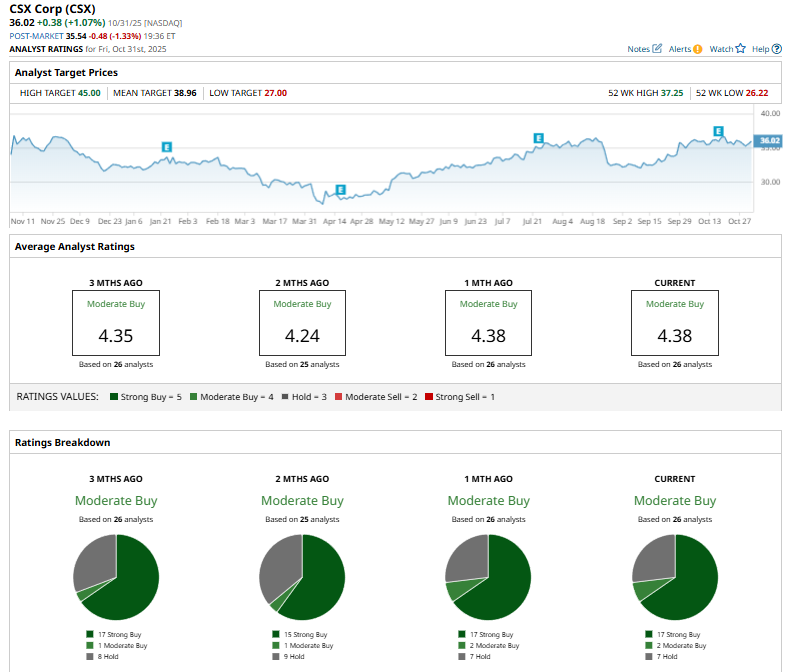

The stock has a consensus “Moderate Buy” rating overall. Of the 26 analysts covering the stock, opinions include 17 “Strong Buys,” two “Moderate Buys,” and seven “Holds.”

This configuration is notably more bullish than two months ago, when only 15 analysts gave “Strong Buy” recommendations.

On Oct. 9, J.P. Morgan analyst Brian Ossenbeck reiterated a “Buy” rating on CSX and set a $40 price target.

CSX’s mean price target of $38.96 suggests a modest 8.2% upside from current price levels, while the Street-high target of $45 represents a notable 24.9% premium.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart