Wilmington, Massachusetts-based Charles River Laboratories International, Inc. (CRL) is a contract research organization. It provides drug discovery, non-clinical development, and safety testing services. With a market cap of approximately $8 billion, Charles Rivers operates through Research Models and Services (RMS), Discovery and Safety Assessment (DSA), and Manufacturing Solutions segments.

The healthcare major has notably underperformed the broader market over the past year. CRL stock prices have declined 13.7% over the past 52 weeks and 12.2% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 10.5% gains over the past year and 11.2% returns in 2025.

Narrowing the focus, Charles River has also lagged behind the sector-focused Healthcare Select Sector SPDR Fund’s (XLV) 6% uptick over the past 52 weeks and 10.1% gains in 2025.

Charles River Laboratories’ stock prices dropped 5.7% in the trading session following the release of its Q3 results on Nov. 5. The company’s topline for the quarter dipped 49 bps year-over-year to $1 billion, but exceeded the Street’s expectations by 2.1%. Further, its adjusted EPS declined 6.2% year-over-year to $2.43, but surpassed the consensus estimates by 4.7%. Meanwhile, CRL reduced its full-year GAAP-based EPS guidance from the previous range of $4.25 - $4.65 to $4.15 - $4.35, which likely unsettled investor confidence.

For the full fiscal 2025, ending in December, analysts expect CRL to deliver an adjusted EPS of $10.21, down 1.1% year-over-year. On a positive note, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

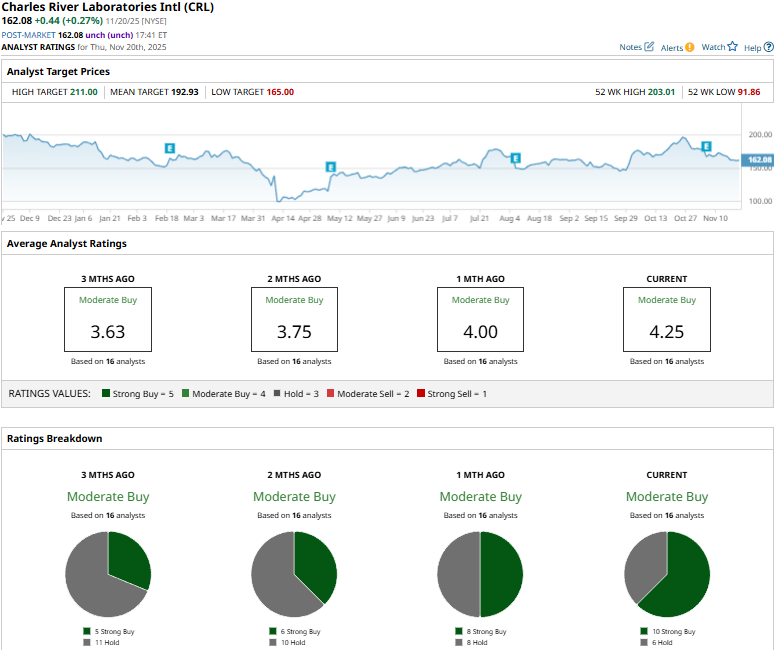

Among the 16 analysts covering the CRL stock, the consensus rating is a “Moderate Buy.” That’s based on 10 “Strong Buys,” and six “Holds.”

This configuration is notably more optimistic than a month ago, when eight analysts gave “Strong Buy” recommendations.

On Nov. 11, Morgan Stanley analyst Ricky Goldwasser maintained an “Equal-Weight” rating on CRL and raised the price target from $170 to $185.

CRL’s mean price target of $192.93 represents a 19% premium to current price levels. Meanwhile, the street-high target of $211 suggests a notable 30.2% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Stock’s Dividend Has Risen 1.5X in 2 Years. Is It a Buy Here?

- Wall Street Sees a ‘Buying Opportunity’ in This Rare Earths Stock. Should You Snap Up Shares Now?

- Billionaire Gina Rinehart Is Now the Top Investor in MP Materials. Should You Follow the Money and Buy MP Stock Too?

- Can Nvidia Stock Test Wall Street’s Price Target of $350?