Columbus, Georgia-based Aflac Incorporated (AFL) is a financial services company that provides supplemental health and life insurance policies. Valued at a market cap of $59.8 billion, the company is well known for promptly paying cash benefits directly to policyholders when claims are eligible, and for its strong corporate ethics reputation.

This insurance company has lagged behind the broader market over the past 52 weeks. Shares of AFL have gained 5% over this time frame, while the broader S&P 500 Index ($SPX) has soared 13.3%. Moreover, on a YTD basis, the stock is up 9.9%, compared to SPX’s 15.5% return.

However, zooming in further, AFL has outpaced the SPDR S&P Insurance ETF’s (KIE) marginal downtick over the past 52 weeks and 3.6% YTD rise.

AFL delivered better-than-expected Q3 earnings results on Nov. 4, and its shares surged 2.2% in the following trading session. The company’s total revenue improved 60.7% year-over-year to $4.7 billion, primarily due to net investment gains of $275 million this quarter compared to net investment losses of $1.4 billion in the third quarter of 2024. Meanwhile, its adjusted EPS increased 15.3% from the year-ago quarter to $2.49. Both these figures came in handily ahead of the consensus estimates, bolstering investor confidence.

For the current fiscal year, ending in December, analysts expect AFL’s EPS to decline 1.5% year over year to $7.10. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in two of the last four quarters, while missing on two other occasions.

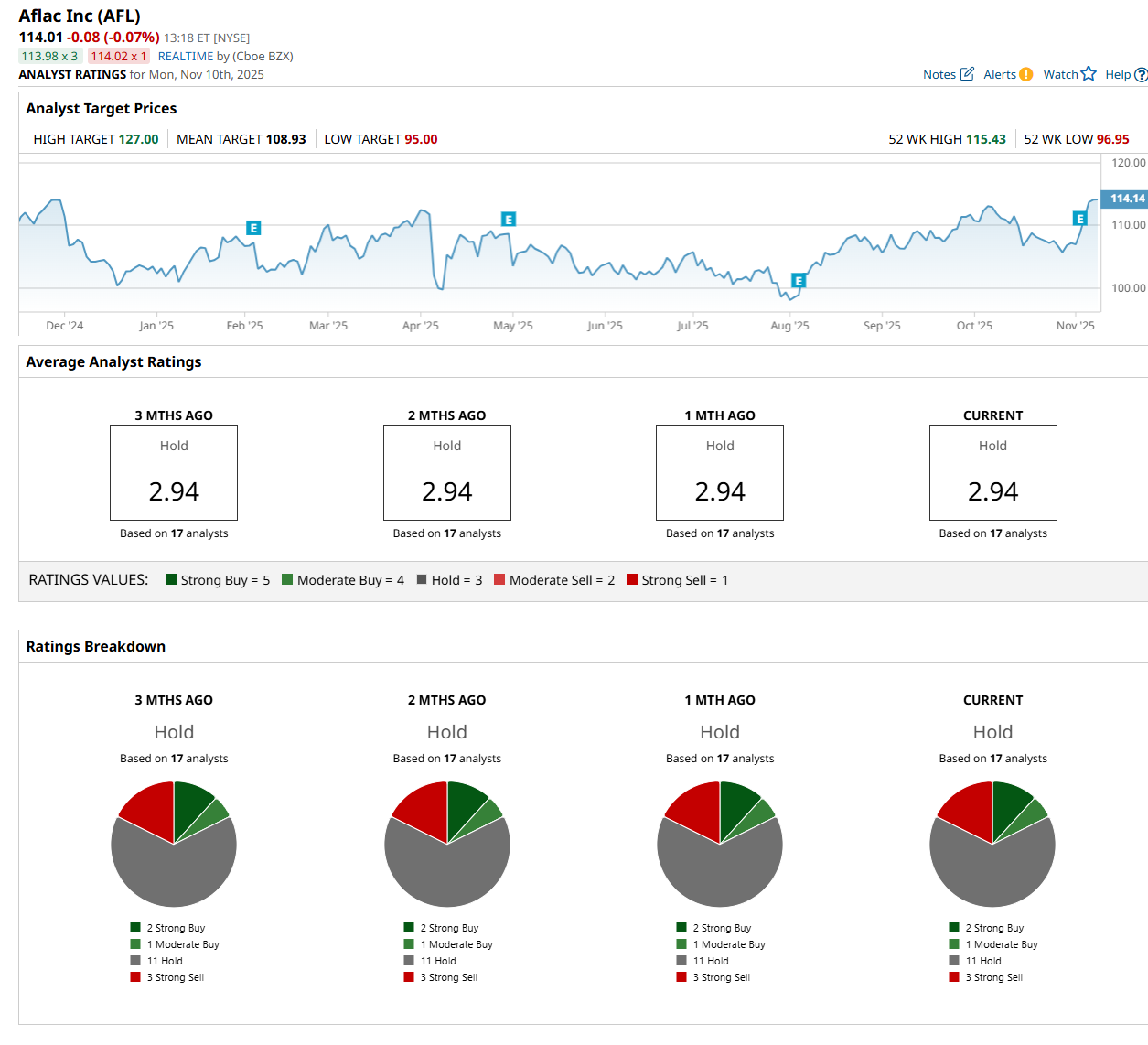

Among the 17 analysts covering the stock, the consensus rating is a "Hold,” which is based on two “Strong Buy,” one "Moderate Buy,” 11 "Hold,” and three "Strong Sell ratings.

The configuration has remained consistent over the past three months.

On Nov. 6, Wells Fargo & Company (WFC) analyst Elyse Greenspan maintained a “Hold" rating on AFL and set a price target of $109.

While the company is trading above its mean price target of $108.93, its Street-high price target of $127 suggests an upside potential of 11.4%.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Analysts Say Nvidia Stock Is ‘Dominant’ Amid a Giant Race to ‘Secure Compute.’ Buy Shares Now?

- Cathie Wood Is Buying the Dip in Archer Aviation Stock. Should You?

- 30,000 Reasons It May Be Time to Sell Amazon Stock Now

- Airbnb Keeps Generating Strong FCF and FCF Margins and Could Be 15% -20% Too Cheap