ConocoPhillips Inc. (COP) raised its dividend per share (DPS) by 7.7% to $3.36 annually. That gives COP stock a 3.84% annual yield. That is well over its historical average, implying COP could be worth 24% more. One way to play it is to short out-of-the-money put options.

COP closed down Thursday, Nov. 20, to $87.47. That is lower than its recent peak of $91.37, which occurred on Nov. 14. That was a week after it released Q3 results on Nov. 6, along with the dividend hike.

The New Dividend and Dividend Yield

I wrote about the possible dividend hike a month ago in an Oct. 10 Barchart article, “ConocoPhillips Could Raise Its Dividend - COP Stock Looks Cheap.”

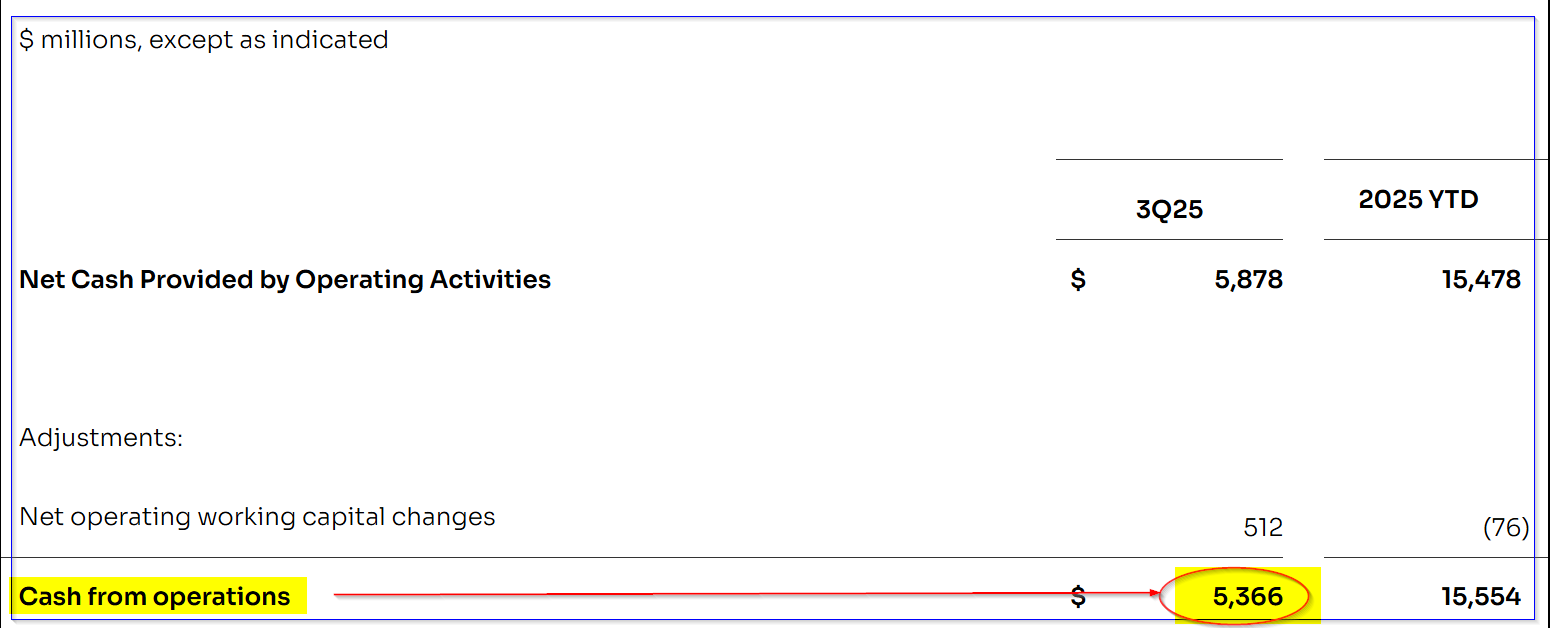

I suspected there would be a 5% dividend hike, based on the company's statements that it pays out 45% of its cash flow from operations (CFFO) in both dividends and buybacks. About half of that goes to each category.

It turns out that Conoco raised its dividend by 7.69% from 78 cents quarterly to 84 cents (i.e., $3.36 annual rate). That means that COP stock now has a 3.84% yield:

$3.36 DPS / $87.47 per share = 0.0384 = 3.84% dividend yield

That will cost the company about $1.038 billion quarterly (i.e., $3.36 x 1.038b shs) or $4.1519 billion annually (based on 1.236 billion shares outstanding).

That represents 19.34% of its run-rate CFFO as of Q3 (i.e., $5.366 b x 4 = $21.464 billion annualized). That's also in line with the 45% CFFO payout estimate from management (assuming half goes to dividends).

In other words, Conoco can easily afford to pay the higher new dividend amount.

This also implies, based on the stock's historical dividend yield, that its valuation could be significantly higher. Let's look at that.

Target Price for COP Stock

Seeking Alpha shows that COP has had an average dividend yield of 3.10% over the last four years. Yahoo! Finance reports that the average 5-year yield has been 2.55%.

Morningstar reports that the average yield has been 2.30% in the prior 5 years. But, its annual yield numbers show that the previous 4 years' average has been 2.4875%.

So, just to be conservative, let's use the highest yield stat (3.10%) and assume that over the next year, the stock will rise to the point where that is its average yield. Here is how that works:

$3.36 annual DPS / 0.0310 yield = $108.39 price target

That represents a potential upside of 24% from here:

$108.39 / $87.47 -1 = 1.239 -1 = +23.9% upside

This is close to where analysts' price targets stand. For example, Yahoo! Finance reports that the average of 29 analysts is $112.93 per share.

Similarly, AnaChart.com, which tracks recent analyst recommendations, reports that 15 analysts have an average price target of $113.63.

The average upside of these surveys is +29.5% higher (i.e., $113.28).

The bottom line is that, based on its average yield and analysts' price targets, COP stock appears to be deeply undervalued.

One way to play this is to set a lower buy-in point by shorting out-of-the-money (OTM) put options. Let's look at that.

Shorting Cash-Secured OTM COP Puts for Income and to Set a Lower Buy-In

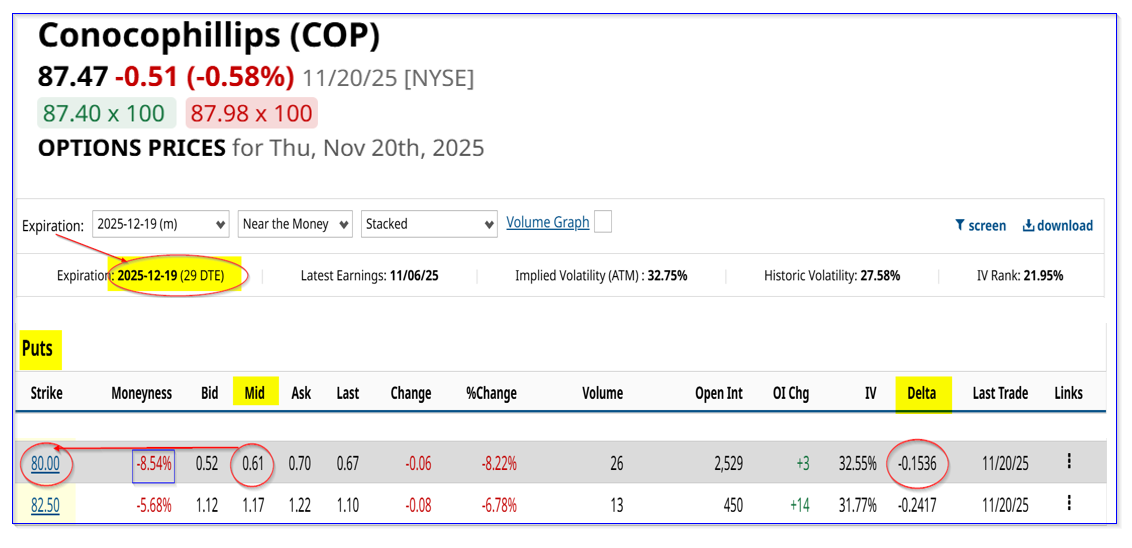

For example, the Dec. 19, 2025, option expiry period shows that the $80 strike price put contract has a midpoint premium of 61 cents.

That means that an investor who secures $8,000 in cash or buying power with their brokerage firm can “Sell to Open” 1 put contract. The account will then immediately receive $61.00.

In other words, the one-month yield is 0.7625% (i.e., over three-quarters of 1%).

That means an investor might have an expected return (ER) of 2.2875% over 3 months, assuming this yield can be repeated each month. That's almost the same as holding common shares for a full year.

Note that this sets up a lower potential buy-in point, if COP falls to $80, and an even lower breakeven point:

$80.00 - $0.61 = $79.39 breakeven

Think about that. That means the annual yield for the investor would be 4.23% (i.e., $3.36/$79.39 = 0.0423).

That also means the upside is very attractive as well:

$108.39 / $79.39 -1 = 1.365 -1 = +36.5% upside

However, there is only a low 15% chance that COP will fall 8.54% to this $80.00 strike price over the next month. That is seen from its delta ratio of -0.1536.

As a result, less risk-averse investors might try shorting the $82.50 put option. That provides a higher yield of 1.4118% (i.e., $1.17/$82.50), but the strike price is 5.68% out-of-the-money (OTM) and there is a 24% chance (roughly) that this might result in an assignment.

The breakeven point, however, would still be low at $81.33 (i.e., $82.50 - $1.17), or -7% below Thursday's close. Moreover, the 3-month ER is attractive at 4.235% (1.4118% x 3).

The bottom line here is that shorting OTM puts can provide a good return and buy-in point. Moreover, over the next year, holding COP shares looks like a good bet, with a 24% potential upside.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart