Valued at $151.2 billion by market cap, Booking Holdings Inc. (BKNG) is one of the world’s largest online travel companies, operating major brands like Booking.com, Priceline, Agoda, Kayak, Rentalcars.com, and OpenTable. The Connecticut-based company connects travelers with accommodations, flights, rental cars, dining, and activities worldwide.

Shares of this leading provider of online travel and related services have trailed the broader market over the past year. BKNG has dipped 8.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 10.5%. In 2025, BKNG stock is down 7.8%, surpassing SPX’s 11.2% rise on a YTD basis.

Zooming in further, BKNG’s outperformance is also apparent compared to the Amplify Travel Tech ETF (AWAY). The exchange-traded fund has declined 8.6% over the past year and 9.5% in 2025.

On Oct. 28, Booking Holdings reported its third-quarter 2025 results, and despite delivering generally substantial numbers, the stock slipped 2.1% as investors reacted cautiously to the outlook. The company posted $9.01 billion in revenue, up 13% year over year, and gross bookings surged 14% to $49.7 billion, reflecting resilient global travel demand. Room nights booked rose about 8%, and adjusted EPS jumped 19% to $99.50, beating analyst expectations. Booking also raised its annual cost-savings target to $500–550 million, signaling improved operational efficiency.

For the current fiscal year, ending in December, analysts expect BKNG’s EPS to grow 21.3% to $226.96 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

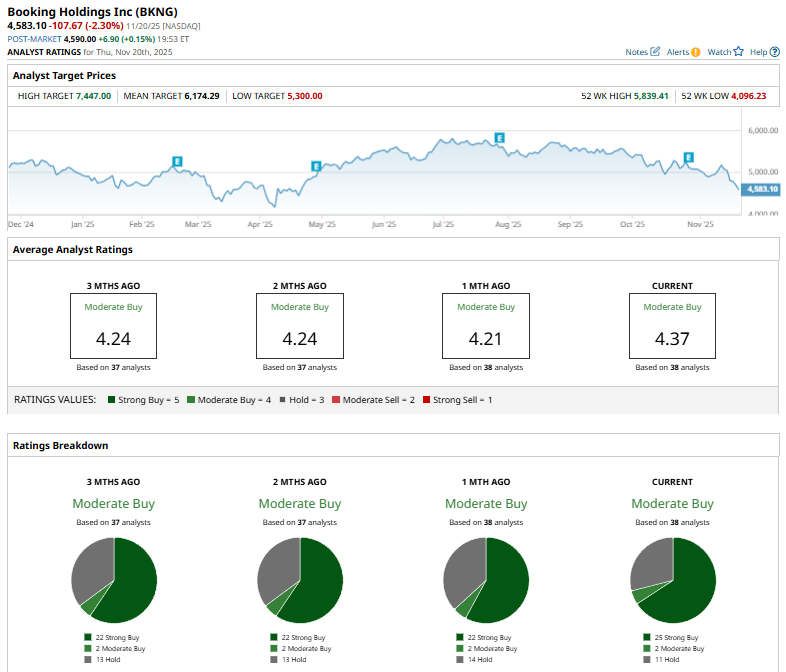

Among the 38 analysts covering BKNG stock, the consensus is a “Moderate Buy.” That’s based on 25 “Strong Buy” ratings, two “Moderate Buys,” and 11 “Holds.”

The configuration is bullish than a month ago when it had 22 “Strong Buy” suggestions.

On Oct. 9, BTIG’s Jake Fuller reiterated his “Buy” rating on Booking Holdings and kept his price target at $6,250.

The mean price target of $6,174.29 represents a 34.7% premium to BKNG’s current price levels. The Street-high price target of $7,447 suggests an ambitious upside potential of 62.5%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Learn How to Read These Smart Money Warning Signs as Commitments of Traders Data Comes Back Online

- ConocoPhillips' 3.84% Dividend Yield Implies COP Stock Could be 24% Undervalued

- Is This Outstanding AI Stock Under $250 Ready to Soar?

- UnitedHealth Stock: ‘Big,’ ‘Fat,’ and ‘Rich,’ or an Undervalued S&P 500 Buy Here?