Shares of popular computer hardware company Dell Technologies (DELL) slumped 8.4% intraday on Nov. 17 after Morgan Stanley analysts downgraded DELL stock. Morgan Stanley analysts slashed the price target from $144 to $110, downgrading their rating from “Overweight” to “Underweight.” The firm cited an increase in the price of memory drives, a component of Dell’s servers and PCs, which might weigh on the company’s margins.

Should you buy the dip in DELL stock now?

About Dell Stock

Dell Technologies is a global company that designs, manufactures, and markets personal computers and other computer products. The company’s integrated solutions, products, and services are marketed across the Americas, Europe, the Middle East, Asia, and internationally.

Dell operates in two primary segments: the Infrastructure Solutions Group (ISG) and the Client Solutions Group (CSG). The ISG segment offers traditional and modern storage solutions, while the CSG segment manufactures laptops, notebooks, and desktop computers. Through its offerings and services, Dell serves consumers, enterprises, governmental agencies, and SMBs. Headquartered in Round Rock, Texas, it has a market capitalization of $80.3 billion.

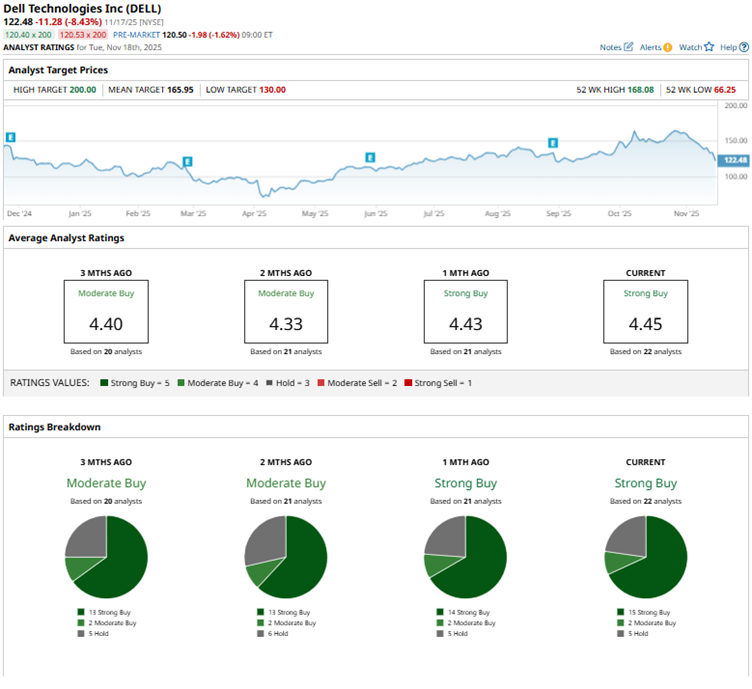

DELL stock has been turbulent on Wall Street for some time. Over the past 52 weeks, the stock has declined by 12%, while over the past six months it has increased by 3%. Dell’s stock reached a 52-week high of $168.08 in early November, but after recent downgrades, it has lost 12% over the past five days and is now down 30% from its 52-week high.

DELL stock is currently trading at a relatively low valuation. Its price sits at 14 times earnings, which is lower than the industry average.

Dell’s Q2 Earnings Were Above Estimates

On Aug. 28, Dell reported its second-quarter results for fiscal 2026 (the quarter that ended on Aug. 1), which came in hotter than expected. Dell’s total net revenue increased 19% year-over-year (YOY) to a record $29.8 billion, which was higher than the $29.32 billion figure that Wall Street analysts had expected.

This was primarily due to the ISG segment’s record revenue of $16.8 billion, reflecting a rise of 44% from the prior year’s period. This, in turn, was based on a robust 69% annual increase in revenue from the company’s servers and networking solutions, driven by AI solutions shipments crossing the $10 billion mark in the first half of the fiscal year, surpassing all shipments in the previous fiscal year.

The CSG segment, on the other hand, has been struck by slow growth. Its net revenues increased modestly by 1% YOY to $12.5 billion, driven by a 2% rise in commercial revenues.

Dell’s bottom-line financials also reaped the benefits of the robust topline growth. The company’s non-GAAP operating income increased by 10% annually to $2.28 billion. Adjusted quarterly EPS grew 19% YOY to $2.32, which was also marginally higher than the $2.31 that Wall Street analysts had expected.

Notably, the company’s adjusted free cash flow grew by a solid 96% YOY to $2.52 billion. In the second quarter, Dell returned $1.3 billion to shareholders through share repurchases and dividends.

Dell expects its fiscal 2026 revenue to be in the range of $105 billion and $109 billion. At the midpoint, this range reflects a 12% YOY growth. Non-GAAP EPS is projected to be $9.55 at the midpoint, up by 17%.

Wall Street analysts are robustly optimistic about Dell’s future earnings. They expect the company’s EPS to climb by 18% YOY to $2.26 for Q3 fiscal 2026. For the current fiscal year, EPS is projected to surge 16% annually to $8.68, followed by 18% growth to $10.25 in the next fiscal year.

What Do Analysts Think About Dell Stock?

Apart from the double downgrade from Morgan Stanley, Dell has received significant positive attention from Wall Street analysts. Recently, analysts at JPMorgan maintained an “Overweight” rating on DELL stock and raised the price target to $170. JPMorgan analysts expect the heightened demand from computing to lift the company’s near-term prospects. They also put DELL on “Positive Catalyst Watch” ahead of its Q3 earnings.

Last month, analysts at Piper Sandler initiated coverage on the stock with an “Overweight” rating and a $172 price target. Analysts at the firm believe the company will be a beneficiary of the upcoming data center refresh cycle, which brightens its prospects for next year. Additionally, analyst Simon Leopold from Raymond James maintained an “Outperform” rating and raised the price target from $152 to $161.

Dell has been in the spotlight on Wall Street for some time now, with analysts awarding it a consensus “Moderate Buy” rating overall. Of the 22 analysts rating the stock, a majority of 14 analysts have a “Strong Buy,” two analysts suggest a “Moderate Buy,” and six analysts play it safe with a “Hold” rating. The consensus price target of $164.50 represents 40% potential upside from current levels. The Street-high price target of $200 indicates potential upside of 70% from here.

Key Takeaways

Despite the spooky downgrade from Morgan Stanley, Dell’s prospects still look promising. Moreover, other analysts remain bullish on DELL stock ahead of its third-quarter earnings report. Therefore, the stock might be a solid dip-buying opportunity now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia Just Waved a Big ‘Green Flag’ for Taiwan Semi. Buy TSM Stock Here, Says Wedbush.

- Nvidia’s Growth Engine Is Running Hot — Should You Get On Board?

- Nvidia Stock Breaks 100-Day Moving Average on Q3 Earnings Selloff. Should You Buy the NVDA Dip?

- Nvidia Is a Leader in AI Computing, But Is NVDA Stock a Buy Now?