The Federal Reserve’s move to cut interest rates has made high-yield dividend stocks more attractive. As bond yields decline in a lower-rate environment, investors often gravitate toward equities that can provide a steadier and potentially higher stream of income. Dividend-paying companies, especially those with a long history of reliable distributions, stand out as compelling investments.

Among the top dividend payers, Enterprise Products Partners (EPD) is a reliable investment. The company offers a high yield of 6.7%, backed by decades of steady dividend growth. The energy infrastructure company’s distributions are driven by its resilient cash flow, led by long-term, fee-based contracts. Its low-risk operating structure and steady cash flows have enabled Enterprise Products to continually raise its distributions through multiple market cycles.

Looking ahead, Enterprise Products is well-positioned to benefit from rising power demand driven by artificial intelligence (AI). As AI accelerates demand for energy infrastructure, the company’s extensive midstream network becomes even more valuable. EPD’s steady earnings, strong cash flow, and exposure to AI-driven secular tailwinds make it a comeplling investment for investors seeking dependable, growing income in an environment where traditional yield options are becoming less attractive. Let’s take a closer look.

Enterprise Products to Maintain Its Dividend Growth Streak

Enterprise Products Partners is a reliable, high-yield dividend stock, as evidenced by its solid dividend growth history. EPD hiked its dividend for 27 consecutive years and is well-positioned to maintain this streak.

On its latest Q3 earnings call, management emphasized that the company still sees a long runway of efficient expansion opportunities across its system. Those opportunities, combined with its disciplined capital strategy, strengthen EPD’s commitment to returning cash to unitholders. Further, growing its distributions remains the core focus of its capital-allocation framework.

The company’s payouts are supported by its diverse assets and high-quality cash flow. Its integrated midstream network connects major natural gas, NGL, and crude oil supply basins across the U.S., Canada, and the Gulf of Mexico to both domestic end users and global export markets. This connectivity keeps its assets highly utilized and supports consistent growth in distributable cash flow. In addition, long-term, fee-based contracts add stability to its operations, helping insulate it from commodity price swings.

Looking ahead, several macro trends are lining up in Enterprise’s favor. Rising global gas and power demand, driven in part by economic growth, industrial activity, and the accelerating build-out of data centers, creates a structural tailwind for the company’s natural gas and NGL infrastructure. Enterprise is already benefiting from data center expansion, particularly in Texas and Louisiana, where incremental power generation is boosting demand for its assets. Its strategic footprint around San Antonio and Dallas positions it well to capture this growth with minimal additional capital spending.

Enterprise Products also remains focused on enhancing its value chain through organic growth projects and selective acquisitions that expand and diversify its asset base. Financially, it remains on solid footing. In the third quarter, Enterprise generated $2.4 billion in adjusted EBITDA and $1.8 billion in distributable cash flow, providing a robust 1.5x distribution coverage ratio.

Operationally, several projects are beginning to contribute. Frac 14 is now online after a brief delay, and the Bahia pipeline and Seminole pipeline conversion are expected to enter service in the coming months. These additions will expand NGL system capacity and improve flexibility across crude pipeline operations.

With its diversified assets, fee-based contracts, and steady cash flow growth, Enterprise Products Partners appears well-positioned to sustain and increase its payouts in the years ahead.

The Bottom Line

Enterprise Products Partners’ high and sustainable yield, along with 27 consecutive years of dividend increases, reflect the strength of its asset base and the reliability of its fee-driven cash flows. With the company benefiting from rising energy demand, it is well-positioned to deliver steady growth well into the future.

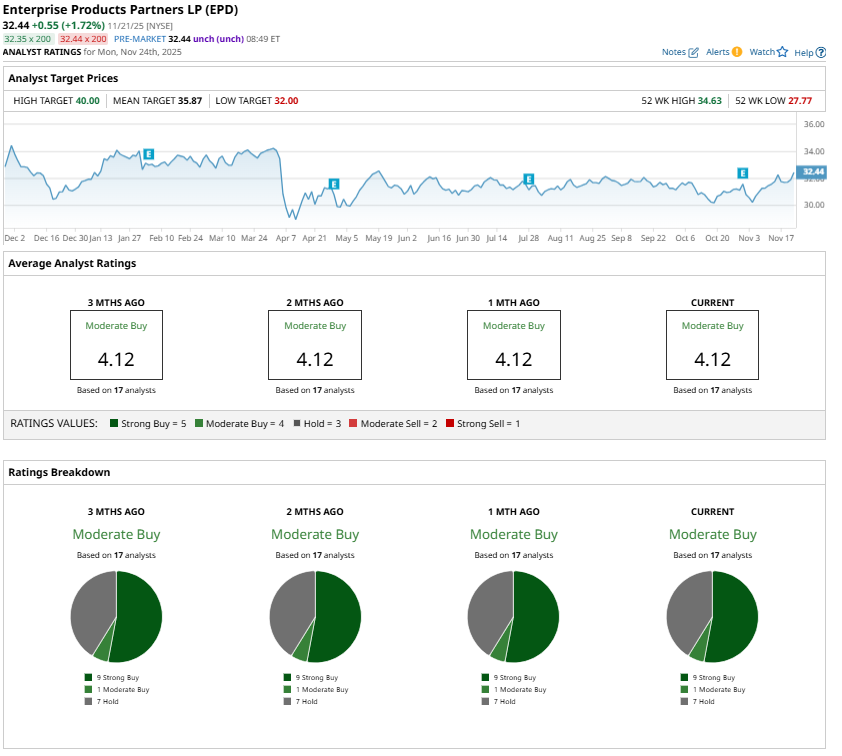

While analysts maintain a “Moderate Buy” consensus rating on EPD, it remains a compelling high-yield stock for investors seeking dependable income in a lower-rate environment.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- With a 6.7% Yield and 27 Years of Dividend Hikes, Is This Stock a Buy Today?

- Marvell Stock Is Down 25% in 2025, and This Analyst Says Investors Should Stay Away from the MRVL Dip

- These Stock Charts Filter Out the Noise So You Can Focus on Price. Here’s What Trend Traders Need to Know.

- Cathie Wood Is Buying the Dip in BitMine Immersion Stock. Should You?