- Eli Lilly (LLY) just became the first healthcare company to join the $1 trillion market cap club.

- Shares are trading at a new all-time high on Friday, Nov. 21.

- The stock is up 40% in the past year and nearly 80% in the past two years.

- Analysts remain highly confident, with a “Strong Buy” rating and price targets as high as $1,500.

Today’s Featured Stock

Newly valued at $1 trillion, Eli Lilly (LLY) is no stranger to Chart of the Day. In fact, my colleague and regular contributor Jim Van Meerten highlighted the blue-chip healthcare firm as recently as Wednesday, Nov. 19.

A big driver of Eli Lilly’s success has been its foray into weight-loss drugs, where it is the main competitor to Ozempic-maker Novo Nordisk (NVO). Eli Lilly’s Zepbound and Mounjaro have been wildly popular, and Wall Street is also eyeing its new oral weight-loss medication that has shown promising clinical-trial results.

What I’m Watching

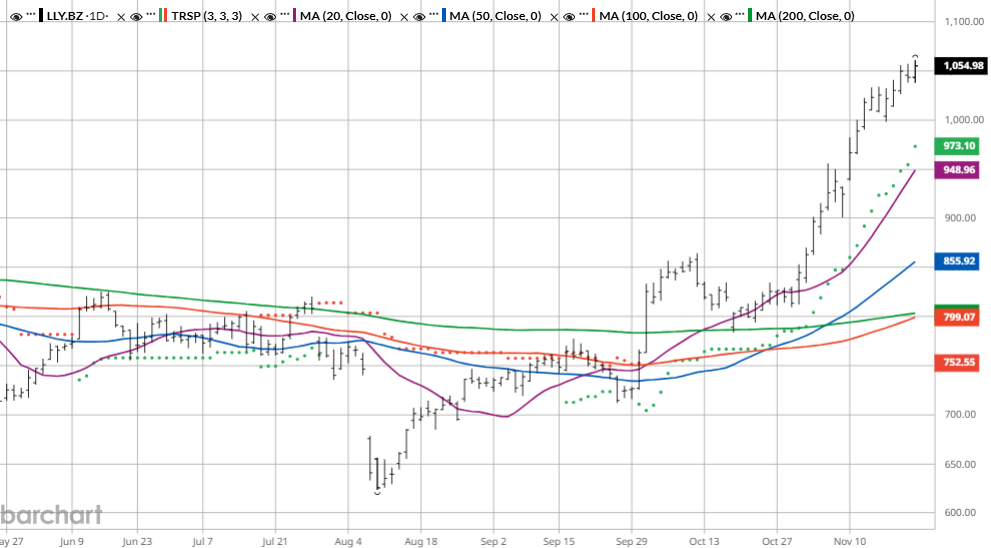

I found today’s Chart of the Day by using Barchart’s powerful screening functions to sort for stocks with the highest technical buy signals; superior current momentum in both strength and direction; and a Tend Seeker “buy” signal. I then used Barchart’s Flipcharts feature to review the charts for consistent price appreciation. LLY checks those boxes. Since the Trend Seeker signaled a new “Buy” on Oct. 1, shares are up 27.64%.

Barchart Technical Indicators for Eli Lilly

Editor’s Note: The technical indicators below are updated live during the session every 20 minutes and can therefore change each day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. These technical indicators form the Barchart Opinion on a particular stock.

Eli Lilly hit an all-time high of $1,061.17 in intraday trading on Nov. 21.

- LLY has a Weighted Alpha of +52.79.

- Lilly has an 88% “Buy” opinion from Barchart.

- The stock gained 40.01% over the past year.

- The stock recently traded at $1,051.45 with a 50-day moving average of $855.85.

- Lilly has made 17 new highs and is up 31.32% over the past month.

- Relative Strength Index (RSI) is at 82.23.

- There’s a technical support level around $1,035.36.

Don’t Forget the Fundamentals

- Eli Lilly broke through the $1 trillion market cap threshold for the first time on Nov. 21.

- 47.73x trailing price-earnings ratio.

- 0.57% dividend yield.

- Earnings are estimated to increase 85% this year and 38% next year, based on Barchart data.

Analyst and Investor Sentiment on Eli Lilly

As my colleague Jim always says, “I don’t buy stocks because everyone else is buying, but I do realize that if major firms and investors are dumping stock, it’s hard to make money swimming against the tide.”

Fortunately, the tide is swimming in favor of Eli Lilly.

- The Wall Street analysts tracked by Barchart have issued 20 “Strong Buys,” 2 “Moderate Buys,” and 5 “Hold” opinions.

- The highest price target is $1,500, implying more than 40% upside potential from here.

The Bottom Line on Eli Lilly

Eli Lilly has been on a tear in 2025, and according to most on Wall Street, that trajectory is likely to continue. UBS is eyeing $126 billion in GLP-1 sales by 2029, with a compound annual growth rate of 30% from 2023-2029.

Although analysts say that Novo Nordisk’s Ozempic and Wegovy currently have much greater name recognition than Eli Lilly’s Ozempic and Mounjaro, UBS thinks Eli Lilly will continue to gain market share at NVO’s expense.

And Eli Lilly is not a one-trick pony. The healthcare giant has a strong and growing pipeline with many treatments in neuroscience and oncology as well.

Today’s Chart of the Day was written by Sarah Holzmann, Barchart’s Editorial Director. Read previous editions of the daily newsletter here.

Additional disclosure: The Barchart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance.

On the date of publication, Jim Van Meerten did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Little-Known Nuclear Energy Stock Is ‘the Most Important Company in America’

- Cathie Wood Keeps Buying the Dip in Circle Stock. Should You?

- Meta Platforms Just Lost Its Chief AI Scientist. Does That Make META Stock a Sell Here?

- Eli Lilly Stock Joins the $1 Trillion Club as LLY Hits New All-Time Highs