Milford, Massachusetts-based Waters Corporation (WAT) is a leading analytical instruments and software company specializing in high-performance liquid chromatography (HPLC), mass spectrometry, and laboratory informatics. With a market cap of $22.4 billion, the company’s technologies are widely used in pharmaceuticals, biotech, life sciences, food safety, environmental testing, and chemical analysis.

Shares of this global leader in analytical instrumentation have underperformed the broader market over the past year. WAT has increased 5.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 10.5%. In 2025, WAT stock is up 2.1%, compared to the SPX’s 11.2% rise on a YTD basis.

Narrowing the focus, WAT has trailed the Health Care Select Sector SPDR Fund (XLV). The exchange-traded fund has gained 6% over the past year and 10.1% on a YTD basis.

On Nov. 4, Waters shares jumped 6.3% after the company delivered a stronger-than-expected third-quarter report. The analytical-instruments maker posted $800 million in revenue, up 8% year over year, driven by solid demand in pharmaceuticals and steady growth across its recurring revenue streams. Its adjusted EPS surged to $3.40, reflecting a 16% jump from last year as margins improved and instrument replacement cycles accelerated.

Strength in LC-MS systems, double-digit chemistry growth, and an 11% boost in pharma end-markets helped fuel the momentum. Waters also raised its full-year sales and earnings guidance, signaling confidence in the demand outlook.

For the current fiscal year, ending in December, analysts expect WAT’s EPS to grow 10.5% to $13.10 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

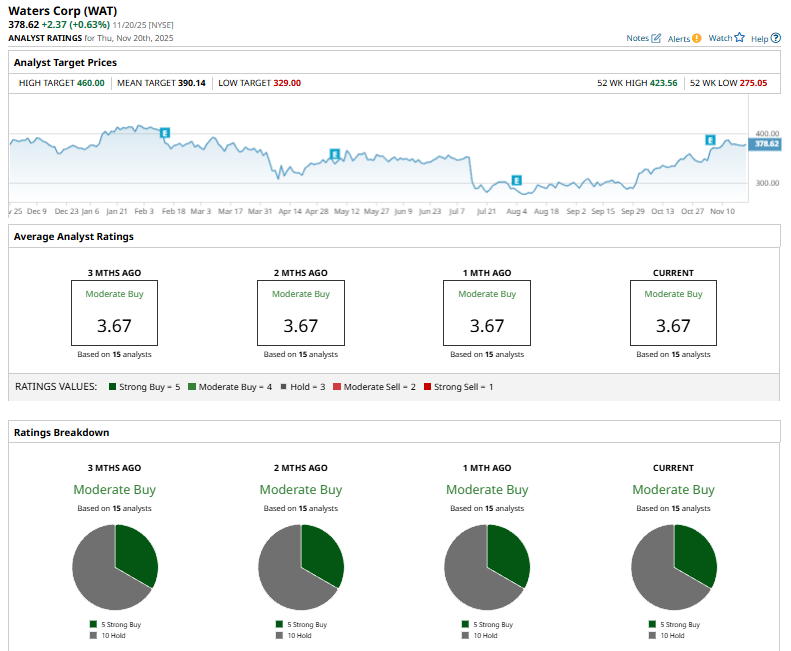

Among the 15 analysts covering WAT stock, the consensus is a “Moderate Buy.” That’s based on five “Strong Buy” ratings and 10 “Holds.”

On Oct. 8, Rothschild & Co initiated coverage on Waters with a “Buy” rating, as analyst Natalya Davies set a $390 price target, drawing renewed attention to the stock.

The mean price target of $390.14 represents a 3% premium to WAT’s current price levels. The Street-high price target of $460 suggests an ambitious upside potential of 21.5%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart